Peter Thiel, the cofounder of PayPal and first outside investor in Facebook, spoke Monday at the Franklin Institute in Center City. Thiel was there to talk about his new book, Zero to One, but also shared insights on globalization, higher education and what he looks for in new companies to invest in.

The takeaway (for all of it): be unconventional.

A panel of local tech leaders — Robin Hood Ventures Executive Director (and new Temple entrepreneurship chief) Ellen Weber, Gabriel Investments Managing Partner Richard Vague, Market Atlas Founder and Third Cohort Capital Partner Jon Gosier and SEI Chief Marketing Officer Mark Samuels — kicked off the Arts + Business Council of Greater Philadelphia event, discussing the strengths and weaknesses of the region’s startup ecosystem. The panel, and a Q&A with Thiel following his talk, was moderated by Technical.ly Editor-in-Chief Zack Seward.

“Anytime there is a trend, you can safely say there is too much of it,” Thiel told the audience, which was seated under the stony gaze of the museum’s massive Ben Franklin statue.

In unpacking his investment approach, be it for the Thiel Foundation or his Founders Fund, Thiel talked a lot about moonshots, like curing aging. “Aging is extremely understudied,” he said. “Every disease is linked to aging, and these basic science questions are not being answered where there is a crossover to technology somewhere.”

Thiel, who was greeted after the talk by the father of a Thiel Fellow, also has iconoclastic views on higher ed.

Being an entrepreneur, he said, is not something that you learn; entrepreneurship starts with a solution to a problem. “If someone tells you that in five or 10 years they really want to be an entrepreneur, that’s a really bad answer,” Thiel said. “That’s like saying, ‘I really want to be rich or famous.'”

You don’t start a company to get a line on your résumé, he said. A lot can go wrong — but, of course, the upside is great.

“Big companies are too bureaucratic and nonprofits are too slow,” Thiel said. “That’s why small tech startups keep popping up, to solve these problems that larger companies can’t.”

The best of those startups, Thiel said, are the ones that are uncompromisingly singular.

“I look for very unique companies that don’t actually fit a pattern,” he told the audience of several hundred. Think TheFacebook in the early days. Or synthetic meat producer, and Thiel investment, Modern Meadow. Or companies in the ascendant “sharing economy.” “Facebook was very poorly understood and so was Airbnb,” Thiel said.

“When you find a company that is one-of-a-kind and doesn’t really fit a category, it is usually undervalued and underestimated,” he added.

Before you go...

Please consider supporting Technical.ly to keep our independent journalism strong. Unlike most business-focused media outlets, we don’t have a paywall. Instead, we count on your personal and organizational support.

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!

Philly’s tech and innovation ecosystem runs on collaboration

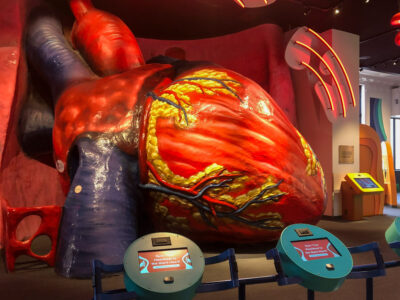

Look inside: Franklin Institute’s Giant Heart reopens with new immersive exhibits