Moven has an extremely difficult mission: to re-invent banking.

We’re accomplishing that by blending instant financial advice and modern digital banking into one mobile app experience. Providing actionable financial insights while you’re banking meets an obvious but significant unmet need to the masses.

For example, every time a Moven customer swipes their debit card or taps their phone to make a purchase, in fewer than two seconds, we give them awareness if they are over-spending in a specific category, such as dining out. Every morning a customer wakes up to a daily digest of yesterday’s spending, and if it is in their best interest to tuck away savings towards an emergency cash fund, we give an actionable recommendation to save $100 with one frictionless and secure tap of their phone. Another example is Moven’s app security model that supports a seamless mobile experience across channels like Watch OS and Widgets, without compromising on privacy and security concerns.

While the ideas for these features come from a few industry experts, the main reason these ideas have matured and been executed with so much success is because of an operating model we developed based on how digital-born companies like Amazon and PayPal operate. We call it “business technology.”

It’s a response to the fact that, while many large organizations have embraced the latest methods in “IT development,” including over-used concepts such as “agile,” “innovation” and “design thinking,” they often fail to grasp the key principles as to why these new approaches exist, leading to a façade of modern processes wrapped around an existing legacy operational model.

Our business technology model aims to cohesively blend business and technology into single capability-aligned product teams, destroying the inefficient handoffs between business and IT in the process. For example, our team model consists of a single product manager, UX designers, business analysts, mobile engineers, full stack engineers, data scientists and a scrum master as part of a team accountable for a dedicated capability such as our financial advice features.

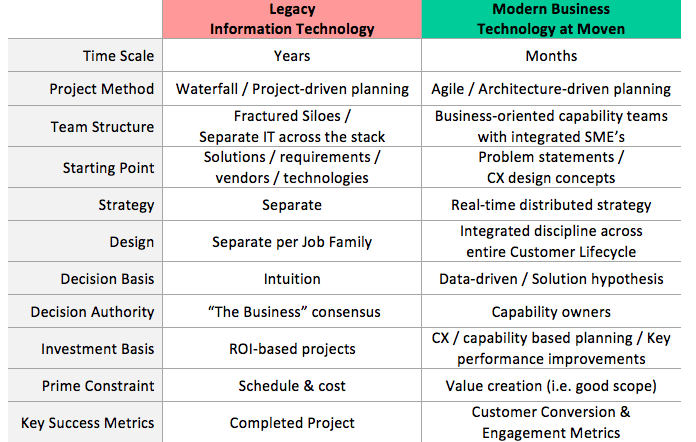

Beyond team structure and a flat organizational chart, there are 11 major differences between our business technology operating model and a legacy IT organization, shown below.

Some key differences.

The value of these differences should be self-evident, but it’s more important to focus on results. Specifically, this operating model, from a pure functionality output perspective, is outperforming teams from my past. However, what’s really exciting is the true business value we’re delivering to the market. For example, the Moven U.S. app has reached industry-leading sales conversion and engagement rates, prospects who start our signup experience finish at a much higher rate than traditional banks and customers using our app use it two to three times more per month than existing bank apps.

The best part is, we’re only just beginning and have many more customer use cases to solve for as we expand upon our initial success. Hopefully, the rest of the banking industry can learn from this team model and its impact on delivering measurable value.

Technical.ly's Editorial Calendar explores a different topic each month. The October 2016 topic is fintech. See fintech coverage from all five of our East Coast markets here.

Before you go...

Please consider supporting Technical.ly to keep our independent journalism strong. Unlike most business-focused media outlets, we don’t have a paywall. Instead, we count on your personal and organizational support.

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!

The person charged in the UnitedHealthcare CEO shooting had a ton of tech connections

The looming TikTok ban doesn’t strike financial fear into the hearts of creators — it’s community they’re worried about

Where are the country’s most vibrant tech and startup communities?