This piece first appeared in Technical.ly CEO Chris Wink’s Builders newsletter. It features tips on growing powerful teams and dynamic workplaces. Sign up to get more pieces like this in your inbox before they appear on our site.

“Collective ownership is centuries old,” Anna-Lisa Miller told me. In 2021, she was named the founding executive director of Ownership Works, a nonprofit formed by financiers to advance employee ownership. “There’s a big social case to be made for expanding this.”

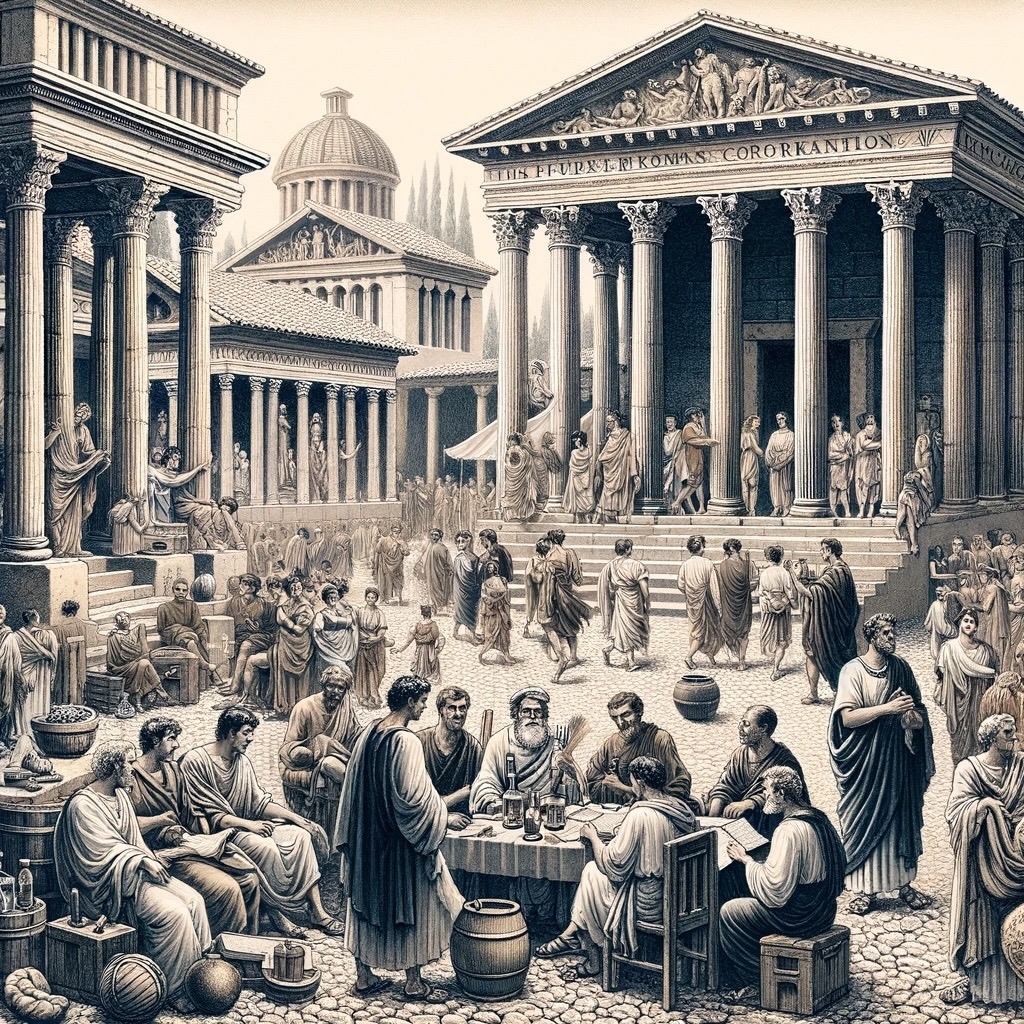

Corporations were invented in Roman times to extend the effectiveness of the government. Cicero called them “sinews of the state.” Over the next two thousand years, their form was refined but always followed the logic that they were meant to extend the common good of the nation.

