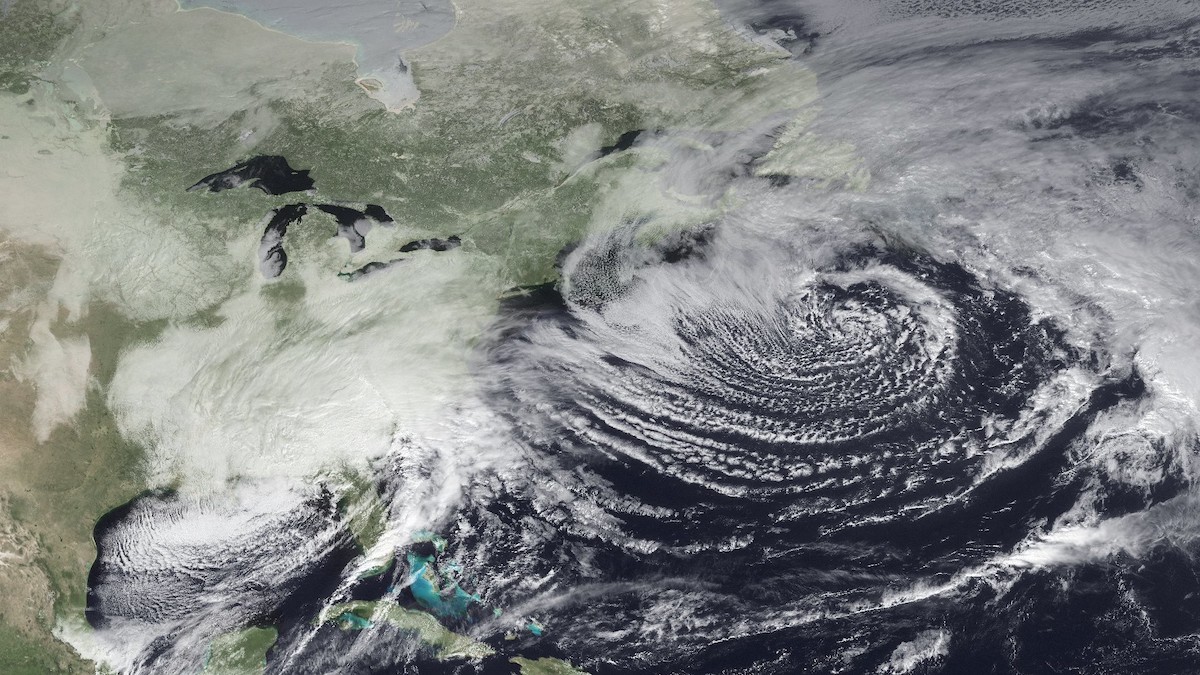

Reston-based ASRC Federal subsidiary Data Networks, secured a spot on a National Oceanic and Atmospheric Administration (NOAA) 10-year contract vehicle, which has an $8 billion ceiling. The company is on the satellite domain of the contract.

The subsidiary will be responsible for supporting the acquisition, deployment and ground system development and monitoring of satellites essential for forecasting weather, analyzing environmental and climate phenomena and monitoring hazards worldwide.

“Our team brings technical expertise across the entire satellite mission lifecycle,” said Jennifer Felix, president and CEO of ASRC Federal, in a written statement. “This win extends our work with NOAA and supports the critical mission of better understanding of our evolving planet.”

CACI wins $2.7 billion contract

The National Security Agency (NSA) awarded a $2.7 billion mission expertise contract to the Consolidated Analysis Center, Inc. (CACI), also headquartered in Reston. The company will provide network and exploitation analysis to the agency’s foreign intelligence and cybersecurity missions. This is a single-award, indefinite delivery, indefinite quantity contract.

“We are honored to assist the NSA as it confronts existing and future threats against national security,” said John Mengucci, CACI president and CEO, in a written statement. “CACI has been privileged to work with the NSA for more than 20 years. Our extensive expertise and critical support have contributed to some of the nation’s most important global foreign intelligence and cybersecurity missions.”

EJF Capital raises $167 million

Arlington’s EJF Capital, a global alternative asset management firm, closed its second Opportunity Zone investment fund with about $167 million.

The funding will contribute to EJF OpZone Fund I, which aims to invest in housing and industrial development projects in “Qualified Opportunity Zones,” or lower-income census areas as defined under the IRA’s Tax Cut and Jobs Act (TCJA) of 2017. The strategy is to capitalize on the tax benefits outlined in the TCJA for investing in Opportunity Zones.

“The successful closing of our second Opportunity Zone fund reflects the confidence placed in us by our investors, both existing and new, and is a testament to the resiliency of our asset classes, the strength of our investment platform and the depth of our regulatory-driven focus and financial and real estate expertise,” said Neal Wilson, co-CEO of EJF, in a written statement. “We are grateful for our investors’ strong support as we continue to execute on the significant opportunities ahead and pursue consistent performance across our portfolio throughout market cycles.”

Here’s who else raised money:

- DataTribe, a self-described “cyber foundry” in Fulton, Maryland that invests in and co-builds cybersecurity and data science companies, just announced it is taking applications for the 2023 Cybersecurity Startup Challenge until Saturday, Sept. 23. The competition searches for pre-Series A tech startups focused on cybersecurity and data science. Three finalists will share the $20,000 prize money, with one winner receiving up to $2 million in seed capital from the company.

- Georgiamune, a clinical stage biotech company located in Gaithersburg, Maryland, secured $75 million in Series A funding.

- Falls Church, Virginia-based Hushmesh, a cybersecurity company, raised $5.2 million in an early-stage financing round. The money will be used to develop the company’s “Mesh” product, a secure internet space that features automated and encrypted security.

- Arlington, Virginia’s GoTab, a restaurant commerce platform, raised $18 million in a Series A funding round.

- Electra Aero, based in Falls Church, Virginia, is an aerospace company developing and manufacturing hybrid-electric aircraft. The Lockheed Martin and US Air Force-backed company secured an undisclosed amount of funding from Statkraft Ventures.

- DC-based Exponential Exchange, a financial innovation platform, closed a $7.4 million seed funding round.

- DocketScope is a subsidiary of Arlington, Virginia’s The Regulatory Group. The company, a SaaS firm that analyzes public comments on proposed regulations, raised $400,000 in a seed funding round.

Here’s who else nabbed a contract:

- ASRC also won the National Institutes of Health’s $90 million contract. The company will study environmental effects on public health for five years.

- The Naval Facility Engineering Systems Command Southwest awarded a one-year, $11 million contract to Parsons Corporation, which is headquartered in Centreville, Virginia. The tech-focused defense, intelligence, security and infrastructure engineering firm will provide project performance assessment and programmatic risk management services for the Facility Engineering Command’s construction program.

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!

Donate to the Journalism Fund

Your support powers our independent journalism. Unlike most business-media outlets, we don’t have a paywall. Instead, we count on your personal and organizational contributions.