TEDCO made a series of promotions and hiring moves as the state’s quasi-public organization backing early-stage companies looks to rework the programs it offers to help entrepreneurs.

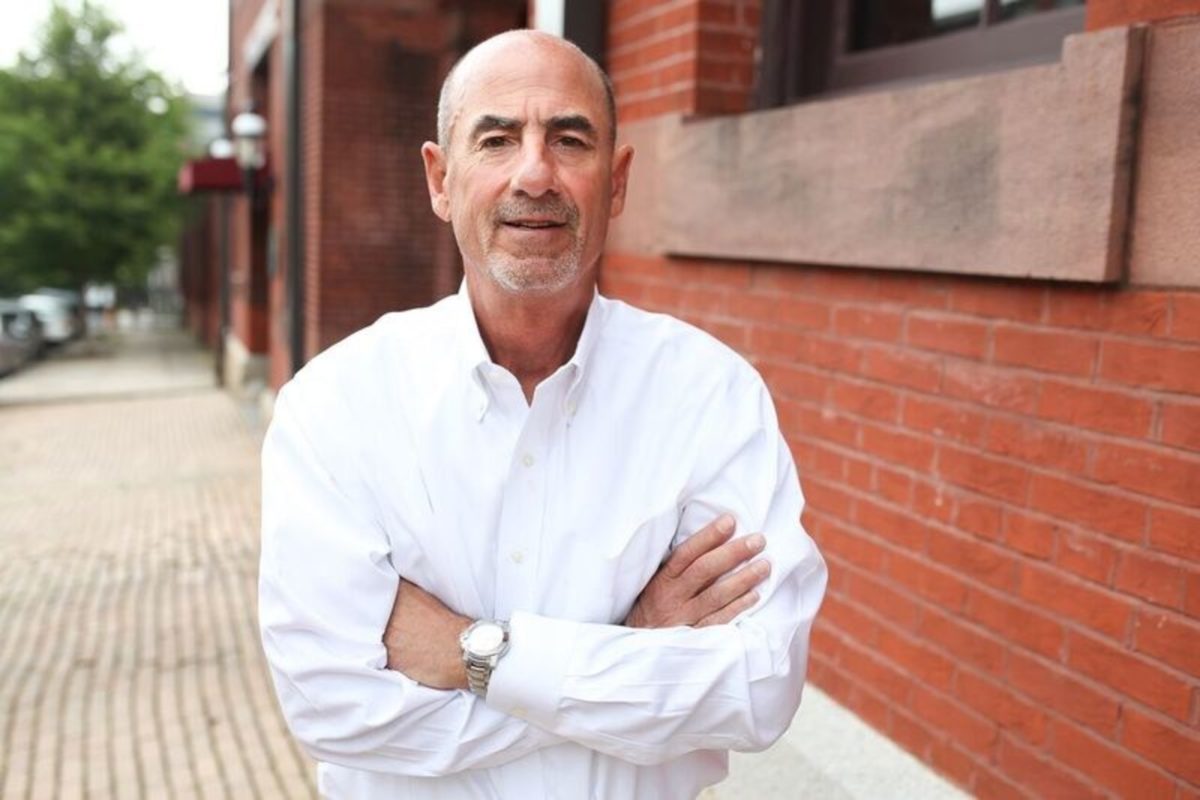

The latest announcement hones in on themes that recently-hired CEO George Davis touched on in announcing “TEDCO 2.0” at the organization’s Entrepreneur Expo in Baltimore last fall.

Davis, who was an entrepreneur and investor before he took the helm at TEDCO in mid-2017, said in an interview that the organization continues support entrepreneurs developing early-stage companies and support tech transfer. While change had been in motion at TEDCO for a while, the adjustments are making good on Davis’ previously announced plans to bring new programs and a venture mindset. With that came a look at the teams within the organization itself.

“We want to pull all this together so that if you come to TEDCO, regardless of if we give you money or not, we’ll get connected to what you need. We want to be able to get you where you need to go,” Davis said.

Here’s a look at the areas of focus and relevant promotions:

Business Development: Davis said more needs to be done to connect the whole community with entrepreneurs, whether it’s larger businesses, academics or government. To that end, Jennifer Hammaker was promoted to Vice President of Business Development. She’ll also lead an effort to get into the system and collect feedback on what entrepreneurs want, as well as promoting TEDCO.

Maryland Innovation Initiative: Arti Santhanam will now lead the $5.8 million program that provides funding and resources for tech transfer efforts coming out of the state’s universities. Previously, Hammaker led this initiative and Santhanam led the Life Science Investment Fund.

Pre-Seed Fund: TEDCO is looking to expand on an initial pilot of this fund that was focused on providing funding to women and people of color. Davis said the initial year saw 400 applications for only 10 grants. The fund will be led by program mangers McKeever Conwell and Angela Singleton.

Rural Business Innovation Initiative: This effort to provide more support for startups in the state’s rural areas has been well-received, Davis said, and TEDCO is looking to expand its offerings. Anne Balduzzi will now serve in an expanded role as Director of Advisory Services. That will include running the rural initiative as well as connecting entrepreneurs around the state to…

…New Gateway Services: Speaking of which, Davis said TEDCO is rethinking its entry points for entrepreneurs. It’s rolling out a new online tool where entrepreneurs can get an immediate assessment on whether they’re ready for funding, as well as other online tools. An expanded version of the Loaned Executive Program, which offers startups access to leaders who can help build a business in specific areas, is also rolling out.

Big Business: Through a program called IConnect, Davis said TEDCO is looking to spur connections with the larger companies in the state – those big homegrown companies like Stanley Black and Decker and McCormick – so that they can in turn connect startups to these enterprises as potential clients or mentors. That’s now part of the charge for longtime TEDCO leader Stephen Auvil.

Seed Funds: TEDCO’s early-stage funds have about $6 million a year, between funds dedicated to general tech, cybersecurity, life sciences and the “gap fund” to provide a second round of funding. TEDCO hired Frank Glover, previously an associate at Owings Mills–based Greenspring Associates, as Lead Director to oversee these funds. As shown in a recent announcement, the investments in companies from these funds will range from $100,000-$500,000. Internally, changes were also made to the process for reviewing funds to move faster.

Later-Stage Funds: For companies that are beyond the earliest stages in the state, Davis pointed to the Maryland Venture Fund, as well as the recently-launched Maryland Opportunity Fund, which is backed by $25 million from the Maryland State Retirement and Pension Fund. With all of its funds, Davis said TEDCO is looking to spur additional investors who will back companies. The goal, of course, is to find companies that can produce returns and lead to larger growth. Davis said TEDCO invested $750,000 in Harpoon Medical, and received a $5.2 million check when the company was acquired last year by Edwards Lifesciences.

Davis said TEDCO may look to grow further with new hires as the new programs roll out.

‘TEDCO 2.0’ comes into focus