We’re always working to better understand the early-stage companies we report on.

In December and January, we ran a baseline survey to hear from 100 CEOs of technology companies in our five Technical.ly markets — Philadelphia, Baltimore, Brooklyn, Delaware and Washington, D.C. It was a follow-up to the pilot survey we did of 70 Philadelphia tech founders in 2013.

This is something we’d like to grow, but even these early data come with some interesting threads. Here are a few of them:

- More than 1,500 jobs were represented by the 95 companies surveyed. The average sized team was 15 employees and all respondents expected to employ fewer than 150 by the end of 2015.

- More than 125,000 square feet of office space was occupied by the surveyed companies. Forty-eight percent were in dedicated office space, 30 percent were in a coworking or incubator space and 15 percent telecommute. The rest were in accelerator programs or co-housed with another company. There was a divide locally: At least three-quarters of respondents from Brooklyn and D.C. reported working from coworking spaces or telecommuting; more than 60 percent in Philadelphia and Baltimore reported having dedicated office space. That could be a sign of relatively cheaper commercial real estate options in those cities.

- Many entrepreneurs are building companies where they grew up. More than a third of all surveyed are doing so, and a plurality of founders in all markets were doing the same, ranging from 48 percent in Philadelphia to one in six of those surveyed in D.C. In Baltimore and D.C., more founders said they were first brought to those places by a previous job. In Brooklyn, more than half said either previous work or for business reasons (proximity to investors or customers) was why they were there, but still a third cited family ties.

- More than half of businesses surveyed were bootstrapping. Fifty-five percent were building on current revenue and more than 60 percent had used personal capital from previous work. About a quarter of those surveyed had raised institutional venture capital, and more than 40 percent received angel investment.

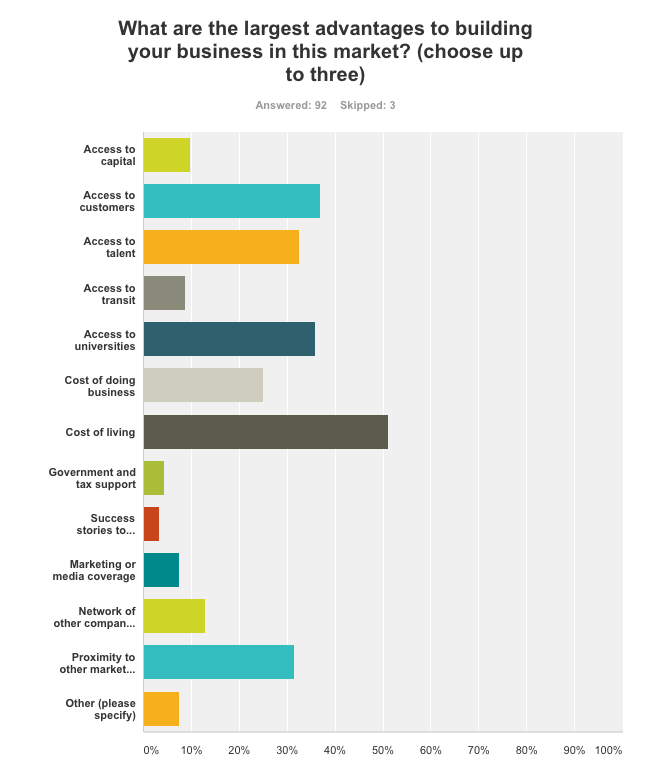

- Businesses want more capital and talent. All markets, despite their differences, from Brooklyn to Delaware, cite access to capital and talent as chief obstacles to growth. Brooklyn respondents disproportionately cite cost of living and cost of doing business as obstacles; Baltimore respondents disproportionately cite a lack of a strong network of successful tech businesses to follow; Philadelphia respondents disproportionately cite a lack of government and tax support.

- Mid-Atlantic entrepreneurs see access to customers, to universities and to talent as their biggest advantages. All were listed as one of the three biggest advantages by at least a third of those surveyed. Cost of living had the highest overall rank but that was powered by near universal response from founders in Philadelphia, Baltimore and Delaware. No respondents from Brooklyn or D.C. listed cost of living, but in Brooklyn several prioritized access to capital.

