Like many startup founders, Philly’s Cody Eddings and Anis Taylor used the pandemic as a time to pivot and find the product market fit for their young business.

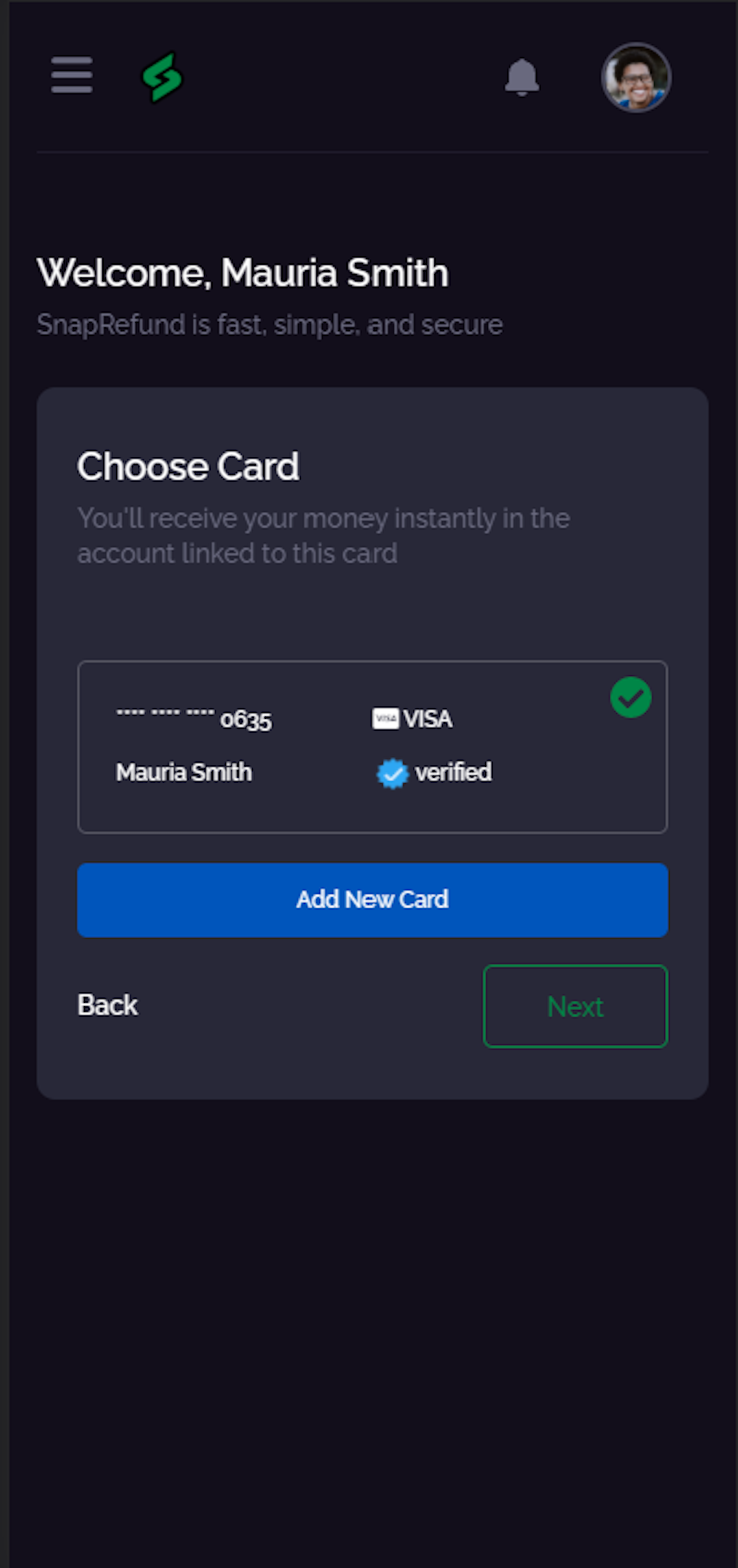

The pair are behind SnapRefund, a fintech startup that makes receiving refunds in the insurance industry speedier. Technical.ly first heard about the company when we talked to Eddings about his career as an engineer early last year.

“I’ve always been someone who’s wanted to be an entrepreneur and provide something of value,” he told us then. “I enjoyed having a grind. It requires insane amounts of work ethic. Your goal is that one day you can focus on one thing you want to do. It’s a fun challenge to see how each can help the other.”

Since then, the company’s taken on its third iteration.

SnapRefund started as Dime in 2019, with a goal of helping people, especially the underbanked, gain greater control of their money. The fintech platform was set up to help send digital payments outside traditional banking systems. By last year, the name and business model had changed, to a goal of shortening the time it took to receive a refund from ecommerce businesses.

But for the last year, the pair has been working on using their technology in a different space — insurance. With about a 15-day average for claims to be paid out, according to the founders, SnapRefund will make the paper check payout process digital.

Eddings, who’s based in Old City, said it wasn’t one big moment that made the cofounders pivot again. But at some point, they realized that all the moving parts involved in ecommerce — as companies in that space often work with third parties to process refunds — would make it a harder industry to service. SnapRefund’s tech, which allows a refund to be directly deposited into a bank amount digitally, fit the insurance industry well, too.

“We intentionally kept our backend agnostic, so that we could wrap that in industry-specific functionality,” Eddings said of being able to easily switch to the insurance focus. “We realized ecommerce was tough, and we knew we could apply our tech in a lot of different ways as we were developing it.”

Since the pivot, SnapRefund participated in Philly Startup Leaders‘ spring 2021 idea-stage accelerator. The cofounders have also been working with a development team and a collection of contractors and interns. The company made our 2022 list of promising tech startups as a runner up, and Eddings and Taylor are aiming to hit the “go live” switch on the platform later this month.

They’ve started building relationships with insurance carriers mostly though cold calls and organic connections through their network. The tech applies to any kind of insurance space, but they’re targeting dental and pet insurance. They’ve also been using LinkedIn Sales Navigator; “it’s a hard industry to sell into,” Eddings said.

Through the business’ different focuses, Eddings said he and Taylor have learned a lot about the fintech industry.

“We’ve learned so much about how payment rails operate domestically and abroad, how money flows from and to accounts, how digital systems are set up, how to use these newer technologies,” he said. “But overall, we’ve hit our stride on understanding how to operate a business.”

Eddings and Taylor have both started companies on their own: Eddings founded GS Technologies, the maker of the GuitarSim app, and Taylor launched Higher Than 7 Productions, an entertainment production company. But working on SnapRefund together has allowed them to bring all those lessons learned together.

“It has its own personality and life,” Eddings said.