Working on Honeycomb Credit, an investment crowdfunding platform that focuses on connecting small businesses with hyperlocal capital, I am often thinking about the intersection of small business lending and impact investing.

In this post, I walk through my case for why investing in local businesses is inherently impact investing. After reading this, you will understand why small businesses struggle to access capital even in a strong economy, why decentralized local lenders provide fair capital, and how you and everyone around you can participate in transforming the trillion-dollar small business lending industry currently failing many local small businesses.

What’s wrong with the small business lending market?

If you were to read the headline economic numbers, you would assume that small businesses are doing great — and by many metrics they are: Business creation is up, owner confidence is high, and over 30% of business owners say that now is a good time to expand (as of early 2018), according to the National Federation of Independent Business.

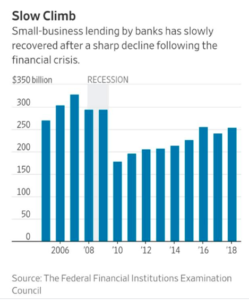

But digging deeper into the data, access to affordable capital eludes many small businesses in our community. A recent SBA report found that bank lending to small businesses declined by approximately $100 billion from 2008 to 2016. Despite an unprecedented run of economic growth, lending remains far from the highs of 12 years ago, impacting smaller businesses most. The recently published Small Business Credit Survey by the Federal Reserve found that of businesses seeking smaller loans, between $25,000 and $100,000 in financing, about half received less money from lenders than they were looking for.

As businesses are denied bank capital, they are increasingly turning to high-interest sources such as credit cards or online lenders. The online small business lending market has grown dramatically. In 2018, one-third of small businesses turned to online lenders up from 19% in 2016. Online lenders such as Paypal, Kabbage, and Ondeck help businesses meet their capital needs, but often at exorbitant rates, averaging annualized rates of 45% (!) throughout the industry, according to the Wall Street Journal. Our favorite local businesses are paying exorbitant APRs and losing livelihoods as a result. We need to find out what’s wrong with the small business lending market and how we can fix it.

An ECON 101 explanation for small business lending’s retreat

Why have banks’ small business lending stagnated despite positive economic conditions? Most economists point to the fact that from 1984 to 2017, we lost over 10,000 community banks due to a combination of increased regulation, branch shutdowns, and acquisitions. Consolidation in the banking industry has stunted small business lending leaving many local businesses unable to access capital.

First, consolidation has increased information asymmetries in the small business lending world, making underwriting increasingly quantitative. In the heyday of community banking, the underwriting team was local and familiar with those intangibles that made a business more bankable than the numbers might show. Because they can’t live and breathe the local context, most large underwriting operations have made quantitative elements (credit scores, DSCRs, years of profitability) the key drivers of their decision making, leaving many great businesses behind.

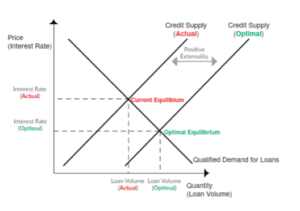

Second, faraway banks don’t internalize the positive externalities of supporting local businesses, so they undersupply small business loans. An externality is essentially a side effect of one person or group’s action that impacts others. Some economic activities can have negative externalities, like a coal plant polluting the air. But they can also be positive. For example, if you walk or take public transit to work, you reduce congestion on the highway, making everyone’s commute a little more efficient. Although externalities generally work in small ways, at scale, they add up.

By setting up shop in our communities, small businesses provide many positive externalities. Small businesses fill empty storefronts, increase actual and perceived safety, employ local people, and grow the local tax base. Surprisingly, banks used to be one of the biggest beneficiaries of these externalities. By lending to one business in their community, they would inadvertently be supporting the growth of an entire local corridor and the neighborhoods around it — making their previous local loans even more secure.

As the banking industry has consolidated, banks have less reason to lend with positive externalities in mind. A large bank in Manhattan sees virtually no positive externalities from a small business in Kensington. This means that the laws of economics tell us that large regional banks and national banks are less likely to take chances on small businesses than a community bank. And as community banks have disappeared, so has capital for small businesses.

