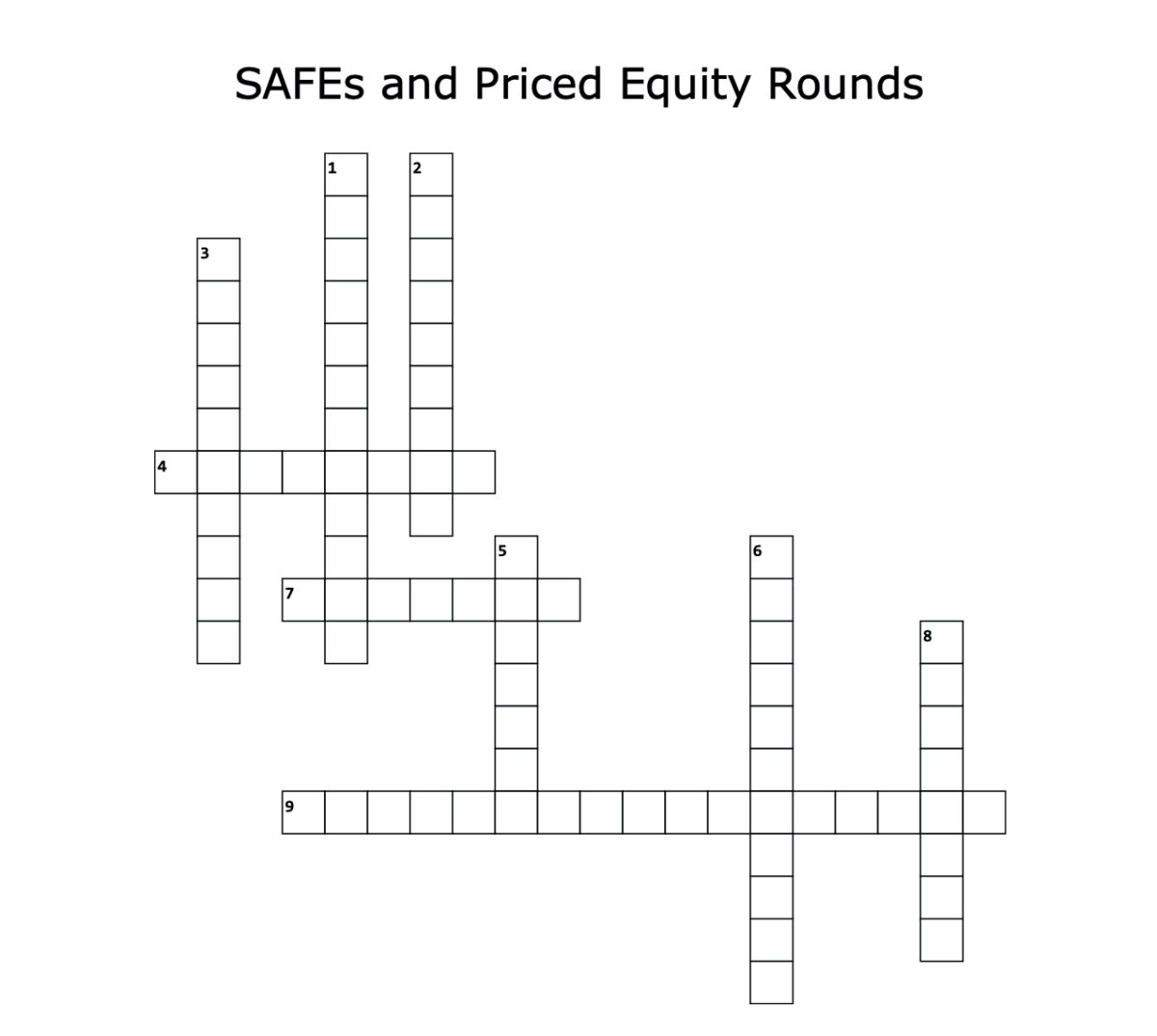

Unleash your financial acumen and sharpen your vocabulary as you journey through this crossword puzzle, designed to delve into the intricate tapestry of venture capital terms and instruments.

Each clue will lead you into (at least one area) of the labyrinth of entrepreneurial finance. So, grab your pen and venture forth into the crossword adventure that will unravel the mysteries of the funding landscape.

(Hint: Check out these previous guest posts from Ballard Spahr to learn more about SAFEs, convertible notes and priced rounds.)

If you want to download a PDF of the puzzle, click here.

Crossword puzzle created by Ballard Spahr via Crossword Labs. (Courtesy Ballard Spahr)

Across

4. A type of SAFE that looks at the valuation of the company before the financing.

7. The people you should talk to about how to use a SAFE for your startup.

9. A provision that allows an investor to ask for the same terms as a SAFE that the company enters into after the investor’s SAFE, if the subsequent SAFE has better terms.

Down

1. A conversion mechanism by which if the company raises money at a high valuation, the SAFE investor can convert at a share price based upon a pre-agreed lower valuation.

2. A type of SAFE that looks at the valuation of the company after the financing.

3. What happens to the SAFE funds to make them into shares.

5. Rights that allow an investor to invest additional funds to maintain their ownership percentage during equity financings subsequent to the converting financing.

6. The original creator of the SAFE.

8. A conversion mechanism by which if the company raises money at a valuation, the SAFE investor can convert to a lesser price per share than the price raised in the conversion event.

_

Kim’s Korner is a series of articles by Ballard Spahr’s emerging company and venture capital attorneys. The column is not legal advice. The substance of the column is derived from our experience working with founders and details many of the current critical issues facing startups.

Learn more about Ballard Spahr

This is a sponsored guest post by Ballard Spahr. Ballard Spahr is a Technical.ly Ecosystem Builder client.

Before you go...

Please consider supporting Technical.ly to keep our independent journalism strong. Unlike most business-focused media outlets, we don’t have a paywall. Instead, we count on your personal and organizational support.

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!

The person charged in the UnitedHealthcare CEO shooting had a ton of tech connections

The looming TikTok ban doesn’t strike financial fear into the hearts of creators — it’s community they’re worried about

Where are the country’s most vibrant tech and startup communities?