Sharif Alexandre wants you to text more.

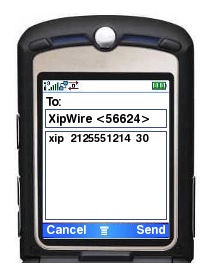

The founder of Fitler Square-based mobile payment platform XIPWIRE lets consumers send and receive money by SMS message. After registering for the service and linking a bank account, users can send a simple message which automatically pulls money from a virtual wallet or bank account.

“Xip $10 to Bill.” Bill’s got your dills.

The service works, Alexandre says, for inconvenient circumstances when someone’s forgotten a wallet or has to divvy up a tab. “If you go out to lunch and have to split the check, you go to ATM, you don’t know how much you owe,” Alexandre says. “If everyone has a XIPWIRE account, you can literally xip them money.”

Currently in soft-launch, plans are for XIPWIRE to be available to consumers next week.

The co mpany is first focusing on campus environments – like Penn, where Alexandre earned his bachelor’s degree in engineering in 1994 – where there are tight ecosystems that can revolve around tech savvy peer word-of-mouth.

mpany is first focusing on campus environments – like Penn, where Alexandre earned his bachelor’s degree in engineering in 1994 – where there are tight ecosystems that can revolve around tech savvy peer word-of-mouth.

In a telephone interview with Technically Philly, Alexandre pushed heavyily the “idealistic social good” of the project. The company hopes to tap what the financial industry calls the “underbanked:” those folks who are unable to get bank accounts.

COULD IT BE CHEAPER THAN TRADITIONAL TRANSACTION SERVICES?

For individuals, the service is cheaper than moving cash, Alexandre says, since expensive fees are tacked on at ATMs. The company is also making a play as a more affordable alternative to debit payment systems for merchants and nonprofits.

Individuals pay a $0.50 transaction fee when receiving a transaction or transferring funds between XIPWIRE wallets or bank accounts. When transferring funds from a credit card, there’s a 0.50 transaction fee along with a 2.5 percent service charge for card processing.

Individuals pay a $0.50 transaction fee when receiving a transaction or transferring funds between XIPWIRE wallets or bank accounts. When transferring funds from a credit card, there’s a 0.50 transaction fee along with a 2.5 percent service charge for card processing.

Cheaper than ATM fees, the organization points out.

For merchants, there’s a $0.15 transaction charge plus a 1 percent service charge for customer transactions. Nonprofit organizations are charged $0.15 per transaction and spared the 1 percent service charge for transactions.

In prelaunch, the site has only adopted a handful of merchants, though it hopes to expand on launch. They’ve been able to sign on the Philly Mag fave Buttercream Cupcake Lady who savvily uses Twitter to reveal the location of her postal truck/converted cupcake-haven each day. Philadelphia Animal Welfare Society has also expressed interest because it could save money with the service’s transaction rates.

It’s a short list of vendors, but it’s also a self-funded project only introduced in December. Alexandre, who excitedly explained his project – to the point that sometimes he was nearly out of breath – says that he’s even hesitant to take venture capital or angel funding until the company can find the right partner.

“It’s not about getting money, it’s about building something that has value to ourselves and to our society.”

It’s been a hobby project for two years for Alexandre, who after graduating from Penn, earned a Master’s degree in computer engineering from the University of Colorado before working as a systems and database administrator for companies like Raytheon, Lockheed Martin and Sprint. Working with financial systems for an online music service for MTV sparked Alexandre’s interest in a mobile payment platform.

“I just thought the whole idea to be able to text money was so cool. [I always asked myself] ‘how would you do that? How do you make that happen? How do you make it secure,” he says. “My rule of thumb was that I had to be comfortable enough using it myself, and I’ve been using it on a daily basis.”

SECURITY: A MAJOR PRIORITY

Alexandre says he learned a lot with the MTV gig, but most important was the complicated international PCI security compliance that goes into account data protection. He built the entire system with it in mind.

Each transaction requires PIN authentication. When a user sends a payment, the system asks him or her for the proper PIN authentication to complete the transaction. Users have to log in to the Web site to accept a payment so that there’s an IP address trail. If a phone is lost, a user can lock the system from the Web account.

Inside the database, sensitive data is encrypted. If a hacker does break into the system, they’re rendered harmless. For someone to do real harm to a user’s bank account, they’d have to know a user’s username, PIN number, Web account password and they’d have to physically have the user’s cell phone with them as well.

Now, it’s all about sales and marketing, Alexandre says, to capture some of the fast-growing mobile payment market. According to research firm Gartner, mobile payments are expected to double by 2012 to more than 190 million users from 74.4 million in 2009. It’s a big marketplace, so it’s less about competition, he says.

The team is aware of local mobile payment contender Venmo which has been in closed beta since late last year. “It’s hard to discern where we overlap or where we were different,” Alexandre says. “I think the space is so young, there’s definitely going to be room for many players.” XIPWIRE boasts mobile payment certification from all major carriers in the city, something it says sets it apart from Venmo.

As for major players, like Visa and others, who are pushing mobile payment services based on Near Field Communication and RFID technologies, Alexandre says that it’s a different market. “XIPWIRE is in a unique position where it offers payments both with merchants and person-to-person.”

For now XIPWIRE has its course set locally, for the city’s accessible merchants, university ecosystems and eventually, a large population of folks who don’t own bank accounts but certainly own cellular phones who’d be able to take advantage of a cashless payment system. There’s definitely a growth strategy for moving beyond Philadelphia, Alexandre says, but it’s Philadelphia first.

“If you can’t make it work in Philly, honestly, I don’t think it will work anywhere.”

Every Wednesday, Shop Talk shows you what goes into a tech product, organization or business in the Philadelphia region. See others here.