At its core, we’re seeing a market failure, where positive externalities are not being correctly accounted for when making economic decisions, where banks are increasingly conservative in their lending because they don’t have the qualitative data that used to round out their decisions. This means that in aggregate, we are underfunding small businesses, and we are charging interest rates that are too high — hurting the Main Street growth we need.

Solution: keeping the lending decision local

So then what should we do? If banking consolidation has made small business lending difficult even in positive economic times, people passionate about bringing back local lending should take a page from community solutions.

Philadelphia’s network of Community Development Financial Institutions (CDFIs) and public-private small business loan funds such as PIDC serve as great resources of capital in Philadelphia because they are deeply attuned to their local context and benefit directly for promoting the positive externalities associated with local lending. Not only have they maintained fair lending, but these mission-driven organizations have also focused their attention lending to populations historically mis-served by the banking industry. These are efforts that should be supported both by government dollars and through financially concessionary impact investment.

However, when a trillion-dollar industry is retreating from lending to the newest businesses on the block, leaving around $350 billion worth of small business loans underserved every year, it takes more than local organizations to fix the issue. We need to solve the fundamental market failure in the small business lending world.

Why we want to turn as many people as possible into local investors

If the banking system is no longer serving our earlier stage businesses because they are not attuned to our local contexts and do not benefit from the positive externalities associated with commercial lending, then maybe we should change the face of the lenders themselves. If we want more small businesses to access fair capital, we need to give the lending decision to those most knowledgeable about a business’ future, those most closely tied to the positive outcomes of their success: everyday members of the community — broadly defined.

George Cook. (Photo via ImpactPHL)

I’m not alone in this hypothesis, nor am I the first. In 2012, policy analysts, entrepreneurs, and lawmakers saw that the post-recession recovery did not translate to greater levels of investment in business startups. And they too believed that everyday people could do something about it. They passed the Jumpstart Our Business Startups (JOBS) Act with overwhelming bipartisan support. In the regulation, they created an exemption that now made it legal for local businesses to solicit securities investment from non accredited investors publicly.

On the rails of that regulation, we created Honeycomb Credit, the first investment crowdfunding platform dedicated to connecting local investors to Main Street small businesses seeking capital. We work with local businesses assessing their preliminary creditworthiness through conventional means, but whether or not the business receives capital depends on the investment of everyday people. Every day people are expert aggregators of qualitative data, they know the business owner, they have seen the menu improve, and all of these positive beliefs and thoughts are behind their decision to invest.

We have also seen that everyday people can also appreciate externalities in a way that no bank or solely-market driven institution can. In Pittsburgh, we have seen a neighboring business owner invest in the business next door, we have seen our investors invest across color lines, county lines, and state lines. When you give everyday people the chance to invest in one another, they can quickly see how their futures are intertwined. This notion, too, drives their investment decision and creates a lending market aligned with community values. To date, we have helped connect over 40 early-stage businesses and have turned over 600 everyday folks into community investors.

The Invest Local movement, much like the impact investing movement, is still in its infancy but its urgency is real. Almost every day our credit analysis committee interacts with businesses who have fallen victim to merchant cash advances or are seeking to escape a mountain of credit card debt. The lack of accessible and affordable capital is an issue that plagues our entire economy.

But I believe that empowering everyday people to become financial participants in their community is a key part of creating a fairer lending ecosystem. To make it work, I’d like to invite you to join us in the Invest Local movement so we can bring fair capital to our communities, one small business at a time.

This essay was originally published via ImpactPHL Perspectives, a multi-part series which explores the many facets of the impact economy in Greater Philadelphia from the perspectives of its doers, movers, shakers and agents of change. This version has been edited for style.

Before you go...

Please consider supporting Technical.ly to keep our independent journalism strong. Unlike most business-focused media outlets, we don’t have a paywall. Instead, we count on your personal and organizational support.

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!

The person charged in the UnitedHealthcare CEO shooting had a ton of tech connections

From rejection to innovation: How I built a tool to beat AI hiring algorithms at their own game

Where are the country’s most vibrant tech and startup communities?