Business owners of color received significantly more emergency Paycheck Protection Program funding in 2021 than they did in 2020, when just 12% of applicants of color received what they asked for, and as many as 95% of Black-owned businesses across the board were effectively shut out for being non-employer firms.

The second round of PPP, which launched in January 2021, contained changes that were aimed at making the aid accessible to minority-owned businesses. For instance, the first loans went through community banks more likely to have relationships with business owners of color, and they opened up eligibility to smaller businesses, businesses without employees, and contractors. Some banks, like M&T, accepted applications from business owners who had never done business with them previously, which took down a major barrier for businesses that had no bank loan for their business.

Small business platform Womply, which says it facilitated 27% of all minority loans in 2021, including 981 PPP loans for minority-owned businesses in Delaware, has released a report on the impact of PPP on minority-owned businesses that shows a marked increase in 2021.

“Minority,” in the report’s data, is comprised of Black, Hispanic and Latino, North America Indigenous/Alaska Native and Hawaii Native/Pacific Islander.

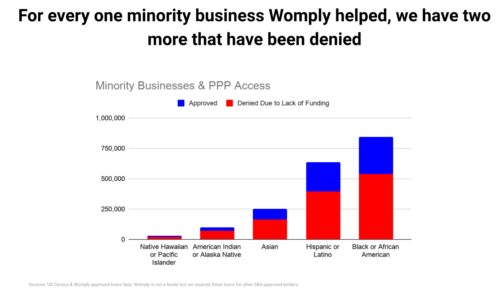

Graph of PPP loan data. Screenshot)

While the data has much improved for minority-owned businesses between the first and second rounds, with minority access doubling in four months from January to April 2021, the initial numbers were so low that doubling it still leaves many businesses without needed funding. Within its process, Womply identified 2,364 minority-owned businesses in Delaware that are still in need of PPP.

That tracks with Womply’s national findings that, for every one PPP loan that goes to a minority-owned business, there are two such businesses that need it but are denied.

The report concluded that another $50 million of PPP loans would be required to fund all eligible businesses, including 1.2 million minority owned businesses.

See the report on Google SlidesBefore you go...

Please consider supporting Technical.ly to keep our independent journalism strong. Unlike most business-focused media outlets, we don’t have a paywall. Instead, we count on your personal and organizational support.

3 ways to support our work:- Contribute to the Journalism Fund. Charitable giving ensures our information remains free and accessible for residents to discover workforce programs and entrepreneurship pathways. This includes philanthropic grants and individual tax-deductible donations from readers like you.

- Use our Preferred Partners. Our directory of vetted providers offers high-quality recommendations for services our readers need, and each referral supports our journalism.

- Use our services. If you need entrepreneurs and tech leaders to buy your services, are seeking technologists to hire or want more professionals to know about your ecosystem, Technical.ly has the biggest and most engaged audience in the mid-Atlantic. We help companies tell their stories and answer big questions to meet and serve our community.

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!

The person charged in the UnitedHealthcare CEO shooting had a ton of tech connections

From rejection to innovation: How I built a tool to beat AI hiring algorithms at their own game

Where are the country’s most vibrant tech and startup communities?