About two years ago, Jeff Gopshtein was deep into work on his end-to-end platform servicing those looking to buy apartment buildings.

It was early 2021, and the market for venture capital, investments and real estate was booming. His digital marketplace Yieldeasy sourced, analyzed and marketed apartment buildings, as well as hosted many of the title, financing and property management tools necessary to complete a property sale. The platform launched in late 2021.

But conditions of the markets changed drastically — especially in real estate. For those who were looking to buy multi-unit buildings, a 2.5% interest rate had been much more doable than the nearly 7% rates of 2023.

While in the Entrepreneur’s Roundtable Accelerator in New York City last year, Gopshtein reassessed.

“It was like the rug got pulled out from underneath us,” the Drexel University alum said of himself and his then-cofounder.

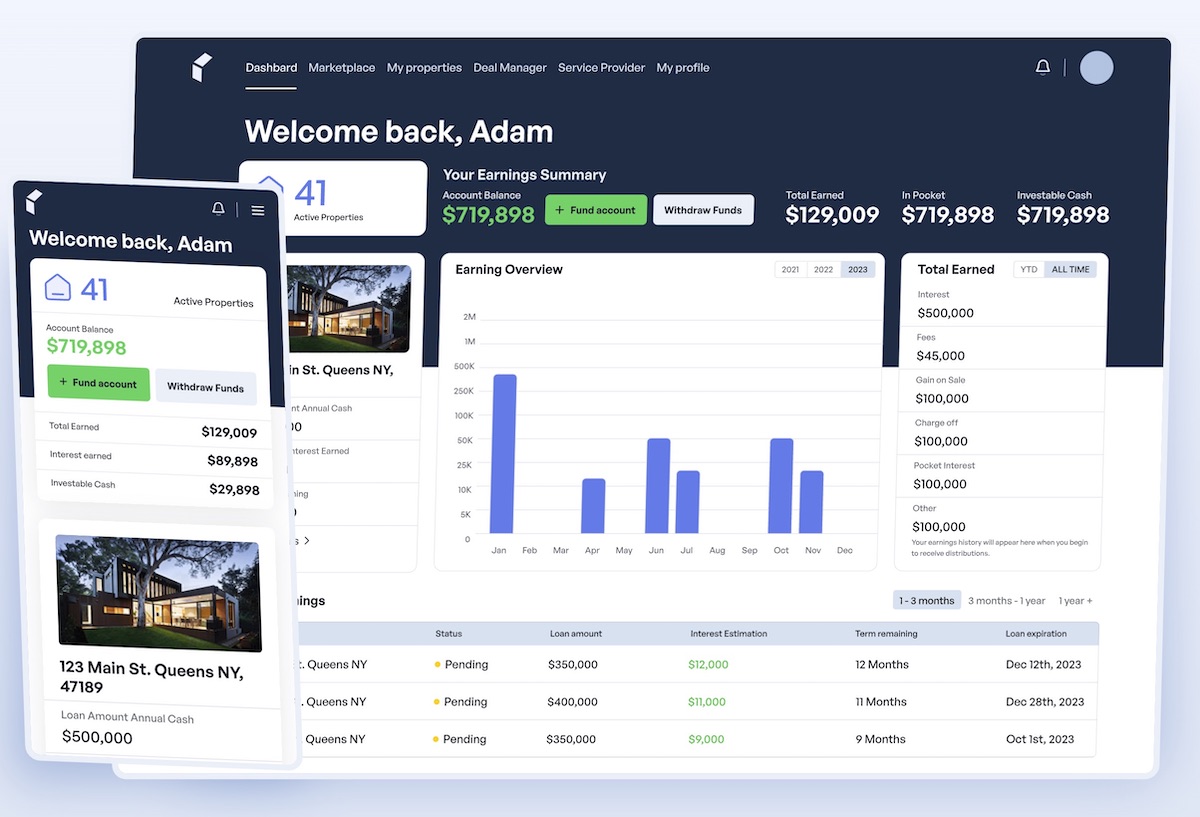

For the last several months, Gopshtein has been working on the next iteration of the startup. Yieldeasy is still in the real estate space, but now it’s focused on getting everyday investors involved in property loans via a system called fractional real estate debt.

Here’s how it works: Borrowers finance properties using a network of accredited lending partners, and through Yieldeasy, qualifying investors can invest alongside the lender, taking a share of the loan. As the property owners make loan payments, investors receive a monthly return. When the loan is fully paid, they receive their principal investment back. Investors who are approved by the site can link their bank account information and “cherry pick” their investments, Gopshtein said.

He’s brought on new cofounder with experience in the mortgage industry, Kirk Ayzenberg, who is from Philadelphia but currently lives in Los Angeles; Gopshtein lives in Bucks County. The startup is partnering with Ayzenberg’s tech-enabled bridge lender Nextres, which gives them access to more than $100 million in loans.

The pair are working with a group of five contracted developers on updates to the platform, which are slated to launch in a few weeks. Yieldeasy’s business model operates by retaining a spread of the investment, and they’re beginning to prepare to raise a seed round of venture capital.

Gopshtein said in addition to changing the “what” of the platform over the last several months, they’ve also changed the “who” of their customer base.

“Before it was like traditional real estate — get your hands dirty and buy a property,” the cofounder said. The product is now for “an accredited investor who can basically invest in this asset from their couch.”