A company is worth however much someone is willing to pay for it.

For big companies traded on the highly active American stock exchanges, millions of traders, analysts and retail investors develop as thorough a valuation as anywhere in the world. Today, Amazon is worth $1.5 trillion and FiscalNote, a DC-based policy software company that went public last summer, is $150 million.

Close observers may remember that FiscalNote, long a celebrated DC tech startup, was valued at $1.3 billion before its initial public offering. Its current valuation of $150 million is less than the $160 million it received in a single round of growth capital back in December 2020. All told, the company has raised $625 million and acquired 10 companies. And yet, by just about almost everyone’s standards, the company is worth $150 million — except maybe founder-CEO Tim Hwang, who is exploring an effort to take the company private again.

To be clear, a declining tech company valuation isn’t faced only by FiscalNote. That company is just chillingly representative, especially for DC tech boosters.

How’d we get here? During the initial pandemic period, remote work and federal stimulus pumped up tech stocks, and investment flooded into private startups. Prices started to rise across the economy. Then by March 2022, the Federal Reserve Bank began increasing interest rates to make borrowing more expensive in an effort to slow down inflation. That set off a chain of events in which tech startups were seen as far less worthy bets for future profits than they had been for the previous decade. By one estimate, tech companies lost $7.4 trillion in cumulative value in 2022. Investors called it “valuation collapse.” That’s played out in public markets, where smaller and newer public companies, like FiscalNote, saw their market caps shrink; in contrast, the seven biggest public tech companies, including Amazon, have weathered the storm far better. What’s happened prominently in public markets also happened to private companies, but that’s been far quieter.

Startups don’t often issue press releases when they think they’re worth less than before — though payment processor Stripe and Checkout.com did.

What this means for those keeping track of tech unicorns — private companies valued at $1 billion or more — remains unclear. That’s because so many companies raised such gargantuan financing rounds in 2021 and 2022 that the strongest of these companies won’t need to go back to the well soon. Without a negotiation with investors, these companies likely won’t announce how much they value their company. Besides, rather than the loss-making “growth-at-all-costs” strategy they operated in years passed, most are feverishly working toward profitability.

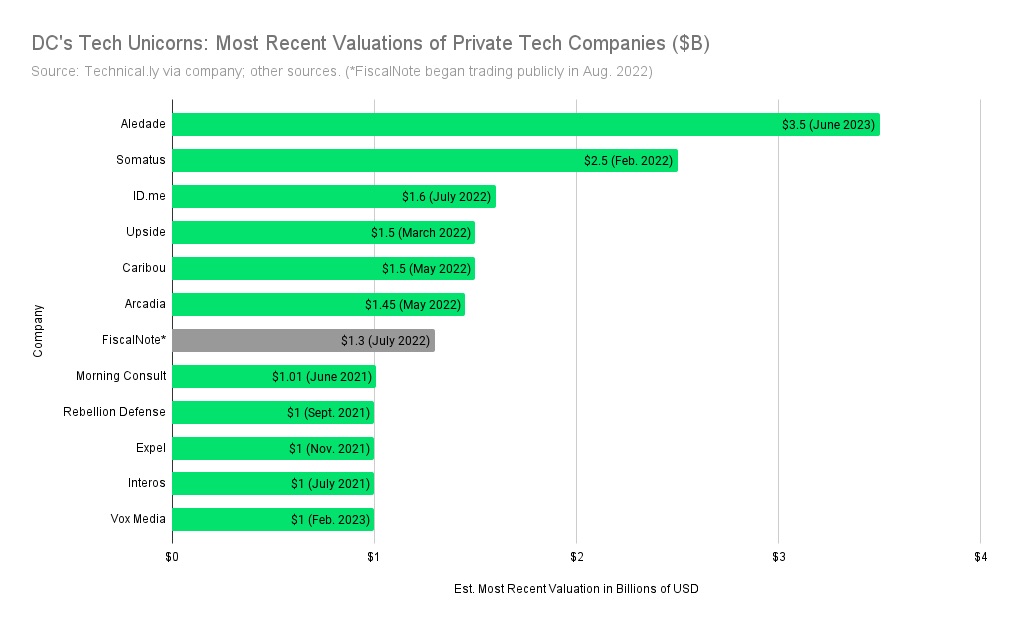

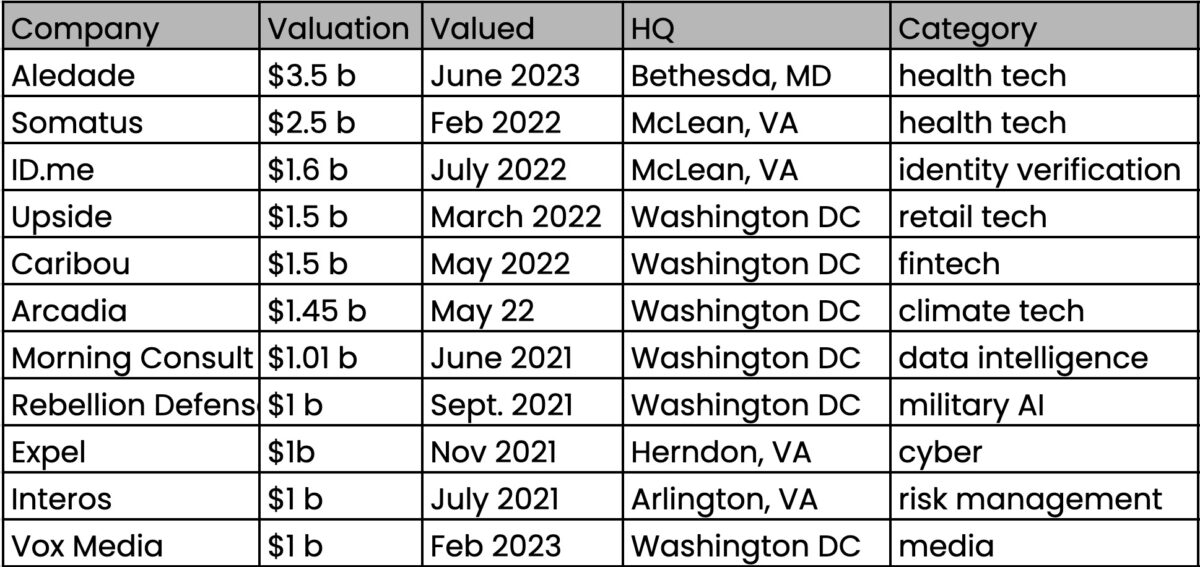

That renders any region’s count of tech unicorns likely inaccurate. Here the DMV is a telling example. By Technical.ly’s count of the most recent public valuations, a dozen tech or tech-enabled private companies in DC, northern Virginia and this part of Maryland (including FiscalNote, which eventually went public) exceed $1 billion. But the timing of these valuations matters.

More recent valuations are likely more accurate, such as the $3.5 billion valuation of Bethesda, Maryland-based health tech power Aledade in June, and even the probable $1 billion valuation of beleaguered, if beloved, digital media pioneer Vox (which we once considered DC’s first tech unicorn) from February. In contrast, the 2021 unicorn-level valuations for Morning Consult, Rebellion Defense, Expel and Interos are far more uncertain. Given that FiscalNote, by most accounts a strong and serious business, is worth barely more than a tenth of what it was a year ago, it’s unlikely all of these other DMV unicorns still justify the distinction.

Why does this matter? In some sense, the correction in tech valuations is welcome. Cheap money is gone, and so these business teams are challenged to create enough value for their companies to thrive — even if they are unlikely to be true unicorns today. The region is best served by healthy, vibrant, value-creating companies that attract and retain employees by inspiring, serving and challenging them. That won’t always happen. How much other people are willing to pay for their company will tell the tale.