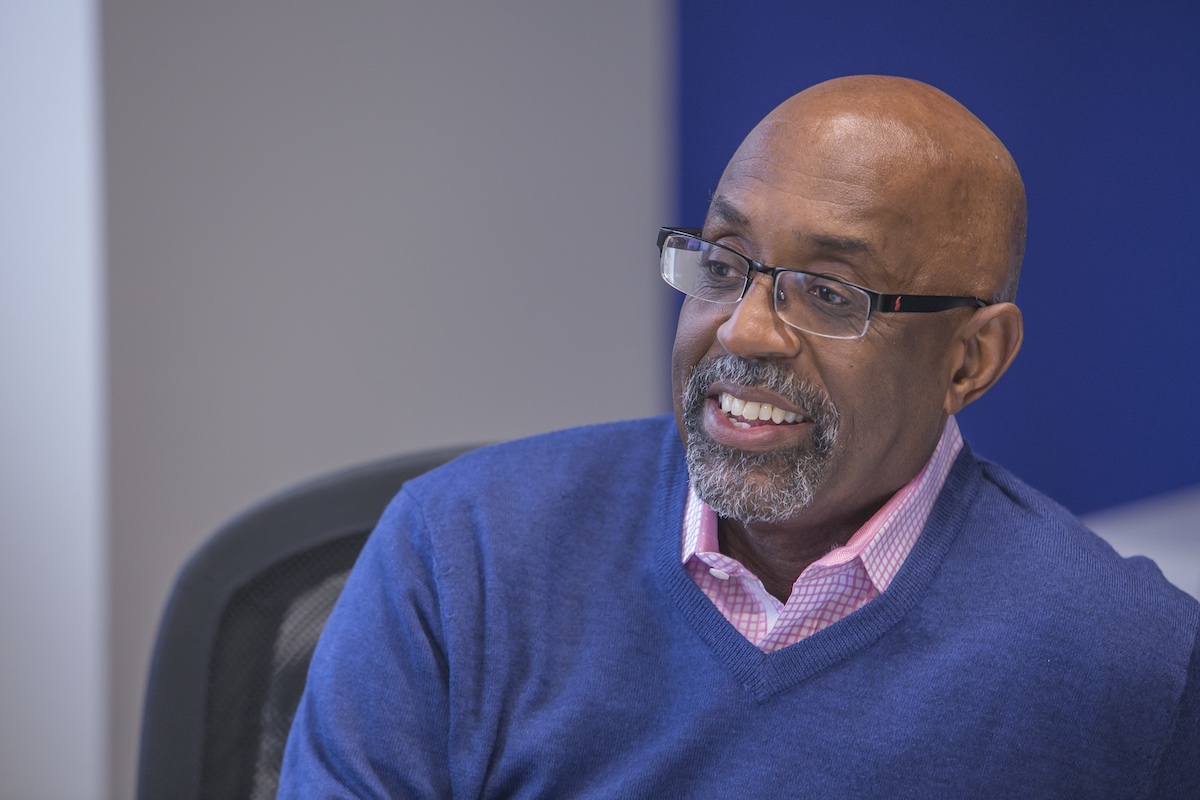

When Thom Webster was launching his first business 40 years ago, his network didn’t have the kind of money to support the type of friends and family round that’s common today.

“Having people invest in me wasn’t really an option,” said Webster, now a serial entrepreneur, mentor and investor. “I didn’t know people who had money to invest, so this idea of having people invest in you instead of you trying to launch a business and sell to the marketplace is really different for me.”

It’s a story of network effect that’s common for Black founders: Who you know dictates how much you raise, and for too many underrepresented founders, the people you know aren’t the people who can fund your startup.

But that pool of potential investors is growing in Philadelphia.

Through a months-long series looking at income, race and occupational data over the past decade in Technical.ly’s mid-Atlantic markets and comparable others across the U.S., we’ve examined what it means to raise capital, who makes enough to invest and what that spread looks like in Philadelphia. We looked through the lens of who in the city makes $200,000 — the income needed to become an accredited angel investor — as a jumping off point to talk about the health and diversity of Philadelphia’s startup ecosystem with people in the know.

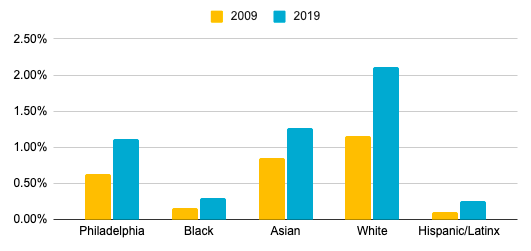

According to U.S. Census PUMAs data compiled and analyzed by Technical.ly with the help of a local data journalist — check out the methodology via GitHub — the number of these individuals has risen in the decade from 2009 to 2019, though not equitably.

Who in Philadelphia makes more than $200,000?

In 2009, .63% of residents made more than $200,000, compared to 1.12% — or 17,119 people — in 2019. The racial breakdown looks like this: 2,006 Black residents, 1,446 Asian residents, 13,533 white residents and 1,628 Latinx residents made more than $200,000 in 2019.

The spread of this growth was relatively equal across race in the decade between 2009 and 2019 — every population roughly doubled their number of people earning above $200,000, except for the number of Latinx high earners, which nearly tripled.

The industries that make the most track with what we know Philadelphia does well. Of those making more than $200,000, 14.5% worked in legal services (peep that this law firm recently began to pay first-year associates more than $200,000 a year), nearly 12% work in medicine, 10.5% work in higher education and 4.75% work in management, scientific and tech consulting services. Computer systems design ranked #11 among the top 20 industries, representing 2.1% among those who make more than $200,000 — up from #14 in 2009, when technologists made up just 1.6%.

Notably, too, a decade ago, tech consulting services wasn’t in the city’s top five high-earning industries, and higher ed took the top spot. But according to a 2017 study by the Economy League, tech services was the highest-earning industry in the city at that time, with an average salary of $126,675.

It’s important to note that Technical.ly’s statistics were collected from data that represents who lives within city limits, so folks who live outside of the city but work here aren’t included. It’s also important to note that inflation over the last decade likely bumped up some of those folks making just under the threshold in 2009 to 2019, according to local researchers.

The minimum income to become an angel investor is likely over what’s considered a “high earner” in Philadelphia, Larry Eichel, a senior adviser to Pew Charitable Trusts’ Philadelphia research and policy initiative told Technical.ly. In 2014, Pew took a look at the city’s middle class, defining it as someone with an income between 67% and 200% of the regional median household income. The range represented everyone between $41,258 to $123,157.

About 10% of the city earned more than that $123,157 number, but just a fraction made more than $200,000, per Pew. And comparatively to the other cities in Pew’s report, Philadelphia has one of the smallest groups of high earners, only above Baltimore and Detroit.

“When you look at people with upper income, where Philadelphia is different from other cities, we have fewer people in the high income category,” Eichel said. “That’s the most important thing to understand about this subject.”

So, the data Technical.ly collected doesn’t help us define high earners, exactly, since we know most of them still make under $200,000. But it does help us understand a few things — who in Philadelphia has the potential to be an angel investor, and what industries they work in.

Place matters

If you chat with any startup founder about where they built their company and why, access to capital tops nearly every list. It’s a large part of how Silicon Valley got its reputation as the United States’ tech hub, or why founders head to New York or Austin in pursuit of connections and capital. And while the COVID-19 pandemic proved that fundraising doesn’t have to happen in-person or by jumping on a flight to give your pitch, having those investors nearby is a major advantage, many startup founders have told Technical.ly.

Philadelphia founders have a lot of reasons for building their companies here. Many love the talent the city’s many universities cultivate, its growing life sciences sector, its still relatively affordable cost of living, range of amenities and its proximity to nearby metros D.C. and New York.

It’s not enough for everyone who wants to build companies here to do so. Prominent investor Jon Gosier, who is Black, notably left Philadelphia for Atlanta a few years ago after founding adtech company Audigent here, then selling it. Of the millions the company raised, he said, only a fraction came from local investors.

