Though startups from the Penn ecosystem already have a healthy supply of capital to go around, here’s a new national fund that looks to fund startups out of the Ivy League institution: newly-launched Contrary Capital.

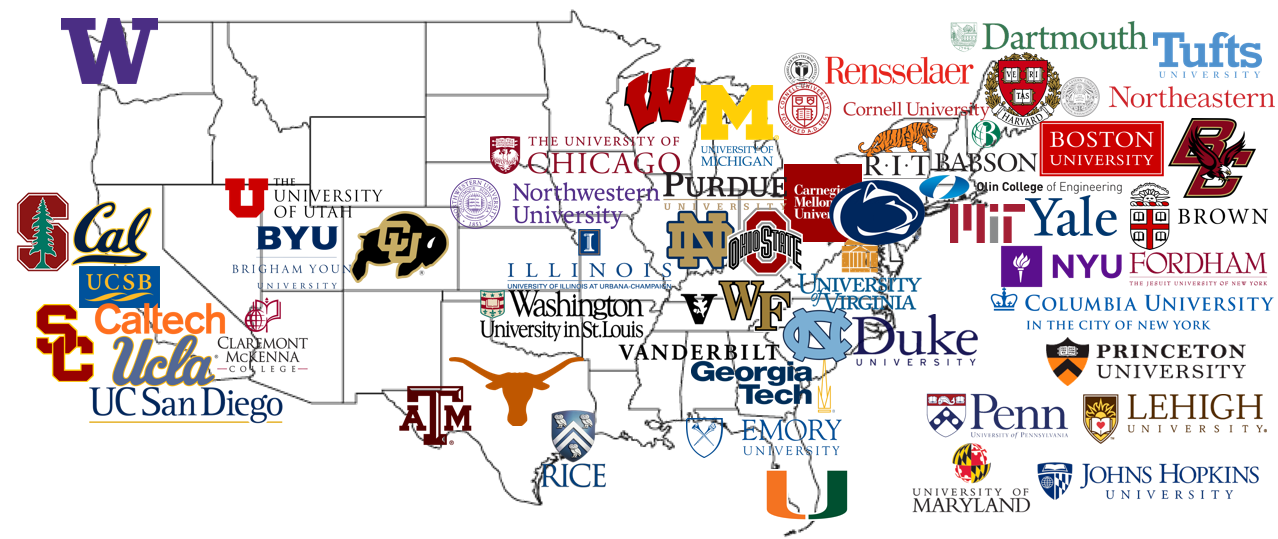

The fund has student investors perched at 55 colleges across the country. In Philly, it’s starting out with two investors at Penn: Julia Taitz and Sanjula Weerawardhena. They’ll be responsible for the Philly area, which means they’ll also be on the lookout for startups from Temple, Drexel and beyond.

Princeton, N.J.-based founder Eric Tarczinsky told Technical.ly that while the fund is still being locked down, Contrary Capital is expected to deploy 30 to 35 investments in the $50,000 to $200,000 range over the next two years.

Tarczinsky, who prides himself on being frugal, told Forbes the fund came together after a country-wide road trip that took him to dozens of college campuses.

“We’re investing in deals that your typical venture fund isn’t doing,” Tarczinsky, 25, claims. “They’re almost viewed as a seed investment.”

Contrary Capital, the founder says, is aiming for a gap left behind by other venture firms in the academic space, and hopes to give not just students, but faculty and recent grads, a shot at the funding through its decentralized model.

Read the full storyBefore you go...

Please consider supporting Technical.ly to keep our independent journalism strong. Unlike most business-focused media outlets, we don’t have a paywall. Instead, we count on your personal and organizational support.

3 ways to support our work:- Contribute to the Journalism Fund. Charitable giving ensures our information remains free and accessible for residents to discover workforce programs and entrepreneurship pathways. This includes philanthropic grants and individual tax-deductible donations from readers like you.

- Use our Preferred Partners. Our directory of vetted providers offers high-quality recommendations for services our readers need, and each referral supports our journalism.

- Use our services. If you need entrepreneurs and tech leaders to buy your services, are seeking technologists to hire or want more professionals to know about your ecosystem, Technical.ly has the biggest and most engaged audience in the mid-Atlantic. We help companies tell their stories and answer big questions to meet and serve our community.

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!

A new model for thinking about how to grow regional economies: the Innovation Ecosystem Stack

Penn dean is a startup founder and ‘engineer at heart’ who loves the connection between education and business

20 tech community events in October you won’t want to miss