Queen Elizabeth didn’t charter the East India Company to make London merchants rich but to organize capital to help extend English rule; Abraham Lincoln chartered the Union Pacific railroad not for Boston capitalists but to bring unified infrastructure. Profit wasn’t the state’s main interest but tolerated if enough public benefit was created, or so argued academic William Magnuson’s 2022 book “For Profit: History of Corporations.”

With few exceptions, however, ownership remained concentrated. That’s why political theorists like Karl Marx made a division between “capital” and “labor” — or the people who owned the stuff, and the people who did the stuff. In the United States, labor unions have been an influential counterweight in that division, as its put in another 2022 book, “Fight Like Hell: The Untold History of American Labor” by Kim Kelly, a progressive, labor-focused journalist.

In recent years, employee ownership has gained prominence. Last year, the US Department of Labor announced a new Division of Employee Ownership.

A key step in the modern form of employee ownership in the United States came with The Employee Retirement Income Security Act of 1974 (ERISA), said Miller of Ownership Works. Among its outcomes, ERISA created the Employee Stock Ownership Plan (ESOP), which enables employees to own part or all of the company they work for.

How widespread is employee ownership?

The concept can mean a few things.

“Employee ownership has a broad definition,” Miller said. It includes ESOPs, worker cooperatives and employee stock participation — ranging from the startup employee with options to a manufacturing line worker with vested equity.

To date, employee ownership is small. About a third of private companies offer some version of employee stock options, and less than half of public companies do, according to a Morgan Stanley analysis.

After peaking in the 1990s, the number of ESOPs in the United States has plateaued at around 6,000, Miller said, with a few hundred starting and being acquired each year. The number of verified worker cooperatives number around 800, with hundreds more that are active but don’t self-identify as formal cooperatives, said Mo Manklang, the policy director at US Federation of Worker Cooperatives (and a former Technical.ly teammate).

“But the headline is that it’s growing,” Miller said.

“There’s been a core group of true believers in this field for two, three decades,” she added. “It’s going to take involvement in people across multiple sectors to grow.”

What is the future of employee ownership?

Other experiments exist.

New York fintech startup Teamshares is building a portfolio of small businesses owned by families, who retain ownership. Private equity icon KKR, which is among the backers of the employee ownership nonprofit Ownership Works, has maintained its own employee ownership program.

A decade ago, the federal JOBS Act helped popularize “equity crowdfunding,” or publicly selling small parts of private businesses.

“It almost democratizes capital,” said Mel Ochoa of Landmark Ventures. “It just spreads access out a little more than we’ve ever seen.”

Ochoa is developing a program to expand the use of equity crowdfunding. He’s worked closely with Jamie Sears, the co-head of impact at UBS, the wealth management giant. Sears has long invested in programs to support entrepreneurship, as detailed in Technical.ly’s recent report The Inclusion Edge. Employee ownership is a natural extension of that, she said.

“At UBS, we’re really committed to creating a more equitable world and unlocking inclusive economic opportunities,” Sears said. “Ownership is really how you build generational wealth.”

The social good of more inclusive economic opportunities fits neatly with UBS’s core business of managing wealth. To make a meaningful dent in wealth inequality, employee ownership will have to grow.

“We’re really excited about expanding the work beyond philanthropic capital,” Sears said. “How do you make it more catalytic? How do you do that at scale?”

Put another way: The future of the ownership economy depends on a clear and effective narrative change about worker ownership creating a happier, healthier, wealthier world.

Join the conversation!

Find news, events, jobs and people who share your interests on Technical.ly's open community Slack

Philly daily roundup: City tech department layoffs; Is AI really new; Esports association comes to Philly

Philly daily roundup: What's next for ACP; Cheese dispensary tech; Philly Tech Week

Philly daily roundup: Minecraft in a Philly school; PTW kicks off; Tech and art happy hour