On the surface level, 2022 was a down year for Philly venture capital. But Philadelphia Alliance for Capital and Technology (PACT) President Dean Miller calls it a bang-up four quarters anyway.

The tech- and capital-focused organization released its 2022 venture report Tuesday, working with PitchBook to pull highlights from the last year of investments in local companies. The data showed that Philadelphia had actually climbed a spot in the top 10 most active US cities for deal count, up to fifth place from 2021. It’s proceeded only by Silicon Valley, New York City, Los Angeles and Boston.

Miller suggests folks look at the data without 2021’s historic year of funding. The year was record-breaking overall, but massive raises by delivery giant Gopuff account for nearly half of all money raised that year — $3.65 billion across multiple rounds (Series G and H).

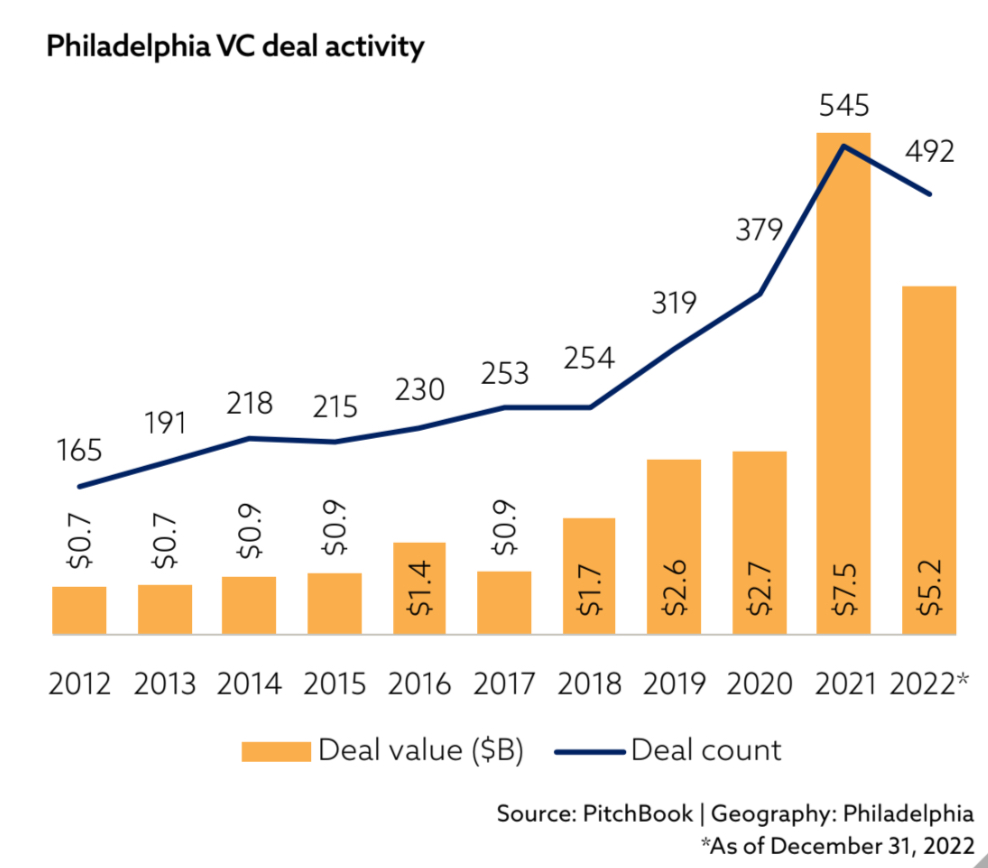

When you remove 2021’s 545 deals at nearly $8 billion, the trajectory of venture capital looks a lot more like a steady upward climb. In fact, 2022 saw nearly double the amount of capital that was raised in 2020.

In 2022, the region saw 492 deals for a total of $5.2 billion. Of those, 216 were angel and seed-stage deals, making up $452.9 million of the deal flow.

Read PACT's 2022 VC reportLife science companies have long made up a large share of Philadelphia’s innovation economy; accordingly, they accounted for a fifth of last year’s funding. But a few other trends emerged in 2022. Fintech companies had a great year, with their deal count nearly doubling from 37 in 2020 to 67. The industry accounted for half a billion dollars of 2022’s deals.

“It’s not a new thing,” Miller told Technical.ly. “A lot of times, people in Philly think of New York when it comes to financial services, but you actually have firms like [Malvern’s] Vanguard and [Oaks’] SEI that fly more under the radar, but are multi-billion dollar fintech services here.”

Another upward trend for Philly is its number of outside investors. Pre-pandemic, a much smaller portion Philly’s investment deals were coming from New York and San Francisco, but starting in 2020, billions of Philly’s investment dollars have come from these two cities. In 2021 and 2022, 6.7 billion came from the Bay Area. Much of this went into a few huge raises, like dbt Labs’ $222 million Series D last February.

It is not unusual outside of a few geographies to be importing your capital.Dean Miller PACT

“It is not unusual outside of a few geographies to be importing your capital,” Miller said. “We import about 80% of our capital. To have a healthy ecosystem, you do want to have early-stage funding locally, but a lot of dollars coming from the outside is a good thing.”

Early-stage funding was most common for Philly companies last year, the report shows. Deals between $1 million and $5 million happened most often, and deals under $5 million accounted for about 70% of all deal flow. It aligns with what Technical.ly has been hearing recently — that early-stage dollars are still flowing, even while later-stage, large rounds have been harder to secure.

Later-stage companies like dbt Labs raised money at high valuations before the market felt the effects of the economic downturn. If you raised a large round in 2021 or early 2022, you don’t need to go to the market now, Miller said; if you got hundreds of millions in capital within the last two years, you should be in the position to be able to decide when you need to raise again, not do so because you have to.

“As an entrepreneur, you put yourself into a great position,” he said of those large rounds in 2021 and early 2022. It might be harder for those trying to raise now.

One missing piece of the VC landscape from the report, Miller notes, is that PitchBook doesn’t track data related to underrepresented founders. (Technical.ly has requested this data from Pitchbook, too). Miller said VC pros know anecdotally and nationally that some progress has been made to fund founders of color and women founders, but they can’t track it via PitchBook.

Overall, 2022 shows that Philadelphia is on a positive trajectory when it comes to deal size, deal count, outside investment coming to the city, and a diverse range of industries pulling in funding.

“I think the foundation has been laid to continue our presence in the top 10 nationally,” Miller said. “We’re punching above our weight. Philadelphia is the sixth largest city, but this year, we’re fifth in terms of deals.”