Money Moves is a column where we chart the funding raises of tech companies across the region. Have a tip? Email us at baltimore@technical.ly.

Sunstone Credit raises $20 million Series A

Pikesville-based Sunstone Credit announced last week the close of an oversubscribed Series A worth $20 million.

A statement noted that the raise was led by an affiliated fund of clean energy- and growth-stage-focused investor Greenbacker Capital Management. Other participating funders include Grotech Ventures, Cross River Digital Ventures, Earthshot Ventures and Forbright Bank. The investments have Grotech Ventures’ managing partner Lawson DeVries joining Sunstone’s board of directors, as well as Cross River and Forbright Bank continuing to finance Sunstone’s loan portfolio.

Sunstone’s primary tech product is a platform designed to help other businesses secure loans to finance transitions to solar and clean energy. The Quarry Lake-adjacent company’s announcement of the raise noted that it will use the funds to hire new employees and further build out its platform. That statement also noted that this raise follows Sunstone earning over $200 million in loan applications since its late-2021 inception, thanks to its partnering with solar developers throughout the country.

“We have a great deal of momentum right now and expect to build upon that in the coming years as more businesses pursue solar energy,” said Wilson Chang, who cofounded Sunstone with Josh Goldberg after the pair launched the now-public Sunlight Financial. “We’ve assembled a great team of industry experts and are excited to partner with an exceptional group of investors that believe in our vision of enabling more companies to use clean energy.”

Fearless, XCell and Points North Studio secure contract to redesign Baltimorecity.gov

The staff of Fearless. (Courtesy photo)

Inner Harbor and Downtown-HQ’d SaaS company Fearless continued its streak of government contracts by landing one with two alums of its Hutch incubator to redesign the City of Baltimore’s primary website.

The nine-month contract will prioritize making Baltimorecity.gov a more accessible and seamless site for city residents to access municipal services like parking ticket payment, 311 requests and more across devices, according to a statement. Kristi Halford of C3 Visionary Strategies, a consulting and public relations firm serving as Fearless’ press representative, told Technical.ly that the value of the contract is about $1.1 million.

“Baltimorecity.gov is an important resource for residents, businesses, and visitors,” Fearless’ announcement reads. “But, it’s not currently meeting its full potential. The website lacks a cohesive look and feel. And using the search function can be confusing and lead to the wrong results. Overall, it’s in need of a redesign that will center accessibility, improve online function and be usable on all devices and browsers.”

Fearless shares the contract with XCell and Points North Studio. XCell President Felix Gilbert told Technical.ly via email that this contract grew out of connections fostered through a Hutch-hosted roundtable with the Mayor’s Office and other events through which city leaders tried to source minority- and women-owned businesses.

“Through those events, companies like ours learned about the process and opportunities to do business with the city,” Gilbert said. “XCell is now a certified minority-owned business in the city and was able to bid on the [request for proposal] for this contract. There were requirements we couldn’t meet as a small business so we brought Fearless in as a partner.”

Besides this contract, Fearless boasts another major connection to Baltimore city government: CEO Delali Dzirasa’s marriage to Dr. Letitia Dzirasa, the City’s health commissioner.

