Editor’s note: While we don’t often report on finance, there is some overlap between big economic trends and how companies do their planning — and regions as a whole must consider how major shifts in the market will affect them, too. With that, please enjoy this 2020 market watch from a smart community member who thinks about this stuff for a living. The following article originally appeared in StratFI’s “Forward View: Market Outlook 2020” email published on Jan. 18.

It’s January, a perfect time to make forecasts! Like our New Year’s resolutions, sometimes they happen, sometimes they don’t. But, hey, they somehow make us feel better and it’s almost always worth the effort.

First, let’s look back: 2019 was full of economic surprises — mostly delightful. No market forecaster in their right mind would have predicted a 30% gain in the S&P 500 last year. It just wasn’t in the cards. But it happened, and nobody is complaining.

The rapid growth of stock prices was triggered by two other surprises:

Surprise #1: Negative interest rates are officially “a thing” now. Roughly $15 trillion of global government bonds now have negative yields. Who would have imagined that? Japan has been flirting with 0% bond yields for decades now, but for 10-year German Bundesbank bonds to yield -0.3%? It suggests some people so freaked at the prospect of losing money that they would gladly invest their hard-earned euros at a guaranteed loss to avoid the possibility of an even greater loss.

This theory was simply never covered in my undergraduate economics classes at William & Mary. Who knew? My head is still spinning …

Surprise #2: Now that it is possible to have negative interest rates, the Federal Reserve decided that it made sense to avoid a mid-2020 recession signaled by the inverted yield curve. Prompted by political pressures, the Fed reduced its benchmark lending rate three times in a single year. Such heroic measures are typically deployed to avoid financial collapse. In this case, it happened within the context of a stable, growing economy with 2% GDP growth and relatively full-employment. We’ve simply never seen this type of preemptive stimulus before.

There are a few implications:

- Asset inflation is back — Low yields on bonds typically leads to higher prices on stocks.

- Wage inflation should be coming back — And this is not necessarily a bad thing. Wages have lagged productivity growth for the past 30 years. We need to do a better job of sharing the economic pie; it starts with fair compensation.

- Malinvestment will happen — Easy money makes for bad decisions. Bad decisions make for good stories. We saw the collapse of WeWork last year. There may be more.

- Government debt will continue to explode — Low interest rates for deficit spending is like giving candy to a diabetic.

Everything here points to a greater toleration for inflationary risks. So what about the markets? As we’ve all learned by now, economists aren’t particularly useful at forecasting the stock market. So, I prefer to use a different set of tools.

Here’s a chart for what’s going on with the S&P 500 index; keep in mind that everything is subject to change:

Top chart: We’ve had steady, rising trend line (green) for the S&P 500 since October. Moving averages (red and blue) are both positive.

There is a possibility of a slight pullback to the lower end of the trading range. Possibly 3230 (-3%) by February/March. Not a big deal.

Conclusion: The “trend is our friend” here. Don’t fight it.

Middle chart: Recent gains are supported by healthy trading volume. We had a few low-volume days over the holiday season, but this is normal.

Conclusion: New money is still going into the market. It can continue until everyone is fully invested and we all have the most to lose.

Bottom chart: Markets are officially in “overbought” range and have been since mid-December.

Conclusion: This is what a raging bull market looks like. Enjoy it while it lasts.

In all seriousness, this is a fairly supportive market for investments. The last two decades have generated below-historically average returns for most investors. So, it’s nice to have a break from that and feel like it is the 1980s/1990s again. Depending on what valuation metrics are used, the market can be shown to be “over” or “under” priced.

This is a very uncertain political landscape, so everything can change in less time than it takes to post a coherent blurb on Twitter.

My sense is that interest rates, tax cuts and temporary relief from trade worries can support market growth, which could continue for the first half of this year. In the second half of the year, we may see some softness without additional economic stimulus. 2021 could be a tougher environment.

At the moment, I’m most interested in foreign emerging markets’ technology stocks.

Sounds a little crazy, I know.

###

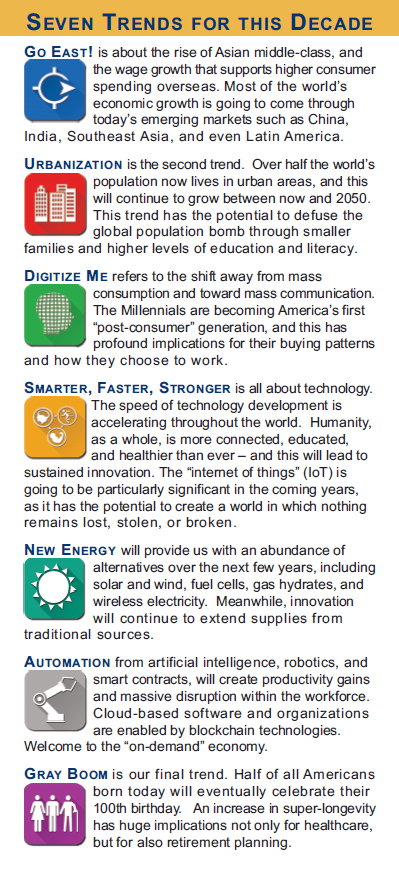

In the Greater Philadelphia area? At this end of this month, I’ll put on my futurist cap and give a workshop on mega-trends for the next decade. This is some fun stuff, and a great way kick-off the new year.

- When — Saturday, Jan. 25, 10 a.m. to noon

- Where — The Seventh Academy, 413 McFarlan Road, Kennett Square

- Organizer — Elizabeth Moro of the Little Barn of Big Ideas

- Suggested donation — $35

- RSVP — littlebarnofbigideas@gmail.com

A taste: