Around 9:10 a.m. Thursday morning, CEO Steve Zarrilli confirmed the major shift in Safeguard Scientifics’ 65-year history during an earnings call: the storied Radnor, Pa., venture firm will stop investing in new companies and seek to sell its position in the 25 companies it has backed.

“We will no longer deploy capital into new companies,” the CEO told investors Thursday, confirming the permanency of the strategy announced in January. Zarrilli made it clear that there was no specific timeline for the strategy, but did say that a strategy of this kind might be expected to take three to five years.

Under the new sell-off strategy, the company announced a “more streamlined organizational structure” that resulted in laying off 50 percent of its staff.

“We remain committed to supporting the needs of our existing partner companies and continue to maintain a deep belief in their underlying value proposition,” Zarrilli said.

The shift in strategy is Safeguard’s response to a particularly bleak year for the company’s finances. In 2017, Safeguard’s net loss came in at $88.6 million, four times greater than 2016 net losses of $22.3 million. Despite the losses, Zarrilli placed hope in the company’s portfolio, which includes Old City software firm WebLinc, Center City health IT company CloudMine and San Francisco-based Syapse, which just expanded its Philly office.

“With revenue growth of 23 percent over the prior year, our partner companies continued to drive strong momentum,” Zarrilli said. “As these companies near maturation, we are well-positioned to capitalize on exit opportunities that will enhance value for our shareholders.”

The problem: So far, at least three investor groups so far have put in doubt Zarrilli’s ability to deliver on his promise of capitalization.

Connecticut-based hedge fund Yakira Capital Management chimed in on Feb. 14 with an open letter to board chairman Robert Rosenthal to question if the firm’s current leadership had “performed appropriately as fiduciaries tasked with representing the best interests of shareholders.” Two weeks before, New York-based Sierra Capital asked for the resignation of current management team.

Most recently, on Feb. 23, Philly-based investor Ira Lubert, a former aide to storied Safeguard founder Pete Musser, joined Maplewood Capital’s Darren Wallis and other investors in Safeguard in an “insurgent slate of candidates that intend to run for Safeguard Scientifics board seats,” wrote Inquirer reporter Joe DiStefano.

An email to Zarrilli and calls to the PR firm representing Safeguard were not immediately returned.

Before you go...

Please consider supporting Technical.ly to keep our independent journalism strong. Unlike most business-focused media outlets, we don’t have a paywall. Instead, we count on your personal and organizational support.

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!

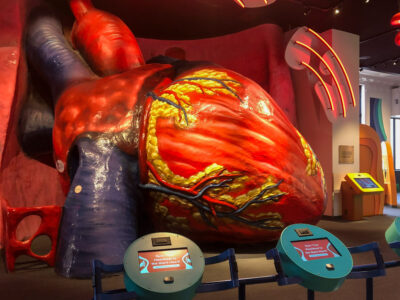

Look inside: Franklin Institute’s Giant Heart reopens with new immersive exhibits

How Berkadia's innovation conference demonstrates its commitment to people and technology

What actually is the 'creator economy'? Here's why we should care