Novel Microdevices’ $4.3 million convertible note round

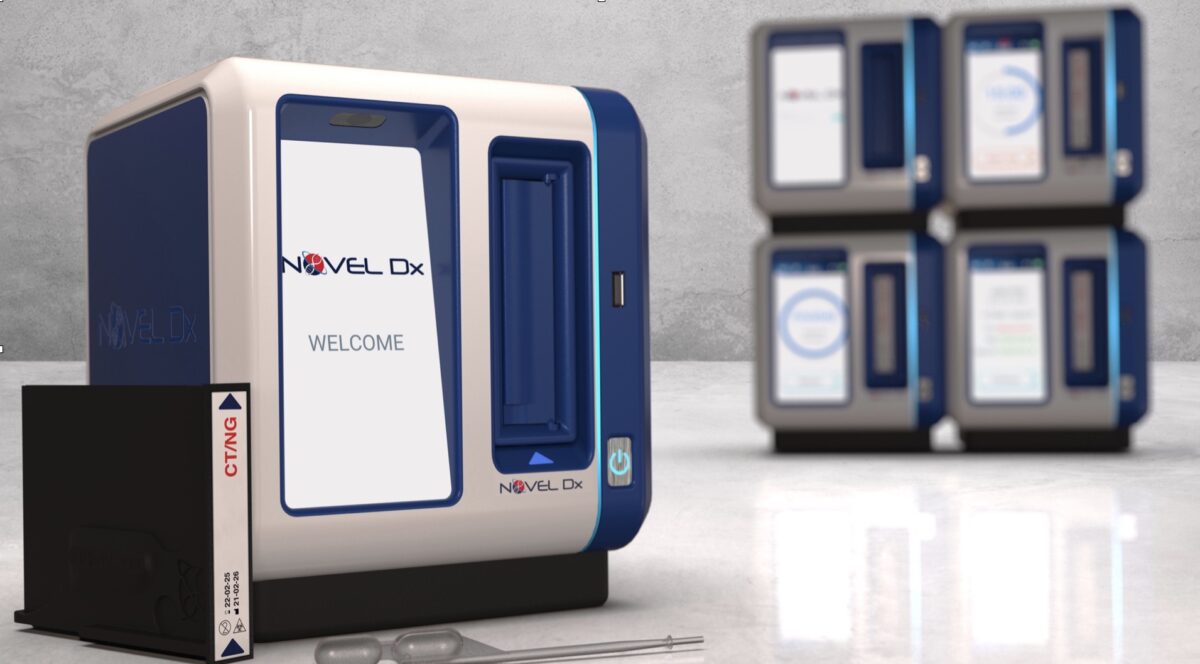

Rendering of the NovelDx. (Courtesy image)

A recent Securities and Exchange Commission filing notes that Novel Microdevices, a healthtech company focused on diagnostics-related device development, completed a raise worth just over $4.3 million. Founder and CEO Andrea Pais said that the raise, which she described as a convertible note round, will help the company finish developing both its NovelDx diagnostic platform and a corresponding “multiplex respiratory panel assay” — the last word of which refers to a procedure for qualitatively detecting the presence of something medically significant — for COVID-19 and related conditions in less than 15 minutes.

“This raise complements the substantial non-dilutive government grant funding the company has received,” said Pais, whose company is based in Southeast Baltimore near the county line with Dundalk, in an email to Technical.ly.

In 2021, Novel Microdevices won an award worth up to $13.8 million from Boston University-based R&D partnership CARB-X, which the company used to develop tests for sexually transmitted diseases. Going forward, Pais said that she and her colleagues aim to raise a $5 million “pre-Series A,” which would support manufacturing and initial launch of the products, by the end of Q2.

Other Baltimore-area Money Moves

- Morgensis, a subsidiary of Germantown, Maryland biotech company Orgenesis that is focused on cell therapy creation, got $50 million from private equity firm Metalmark Capital to establish itself at the Johns Hopkins School of Medicine’s Maryland Center for Cell Therapy Manufacturing in East Baltimore.

- Columbia, Maryland-based health IT company Vheda Inc. logged a $1 million raise in an SEC filing last month.

- The Baltimore Orioles donated $5 million to the CollegeBound Foundation, which the Charles Village-based professional development program for the city’s youth said in an announcement was “the largest gift in CollegeBound’s 35-year history.”

- The US Senate Appropriations Committee’s mid-January Omnibus Spending Bill allocated $418,000 to TEDCO, the State of Maryland-created investment entity, in support of its Open Institute for Black Women Entrepreneur Excellence program.

- Further out west: The Frederick Innovative Technology Center Inc. received $88,000 from the Truist Foundation. The grant will support the FITCI’s Innovation Driven Entrepreneurship Accelerator Lab for early-stage founders.

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!

Donate to the Journalism Fund

Your support powers our independent journalism. Unlike most business-media outlets, we don’t have a paywall. Instead, we count on your personal and organizational contributions.

The tax change that blindsided tech firms may finally be reversed — but time is running out

How to win on Shark Tank: Tips from an entrepreneur who scored a deal