Many of the winners of the COVID-economy are now trading well below their 2020 lows — Netflix, Peloton, Teledoc, just to name a few. This happened despite the fact that their revenues remain well above pre-COVID levels.

It certainly feels like we traded in our optimism for VUCA: volatility, uncertainty, complexity and ambiguity. We’ve gone from celebrating our business superstars to celebrating their downfall. Schadenfreude makes for great headlines.

Last week’s collapse of crypto exchange FTX was well worth its own streaming documentary à la “WeCrashed,” “Inventing Anna” and “Fyre: The Greatest Party that Never Happened.” It was a drama in eight acts:

- Binance makes an early investment in Sam Bankman-Fried’s FTX.

- FTX is wildly successful. Founder becomes a multi-billionaire genius poster-child.

- Founder then aggressively lobbies Congress for less active oversight of the crypto industry, and donates $39 million in the 2022 midterm elections.

- Founder then gloats to regulators about how much better FTX is than Binance.

- Binance is completely offended and tweets that it might sell all its FTX tokens.

- FTX suffers “run on the bank” and a liquidity crisis. Account holders flee.

- Binance tweets that it might buy FTX outright to rescue the company …

- … and rescinds the offer two days later, saying that FTX was too broken to fix. FTX declares bankruptcy by the end of the week.

None of this helped build confidence in Bitcoin, which was already down -70% from its peak before any of this happened.

This is what VUCA looks like.

Putting a value on uncertainty, complexity and ambiguity is difficult. Volatility … we can work with this.

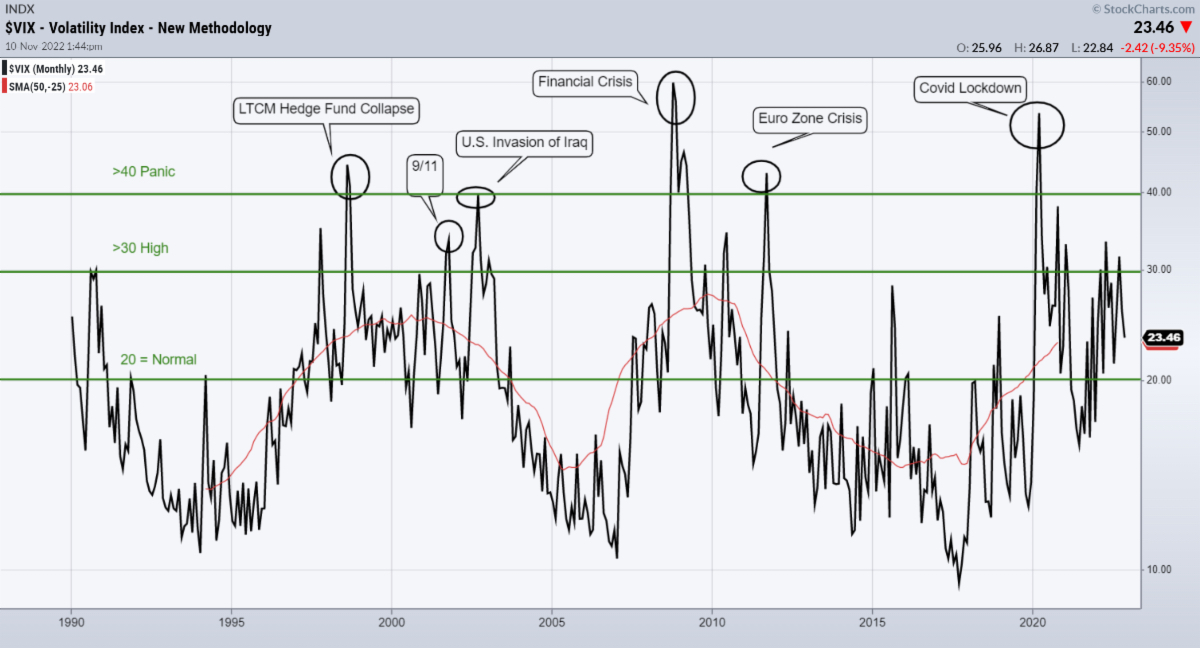

The most publicized measurement for volatility is the least understood. The VIX Index is sometimes known as the “Fear Index,” because it tends to spike during times of panic.

How do you read the VIX?

- Above 40 is panicked

- Above 30 shows anxiety

- Around 20 is normal

- Below 15 is confident

Volatility Index. (Image via Jim Lee, via StockCharts.com)

We’ve seen nothing that resembles the panic selling of previous crises. There are also no clear signs that the worrying is over anytime soon. Stocks are down, but most have not crashed — outside of the tech sector, that is, which really has collapsed.

Now, the important thing about the VIX Index is that it represents a forecast of risk over the next month. If you divide the value of the VIX by 16, you get the estimated daily price fluctuation of the market for the next few weeks. The VIX is at 23 today, this indicates traders are expecting prices for the stock market to swing by 1.5% daily. That’s the new (ab)normal.

The extreme optimism and euphoria are long gone, suggesting that we’ve already seen much of the downside. It might be a good time to invest some cash from the sidelines and think about quality investments — companies that are profitable and have strong enough balance sheets to survive an increasingly likely recession.

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!

Donate to the Journalism Fund

Your support powers our independent journalism. Unlike most business-media outlets, we don’t have a paywall. Instead, we count on your personal and organizational contributions.

Maryland firms score $5M to manufacture everything from soup to nanofiber

National AI safety group and CHIPS for America at risk with latest Trump administration firings

Immigration-focused AI chatbot wins $2,500 from Temple University to go from idea to action