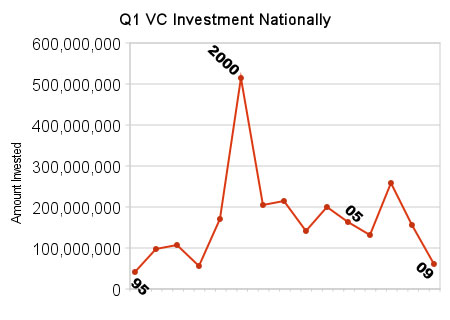

Last week, along with the usual oh-my-God-I’m going-to-be-homeless economics news came word that venture capital funding has plunged 50 percent in year over year first quarter numbers.

The numbers, courtesy of a PricewaterhouseCoopers Money Tree report, had a few people mulling the end of venture capital as we know it. But Technically Philly isn’t as concerned with Silicon Valley as we are with local numbers. Has the the local venture capital market fallen off a cliff, as national numbers indicate?

Join us as we whip out some charts, talk to a few people much smarter than we are and assess the situation. After the jump, find out what is affecting our local VC market and why one investor says business has never been better.

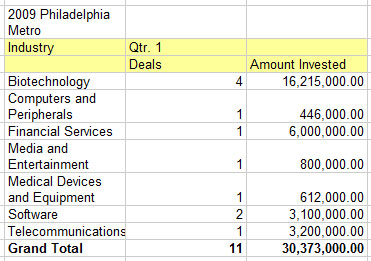

When it comes to venture capital investment, the Philadelphia area saw its numbers fall in lock step with the rest of the country. Compared to the same time period last year, total deals have fallen 57 percent and total amount allocated has fallen 60 percent. Nationally, those numbers are 55 percent and 62 percent, respectively. It is worth noting that the regional numbers are for companies in the Philadelphia area that have received cash, and not the numbers from Philadelphia-based investment firms.

When it comes to venture capital investment, the Philadelphia area saw its numbers fall in lock step with the rest of the country. Compared to the same time period last year, total deals have fallen 57 percent and total amount allocated has fallen 60 percent. Nationally, those numbers are 55 percent and 62 percent, respectively. It is worth noting that the regional numbers are for companies in the Philadelphia area that have received cash, and not the numbers from Philadelphia-based investment firms.

While total investments are down, the most troubling sign out of Philly is the amount of startups that have received funding. PricewaterhouseCoopers local audit partner Al Piscopo thinks that the most important barometer of the local VC market is the amount of new ventures being funded, which in Q1’s case came to a grand total of …. one.

“There was only one investment in a startup, and that was to a software company called OSS-1701, located in Wilmington,” he said. A bad economy tends to affect startup funding more than other kinds of funding. Investment firms have recognized that the exit markets such as IPOs and acquisitions have slowed, so VCs are more apt to fund existing ventures at a more conservative pace to aid them in weathering the bad economy — or at least fund startups with awful names.

From the outside, Philly would seem impervious to the quarterly ups and down of the overall national economy as our main industry is seemingly recession-proof biotechnology. However, numbers have even dipped in that sector as the industry is currently not only suffering from a bad economy, but a regime change in Washington has many VC’s keeping their money close to the vest as they develop a wait-and-see attitude.

“Its fair to say that VC firms are being more selective in the investments that they are making,” said Piscopo. “This quarter was pretty bad, I would hope the numbers don’t go lower than [they did] this quarter. I would hope that this is the bottom.” Piscopo said he anticipates next quarter will still be lower than 2008, but he believes we have seen the bottom.

Seed Funding Strong

Of course there are two sides to every story. While the venture market is finding its bottom, the area’s only early stage accelerator program is looking to grow.

Steve Barsh of the early IT incubator DreamIt Ventures, argues that the panic over the current numbers is overblown, especially in regards to early seed funding. It’s not the first time the Philadelphia region has only had one startup investment in a quarter before. In fact, it’s happened 11 times before.

“They say ‘Oh it’s the worst in 12 years!’ But not in early stage IT,” said Barsh. To be fair, early stage IT and DreamIt are just one small slice of the overall pie. Locally, however they are as early stage as early stage can get and the best barometer of Pennsylvania dollars going to mostly local companies for early stage funding. DreamIt has seen applications for their incubator program double, and the group has funded the same amount of companies this year as it did last year: 11, 5 of whom are local.

“What we’re seeing is: things are great. We’re still building companies, their costs have come down, their time has come down, and their barriers have come down,” said Barsh. While it may not seem like a big difference, angel investment, which DreamIt specializes in, isn’t accurately reflected in the MoneyTree report that tracks investment by larger Venture Capital firms with funds at their disposal.

According to Barsh’s metrics, national early stage IT investments in Q1 2008 amounted to 55 deals for $196 million. Q1 2009 amounted to 34 deals for $138 million. While the numbers have dipped, it is no reason to panic says Barsh.

“We’re very enthusiastic,” he says. “For DreamIt, business has never been better.”

Every Wednesday, Shop Talk shows you what goes into a tech product, organization or business in the Philadelphia region. See others here.

Before you go...

Please consider supporting Technical.ly to keep our independent journalism strong. Unlike most business-focused media outlets, we don’t have a paywall. Instead, we count on your personal and organizational support.

3 ways to support our work:- Contribute to the Journalism Fund. Charitable giving ensures our information remains free and accessible for residents to discover workforce programs and entrepreneurship pathways. This includes philanthropic grants and individual tax-deductible donations from readers like you.

- Use our Preferred Partners. Our directory of vetted providers offers high-quality recommendations for services our readers need, and each referral supports our journalism.

- Use our services. If you need entrepreneurs and tech leaders to buy your services, are seeking technologists to hire or want more professionals to know about your ecosystem, Technical.ly has the biggest and most engaged audience in the mid-Atlantic. We help companies tell their stories and answer big questions to meet and serve our community.

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!