When PeopleJoy founder and CEO Emeka Oguh’s parents emigrated to the United States from Nigeria, they made it clear that education would be his way to success.

Oguh was an astute pupil and earned an undergraduate scholarship to Rutgers University. After graduation, he worked on Wall Street in financial services at Merrill Lynch.

It was there that a former supervisor shared with him the importance of using an entrepreneurial mindset in any professional space.

“One of the best pieces of advice an early manager gave me was to treat every job you’re given like you’re the CEO,” he told Technical.ly. “Your internal stakeholders are your customers. I took that to heart.”

After his experience at Merrill Lynch, attended Harvard Business School for graduate studies. All the while, he grew increasingly interested in owning his own business. The startup world and its capacity for founders to make an impact faster than in the corporate world seemed like a perfect fit for him. He felt the work he did on Wall Street only impacted a small segment of the population and he wanted to make a bigger difference.

Oguh started a mobile app company in 2013, and the following year, he moved to Philadelphia. His company’s eventual acquisition helped him build confidence as an entrepreneur, and in 2017, he launched PeopleJoy as a way to help people develop financial wellness. That year, the founder also participated in the inaugural cohort of Village Capital’s VilCap Communities fintech accelerator, run in partnership with Ben Franklin Technology Partners.

Initially, PeopleJoy was going to work as a virtual financial advisor that could recommend ways for people to better invest. After surveys and market research, however, Oguh realized student debt was a more significant hindrance to people’s financial success. And he knew from personal experience that student debt could be a burden: He and his wife, a physician, shared approximately $400,000 in student debt. Oguh quickly learned that building savings had to happen at the same time he was paying down that debt.

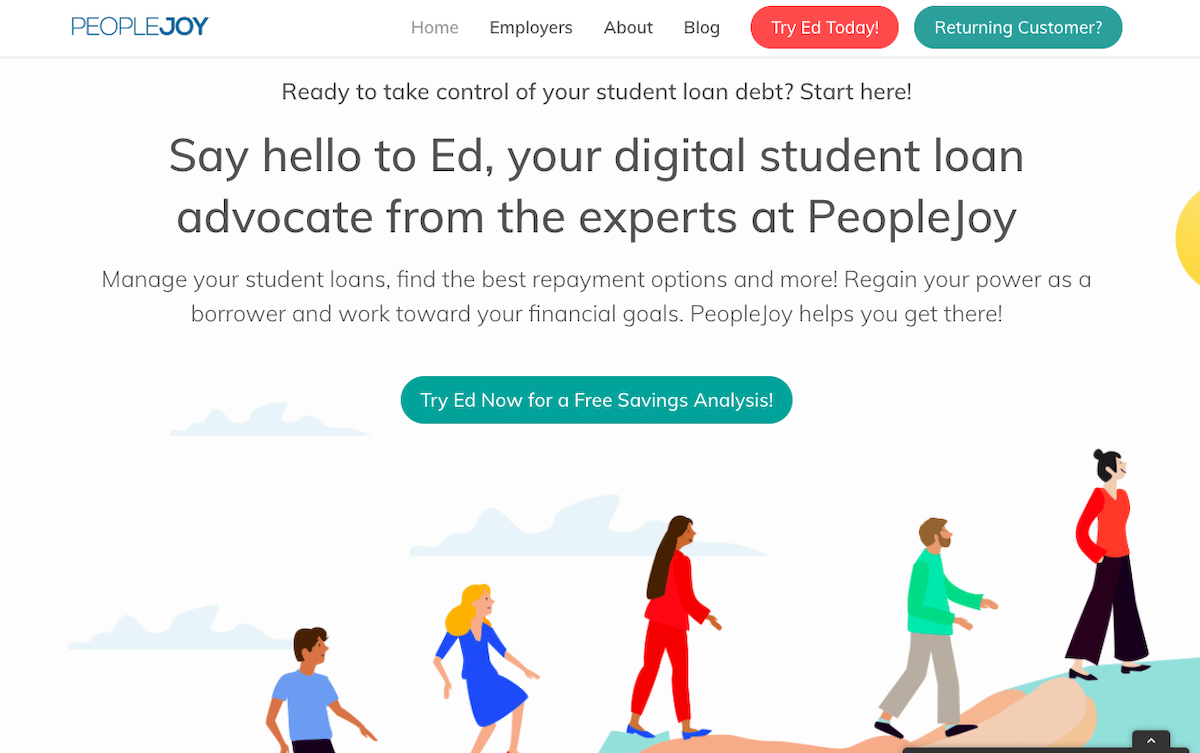

Today, PeopleJoy, which is based in University City, bills itself as a “personal student loan assistant in your back pocket,” helping borrowers manage their loans while offering financial consultations and paperwork e-filing. It also works with employers to create student debt management strategies for employees.

