The Maryland General Assembly ended its 2013 legislative session April 8.

One of the measures approved this year was the Cybersecurity Investment Incentive Tax Credit.

MDBizNews offers a breakdown of what the tax credit provides:

- Establishes a tax credit for investment in startup cybersecurity companies that will help solidify Maryland’s place as a cybersecurity leader in both the government and commercial spaces

- Provides a refundable tax credit to qualified Maryland cybersecurity companies that seek and secure capital from an in-state or out-of-state investor

- Funds the tax credit at $3 million for fiscal year 2014

- Allows Maryland to promote the development of startup cybersecurity companies that provide greater revenues for the state

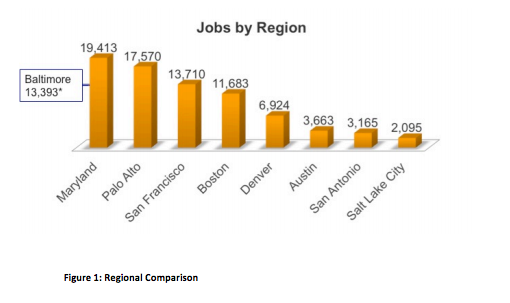

Technically Baltimore has reported much on Maryland’s cybersecurity sector, which is made up of roughly 20,000 jobs, 13,000 of those in Baltimore city.

This tax credit is yet another step in Governor Martin O’Malley‘s push to make the state the “epicenter of cybersecurity.”

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!

Donate to the Journalism Fund

Your support powers our independent journalism. Unlike most business-media outlets, we don’t have a paywall. Instead, we count on your personal and organizational contributions.

The case for storytelling: Want your region’s tech scene to grow? Start with a story, new data says

Why every city has a ‘startup week’ now — and whether they should

This Week in Jobs: The mother of all career roundups with 26 tech opportunities