It has been a terrible, rotten, no good, very bad year for investors.

Let’s call it a “triple bear” market. There is no hiding from it — everyone is looking for a tree to climb or a cave to hide in.

We are in a rare situation when bonds are having their worst year ever, the S&P 500 flirted with -20% losses, and the Nasdaq index for growth stocks was off -27%. Investors holding cash are earning less than 1% yield, while dealing with 8% inflation.

Fortunately, stocks don’t go down forever. Futurists say: “A trend is a trend until it bends or it ends.” The question on everybody’s mind is, how long are these losses going to last?

Trends are powerful. They tell you the direction of movement and the rate of that movement. But, trends won’t tell you when they are going to stop. We use cycles for that.

Cycles are amazing tools for timing the market. They don’t always work, because markets change. But they CAN give you some insights on when things might turn around. Here’s share some of my recent research on market timing using tools from the Foundation for the Study of Cycles:

Cycles are everywhere

From a scientific perspective, cycles and waves can be used to describe the qualities of natural phenomena, including light, sound, electricity, and even gravity. Colors are represented by different frequencies of light in the visible spectrum. High-pitched sounds are tones with short waves, low-pitched sounds have longer waves. Our senses of sight and hearing interpret cycles to understand the world around us.

Cycles also exist in social systems. The market timing system that we’ve developed at StratFI relies heavily on a 15-day cycle for the stock market. This works great for day-to-day trading, but misses out on the “big picture.”

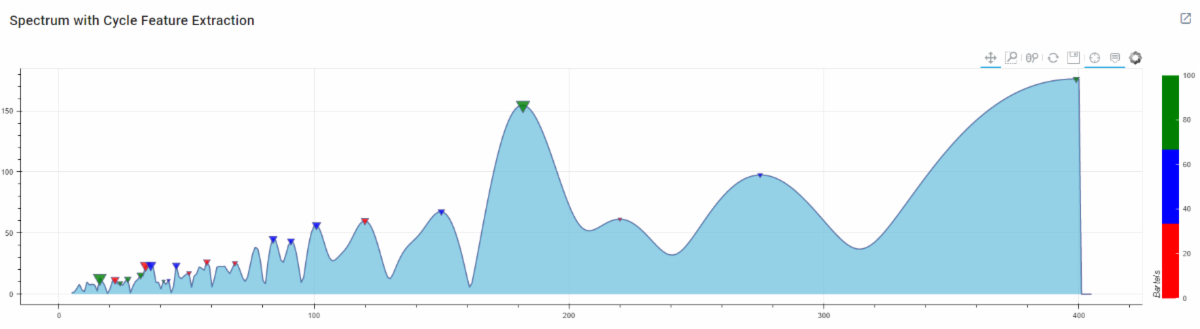

If we do a spectrum analysis of weekly cycles over the past 20 years (x-axis, left to right), the 182-week cycle stands out. It scores well on both strength (y-axis) and persistency (large green triangle). Look for the tall bulge in the center — let’s focus on that.

This is a long-term cycle, taking over three years to complete. It is sometimes referred to as a Kitchin cycle and was originally documented in the 1920s. This cycle is tied to commodities prices and business inventories. Kind of amazing that the pattern is still in place over a hundred years after it was discovered!

Adjusting for skew (stocks spend more time going up than down), we get the following overlay. It suggests that the current downtrend could last until April of 2023. I consider this a worse-case scenario.

(S&P 500 index is in blue, 182-week cycle is in magenta.)

But there is more than one cycle here. If we use the dominant intermediate-term cycle of 184 days, we get a chart suggesting that some type of recovery may already be underway … at least for the next few weeks.

So, the messages from a cycles perspective are mixed, however they do agree on one point: Downtrends don’t last forever. It’s an inexact science. The stock market isn’t physics, but we can use some of the same tools.