When it comes to the economy as a whole, describing a slowdown is the norm as the COVID-19 pandemic continues. In venture capital, however, it’s picking up.

VC investment dollars hit a seven-quarter high in the U.S. in the third quarter of 2020: A total of $36.5 billion was invested in U.S. tech and healthcare companies, according to data from the MoneyTree Report by PwC/CB Insights. That’s up 30% from the second quarter. The total number of deals rose to 1,461 investments in companies, up 1% over the prior quarter.

It’s the second straight quarter of growth, indicating that a slowdown toward the end of March as the pandemic set in didn’t become the norm.

“Things are still going gangbusters,” said Brad Phillips, a director in PwC’s Emerging Company Services practice. “It’s been a relief for a lot of people that were in the market and just didn’t know what was going to happen.”

Cybersecurity stays strong

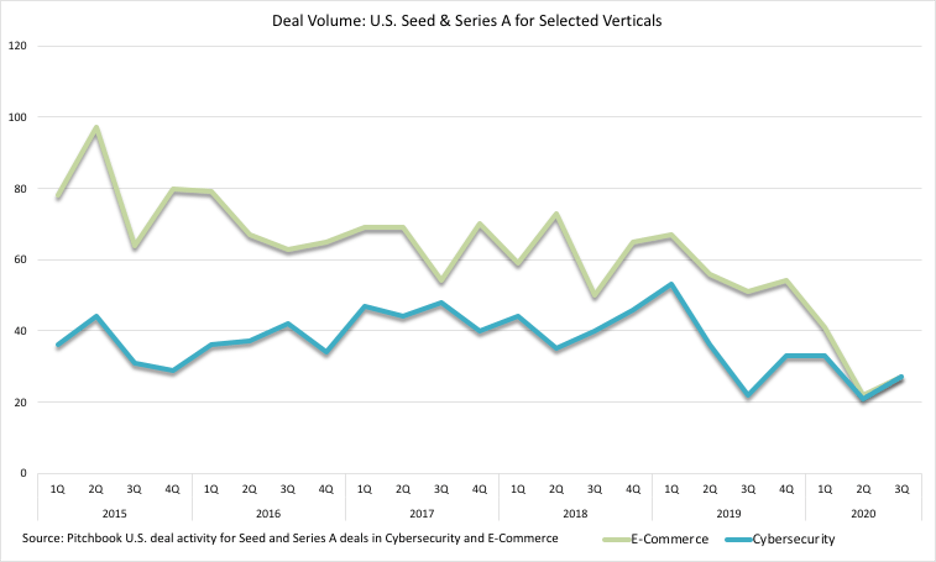

At DataTribe, Q3 was circled on the calendar. The Fulton-based cyber startup foundry, which makes investments as it builds alongside founders, has been tracking activity in cybersecurity deals this year. Though it found that a slowdown in cybersecurity investment began in Q2 of 2019, the effects of the pandemic have been a point of particular interest. But the deal volume data can also be a “lagging indicator,” the team wrote in a Q3 report. Given the time that relationship building and due diligence takes, the deals that closed in Q2 of this year were likely in motion already. So Q3 stood out as the first where deals that started taking shape earlier this year came to fruition.

“The bottom line is it seems that Q3 has shown that cyber investment at an early stage has remained quite resilient and is actually pretty healthy,” said John Funge, DataTribe’s chief product officer.

Nationally, early-stage cybersecurity deals were up 29% over the prior quarter, and up 23% in ecommerce, DataTribe said, citing data from Pitchbook. And cybersecurity, which is one of Maryland’s tech strengths, is gaining prevalence in the market: The sector represented 19% of early-stage deal activity in Q3, up from 14.9% in Q2, which was at that point a high.

Funge noted that the data aligns with the level of activity DataTribe is seeing from experience as it seeks out new companies. In fact, he said there’s been “a bit of an increase.”

Cultural shifts in deal making

Even with the slowdown in the wider economy, the process behind venture capital likely indicated from the start that it wouldn’t change right away. VCs raise funds from various sources that are then invested into companies, so many VCs who had funds already raised prior to the pandemic are still charged with going out and investing that money to generate returns.

Still, venture activity typically centers on in-person meetings. After all, it’s built on the idea that you’re going into business with a company, so you’d want to meet them in person. But with the shift to remote work, they’re doing that work virtually. And it’s actually leaving time for more meetings to help push deals forward faster — for both startups raising funds and investors seeking to back them.

“Based on the numbers it looks like the Zoom fatigue is less exhausting than jumping on a plane,” Phillips said, noting that investors “adjusted really, really quickly. So it’s good to see because we’re in a situation where there’s challenges in the economy, so having money available for these new companies and hearing of firms that are raising money to put into early-stage companies, it’s really encouraging.”

Maryland’s strong showing

On the state level, there wasn’t the same quarter-over-quarter uptick as there was nationally. Maryland had $256 million invested across 17 deals for the third quarter, per the MoneyTree Report. That was a decline from $368 million across 22 deals from the second quarter. Still, it’s worth noting that Q2 saw a notable high for a state where totals are notoriously “choppy.” The national trend was driven in part by the latest rise in “megadeals,” which are investment rounds over $100 million, and Maryland didn’t have one of those.

However, it remains true through the state lens that venture capital is still up in the pandemic: Through Q3, this year’s total of $828 million is already outpacing last year’s full-year total of $700 million.

On the local level, it was a notable quarter for the city as seven companies in Baltimore got funding. These included a pair of notable Series B rounds as fintech company Facet Wealth secured a $25 million Series B, ecommerce logistics and fulfillment company Whitebox closed on $18 million and medical device company CoapTech raised $7 million. In the metro area, Ellicott City-based BlackPoint Cyber raised a Series B of its own at $7 million. Continuing the institutional rounds, Hungry Harvest also added $6.45 million to a previously announced Series A round.

Phillips noted that companies in the state garnered about 70% of the invested dollars in the wider D.C. region, noting that it’s part of a “trend towards Maryland.”

“It was a good quarter for Maryland regarding the share of the total dollars invested in the region,” Phillips said.