As a financial company that aims to help others, PeopleJoy’s services have been in high demand during the pandemic and resulting economic downturn. With many people losing jobs or being furloughed, Oguh said having empathy is at the core of PeopleJoy’s work. The debt management focus of the work his company does has allowed PeopleJoy to help people plan for their future.

“So many people were furloughed and hadn’t built the nest egg,” he said. “Fortunately, the government suspended student loans, but it really made folks aware that it’s important to pay student debt but also have access to savings to tap into. We’re focused on financial wellness and we’ve been really busy. Now that companies are paying a lot of attention to their employees financial wellness, it’s definitely exposed a need for programs like ours.”

PeopleJoy raised a round of investment in January before the pandemic from Ben Franklin Technology Partners and Alabama investment firm Bronze Valley. While business activity dipped between March and May, Oguh applied for and received an Economic Injury Disaster Loan — the no-longer-offered EIDL Advance — that helped the company rebound in preparation for next year.

The killing of Black Americans like George Floyd by police earlier this year was triggering for Oguh and provided sobering reminders of racial inequities in America like the wealth gap. He wanted to fight against systemic racism using his skill set but was not immediately certain how he could do it.

Oguh found that Black students are more likely to come out of school with student debt and that women possess two-thirds of all student debt. By reducing the racial wealth gap, he saw an opportunity to help Black people access economic empowerment through the two primary drivers of wealth for the average American — savings for a home and retirement. The burden of student debt often precludes access to both things.

This past summer, PeopleJoy launched an initiative where the company offered its services free to graduates of historically Black colleges and universities through employers. Employers that hire HBCU graduates received free services for two employees hired from HBCUs. The initiative would help people who graduated from the institutions free services to manage their student debt and also create a higher demand for HBCU graduates at companies across industries.

“We launched that at the Children’s Hospital of Los Angeles and Children’s Hospital of Colorado, we’re really proud of that,” Oguh said. “For me, it’s always how to turn frustration and discrimination into action. I’ve been impressed by companies desires to make a difference.”

Collaboration has been a valuable part of Oguh’s skill set as an entrepreneur. To help give other businesses and organizations affected by the pandemic a platform this year, Oguh launched a PeopleJoy podcast where he spoke to nonprofit leaders about their professional experiences and where they could donate.

Outgoing Campus Philly President Deborah Diamond was a guest on the podcast and, like Oguh, understands how much student debt can impact the decisions made by people new to the workforce.

“What we share with Emeka and PeopleJoy is the belief that work is also personal: People bring their whole selves to their jobs and employers who thrive are those that understand that and treat their employees as whole people,” she told Technical.ly. “At Campus Philly we see that as something current students are looking for in an employer and we ourselves try to be that kind of employer, too.”

Accordingly, Campus Philly, an economic development nonprofit that connects local college students to their city, offers student loan repayment assistance to its employees. Diamond considers the amount modest, but believes it is a sign that the org understands the need to be free of student debt. Prior to this year, employer contributions to employee student loans was taxable. In response to the pandemic, the CARES Act suspended taxes on those contributions, bringing more money to employees and making the process less expensive for employers.

Like Fishbox founder Napoleon Suarez, Oguh is a proponent for mentorship in business and believes it can prepare Black and brown founders for the peaks and valleys that come with entrepreneurship. Mentors can also provide insight into better money management. Oguh is currently a part of the Mentor Connect program from PACT and Ben Franklin Technology Partner, which convenes founders with more seasoned entrepreneurs as coaches.

“Mentors come in different ways,” he said. “Some you have for life, some you have for a day. Anyone that can give you a new perspective is a mentor. This is agnostic of race, but we need more mentors. This is a super lonely journey and it’s always great to talk to current CEOs going through it, but also [have] a safe zone of being able to talk to somebody going through it who isn’t an investor or on your board.”

With student loan repayment going back into effect in the beginning of next year, Oguh is preparing for a busy 2021. For him, the financial advice and guidance PeopleJoy provides have never been more important than it is now.

###

Resources: