Baltimore-based cybersecurity startup Terbium Labs raised $6 million in new funding as the company is looking to ramp up sales.

The round was led by Glasswing Ventures, and the Boston-based venture capital firm’s managing partner Rick Grinnell is joining the Terbium Labs board. The round follows a $6.4 million Series A, and Terbium Labs has now raised about $15 million.

“Our fund is focused on startups that leverage AI technology to create new products and platforms that ensure that the data, users, and devices of the increasingly connected world are secure,” Grinnell said in a statement. “Terbium Labs checks both boxes by offering enterprises a truly unique approach to information security and fraud prevention powered by an AI-controlled dark web crawler.”

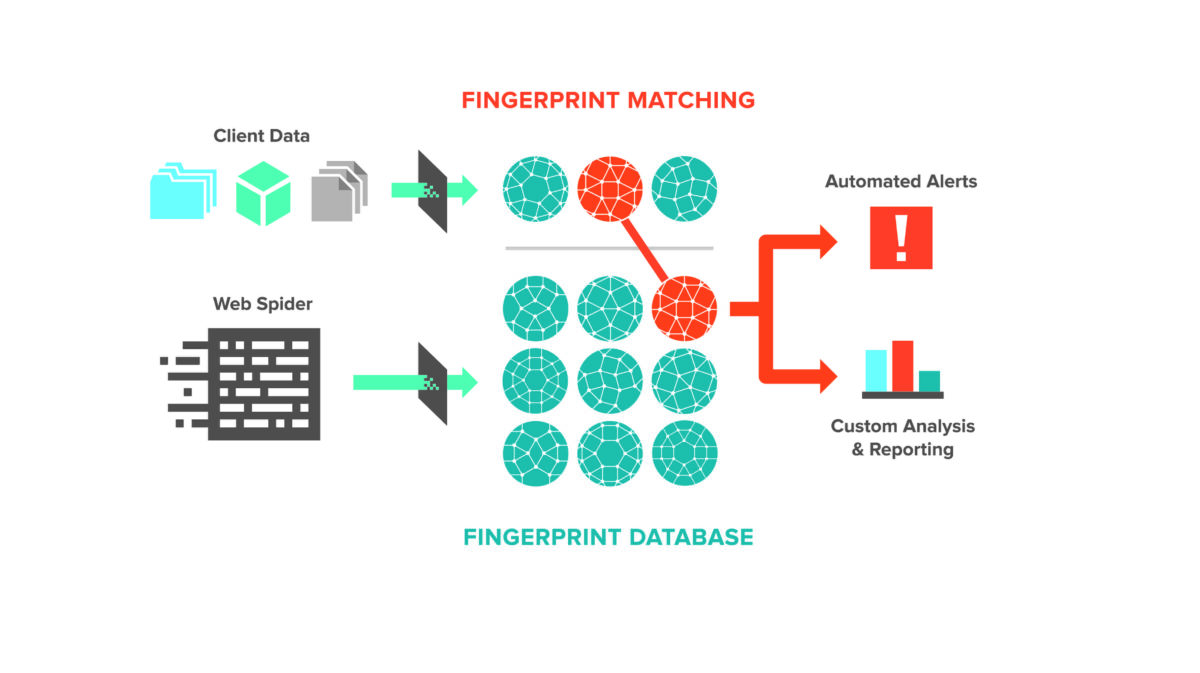

That product, known as Matchlight, scans for data that may have been stolen from its clients. It’s designed to bring automation to a process that has typically been carried out by human analysts, increasing the amount of data that can be processed and cutting down on the time between a breach and when it is discovered. CEO Danny Rogers said said another way the company seeks to stand out is privacy, as the company can identify that data was stolen but does not access the data itself.

The startup is one of a group of Baltimore cybersecurity companies hatched by alums of the region’s government-focused research centers, as Rogers formerly worked at Johns Hopkins Applied Physics Lab. Terbium Labs now has 20 employees working out of its offices in South Baltimore, and has been growing leadership ranks. The company recently hired Munish Walther-Puri as Chief Research Officer. Earlier this year, the company promoted Claire Gollnick to CTO and named Brett Davis as VP of Sales. In the coming months, Rogers said the startup expects to hire more sales staff, and potentially grow the team by 50 percent over the next year.

Clients like MasterCard and Thomson Reuters have been big names for the startup, but Rogers also sees a desire for more security tools from companies that may fall a tier below the giants that have been alerted by big breaches such as Equifax. These middle market companies may be regional banks, health systems or medium-sized tech companies, Rogers said.

“We see a big opportunity in what we call the mainstream market – all of those cos that couldn’t necessarily consume this and couldn’t necessarily do it themselves. Theres really no one serving that market in a meaningful way,” Rogers said. The company will also look to grow sales in Europe.

Terbium Labs raises $6 million, looks to hire for sales push