“In my very successful businesses, only 10% of overall capital came from Philly investors,” Gosier said in July. “This is why people leave. We’re here but all our support comes from elsewhere. I found it difficult to stay.”

He’s not alone. Martice Sutton, founder of Girls Going Global, a nonprofit addressing the disparity of girls of color in international education, told a crowd of Philly bigwigs at the Economy League of Greater Philadelphia‘s 2019 Greater Philadelphia Leadership Exchange summit that being a Black woman “was not a recipe for success in Philadelphia.”

Sutton had tried to start her organization here in 2012, but the idea of giving young girls the opportunity to travel just wasn’t sticking. She was struggling to find a community here that would support her and her business idea.

Ultimately, she found that the scene here had a high barrier to entry than elsewhere. There was a struggle to gain access to financial capital, and “human capital” — the folks who could help her work get off the ground, mentor her or introduce her to the people who could, she said.

That may be changing, though, as Philly tech as a whole sees more programs focused on facilitating that access.

‘The health of an ecosystem’

Thom Webster now mentors, works with investment funds and programs formulated to get Black and brown founders’ STEM ventures off the ground, as well as the newly formed VC group Black Squirrel Collective.

His first investment was in a supply, logistics and delivery company about 30 years ago. What attracted him to the company then is similar to what still attracts him to make an investment: The owner was highly motivated and understood what he wanted to do, but just needed support.

“When you’re an angel investor, you’re prepared to roll up your sleeves. You’re prepared to do what it takes to get the success of the business,” Webster said. “Become part of the management team if you need to. Work alongside them and do what it takes.”

While Webster said his network has changed over the last few decades — he now knows plenty of people with the time and money to invest — still, only a limited number of them follow that path. They’re likely being risk-averse, he said.

“I have a number of friends that are financially established and the idea of being an investor doesn’t even come to them,” he said.

The pool of investors can be a homogenous one. In 2020, only 23% of investment professionals were women, and only 16% of partners were women. In 2019, 65% of VC firms didn’t have a single female partner or GP. And in 2020, of all investment partners, only 3% were Black and 4% were Latinx, per a study by the National Venture Capital Association.

“It’s typically very highly educated white men making the investment. It’s not bad that there’s highly educated white males, but what is bad about it, is that it creates an artificial filter of who you’re seeing,” Emily Foote, principal at Philly’s Osage Ventures, recently said. “The networks are homogeneous. We need to diversify venture — who’s making the investment decisions — and then I think we’ll see the number of women, Black and Latinx founders getting VC deals rise.”

The number of potential investors isn’t the only way to judge a region’s success, Economy League Managing Director Nick Frontino said. There are a lot of recent factors, like a more virtual world and the rise of tech in the gig economy that will impact where and why companies grow here.

Even pre-pandemic, Philadelphia founders could always fly across the country or the world to invest from outsiders.

“But we’re interested in local capital because I think it’s an indicator of the health of an entrepreneurial ecosystem,” he said. “Founders that exit and stay and invest and move onto the next thing, that ends up being a really important component of an innovation ecosystem. It signals access to hard dollars, but also that there’s actual people — the collisions, advice, relationships — that you get with a denser, more diverse, entrepreneurial ecosystem.”

Frontino and others we talked to emphasized that dollars were only one part of how Philadelphia’s startup story persists. The people who have the money to deploy must also be committed to local investing in other ways, they said.

That’s especially true to Webster, who, after decades, still feels being an investor is a new opportunity to him as a person of color.

“In terms of being committed to seeing the opportunity that’s presented to me as a person of color, it’s about success and access. The real value isn’t the money, it’s the access to coaching, mentoring, networking, opportunity, experience,” he said. “The challenges are different, you need the insight, the wisdom, the know-how of someone who has been there and done that. That didn’t exist for me, and that’s what I try to be.”

_

This is the first in a series on how tech economies are growing wealth in U.S. cities, and we need you to be part of it. What do you know that we don’t, or what do you think we need to come to understand about the topic? Email Technical.ly CEO Chris Wink at chris@technical.ly or Technical.ly Managing Editor Julie Zeglen at julie@technical.ly if you have any questions, additions or thoughts.