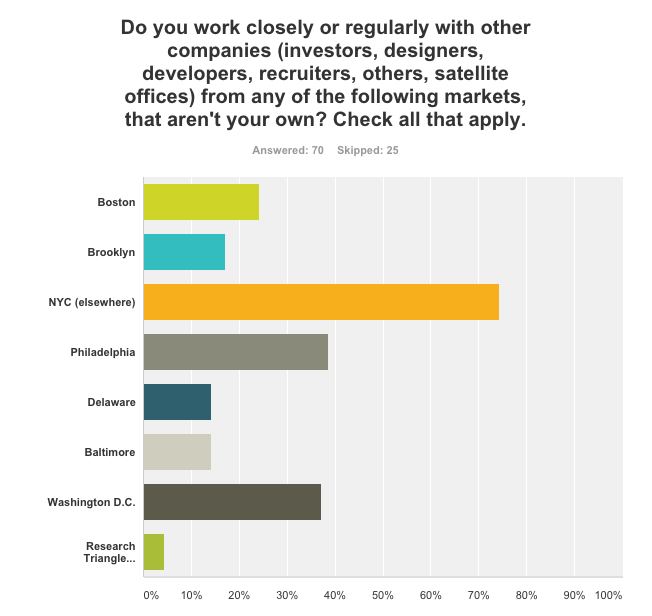

- There is already cross-corridor collaboration. Few respondents did not work with service providers from another mid-Atlantic market. Many cited work with Silicon Valley companies as well.

- Getting acquired is the new going public. More than 30 percent of respondents see an acquisition as the long-term best case scenario, compared to 18 percent who consider an IPO as the best case long-term scenario. More than one in five want to “build the largest independent private company I can.” Others plan to build a lifestyle business and are still uncertain.

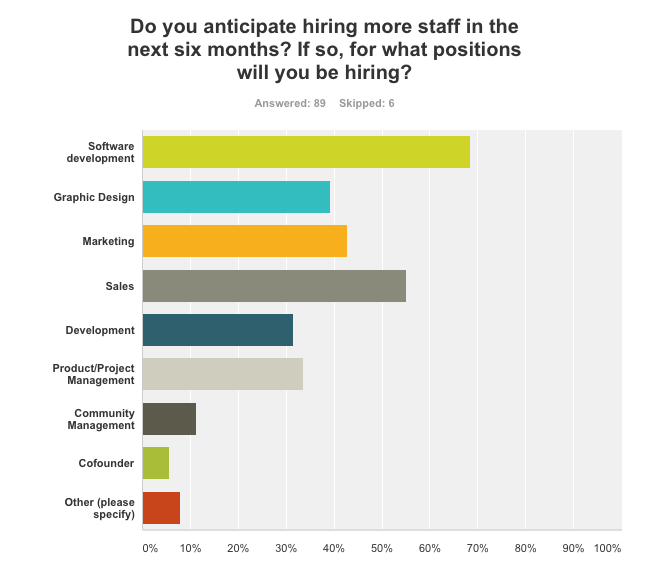

- Everyone is hiring software talent. Nearly 70 percent of surveyed companies are hiring devs in the next six months. More than half will hire sales talent.

- Companies surveyed are growing but not exponentially. Half of those who answered said they plan to hire 1-3 people per quarter this year. A third said they’d likely hire no more than four throughout 2015.

- Many CEOs rank their tech community highly but there is high variability by market. A quarter of all respondents gave their market a score of 8. The average score by market on a 10-point scale (5 is “average”) is as follows:

- Brooklyn, 8.4

- Baltimore, 7.3

- D.C., 6.7

- Philly, 6.5

- Delaware, 5.4

Companies:

Technical.ly

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!

Donate to the Journalism Fund

Your support powers our independent journalism. Unlike most business-media outlets, we don’t have a paywall. Instead, we count on your personal and organizational contributions.

Maryland firms score $5M to manufacture everything from soup to nanofiber

National AI safety group and CHIPS for America at risk with latest Trump administration firings

Immigration-focused AI chatbot wins $2,500 from Temple University to go from idea to action