As entrepreneurs from the state gathered at the Hilton in Baltimore on Wednesday for TEDCO’s Entrepreneur Expo, George Davis announced a vision he is calling “TEDCO 2.0.”

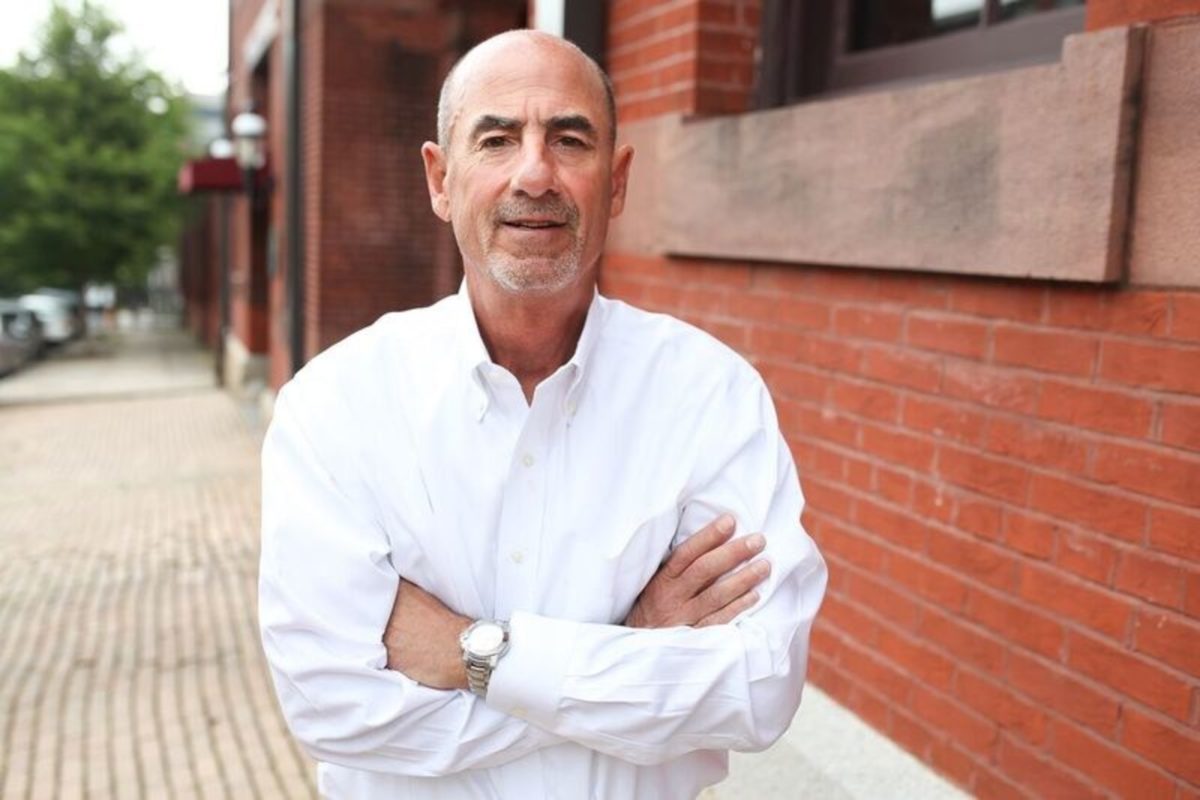

It’s the result of what the investor and entrepreneur learned through conversations and visits around the state he’s made since taking over as the CEO of the state-backed agency that supports early-stage companies in June.

The organization was making some moves toward change before he came on, including absorbing the Maryland Venture Fund, presenting its funds publicly as one Seed Investment Fund and starting a pre-seed fund for entrepreneurs it started with Harbor Bank CDC.

When Davis was set to take the job in June, he told us that he wanted to make the organization more “connective,” and find winners in companies that will have a big economic impact on the state.

Now that he is 127 days in, changes are being implemented to make the organization “bigger faster and better – and more innovative,” Davis said.

Here are three areas of focus for Davis that we gleaned from his remarks and a follow-up conversation:

Bolstering existing programs.

TEDCO seeks to tap the state’s innovation economy, but Davis wants to make sure the agency is also embracing innovation itself. To Davis, that extends to the programs that support entrepreneurs outside of the funding it provides. He talked about adding virtual offerings for TEDCO’s programs, as well as offering more training for entrepreneurs. Initiatives such as the loaned executive program could also be in for expansion. Davis also said he wants TEDCO to operate faster to ensure they are keeping pace with the speed that entrepreneurs operate.

A venture mindset

Along with providing funding, TEDCO wants to find companies that will be big. The agency runs a number of funds that provide capital to early stage companies. Now, Davis said each of those are under the direction of the Maryland Venture Fund, which TEDCO absorbed in 2015 and retooled with new team members. That means Maryland Venture Fund Managing Director Andy Jones is effectively TEDCO’s chief investment officer, Davis said.

With the change, each fund is “getting the acumen of that higher end venture view,” he said. It’s about going “wide” to reach as many different companies as possible. But Davis said they also “want to be able to go deep and find some of thee gold star companies.”

Davis said he is also looking to create an environment where other early-stage investors join TEDCO at a company’s early stages.

Expect more partnerships

Throughout everything that TEDCO does, Davis said he wants more connectivity. That means more partnerships are likely, whether it’s with corporations or syncing up with existing spots in the state that provide resources to entrepreneurs.

“I want to show that we work well with others and coalesce some of these assets that already exist and put them intelligently into play,” Davis said.

Davis also showed he’s not afraid of the agency making a splash. At the end of the Expo, leaders surprised finalists of a competition for new incubator ideas by giving everyone prize money.