Gaining access to venture capital isn’t a new challenge for underrepresented founders, or those seeking to work in VC. But approaches to solving it are changing.

Women are consistently left out of conversations with investors, are granted less funding, and only represented a tiny percentage of all venture capital raised over the last 30 years. At the same time, only 11% of investing partners at VC firms are women, and just 13% of VC funding goes to startups with a woman on the founding team — though, slowly, those numbers are shifting upward.

It’s a clear disconnect from research that shows that gender-diverse teams and women-led companies fare better in profit and growth, all without similar access to capital as men.

There are a lot of reasons to support the success of women-led teams, Ruth Shaber of the Tara Health Foundation said during a webinar held in honor of International Women’s Day, March 8. ImpactPHL had gathered four seasoned women in the entrepreneurship and investor space to talk about how and when to invest in women-owned and women-run companies.

Why fund women-led teams

Women are often closer to the problems they are setting out to solve, including innovation in fighting climate change, access to food and safety, and healthcare. Women often have a different perspective on risk, Shaber said; they tend to see more of long view on the business and are less likely to compromise on short-term gains for long-term gains. Women-led teams have markedly higher levels of collaboration, and lead more inclusive and higher-performing teams.

Judee Von Seldeneck, who recently established the JVS Philadelphia Fund for Women that will provide capital for women entrepreneurs in Philadelphia, said women are more qualified than ever before.

“We’ve got the credentials, the track records, and we’ve delivered results,” she said to the panelists. “Women have gotten better at speaking up — millennials, especially, in this employee-driven economy.”

Chaitali Patel, the chief impact officer at 100 Women in Finance, an org with a goal of introducing young women and girls to careers in finance and investing, agreed that opportunity was more plentiful for women now. But she said women entrepreneurs will still likely be pitching to mostly male investor groups for years to come. She’s working on what she calls the “long game” of creating cohorts of professional women in the investing space who will be able to support future business owners.

“There is real money investors are leaving on the table by not investing in women,” she said, referring to research that profits increase as the share of women on a team increases up to 50%.

And Mindy Posoff, managing director of Golden Seeds LLC, an investment firm that specifically works with women-led and gender diverse teams, said the firm operates with the understanding that investing in women isn’t an impact-related decision, it’s a business one. Those who ignore the proof about women-led teams succeeding are making poor financial decisions: “It’s not impact investing,” she said, referring to the triple-bottom-line practice. “It’s just good investing.”

Making change

So, how do we get more capital into the hands of women? And how can we make more women in charge of making investments? ID these common problems and follow through on the solutions, the speakers said.

“We’ve spent a lot of time looking at our own practices and the short answer is, people have to pay attention to the barriers at play,” Posoff said. “The only way to make those changes is having to be intentional, add these practices to your due diligence, but not set a different bar for what they’re looking for. Your process has to have intention. You have to allow access and you have to execute.”

Each type of capital is different, she added. Angel, venture, strategic and private equity investors will each have different goals for their investments, and understanding the differences might be key to getting the right deal. While venture capitalists are often looking for a huge return on larger growth companies, angels might be looking be looking for a return alongside a more personal interest in the business plan or mission.

Von Seldeneck suggested women look into grant programs specifically catered to them, like the US Small Business Association’s programs for women-owned small businesses. There are also funds, like hers, that aim to provide grants specifically to Philly’s women-owned startups.

Patel’s solutions-oriented org focuses on improving the number of women whose “titles and roles directly touch the money” at investment firms. She also tells women who are pitching to investors that it’s essentially a numbers game, both in your business plan and in the number of people you know.

“Talk to anyone who will listen to you,” she said. “Have your story, value and thesis, get those down right, and practice as much as you can. Substance means a lot less than style in some of these cases. And network and get out to meet as many people as possible.”

Before you go...

Please consider supporting Technical.ly to keep our independent journalism strong. Unlike most business-focused media outlets, we don’t have a paywall. Instead, we count on your personal and organizational support.

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!

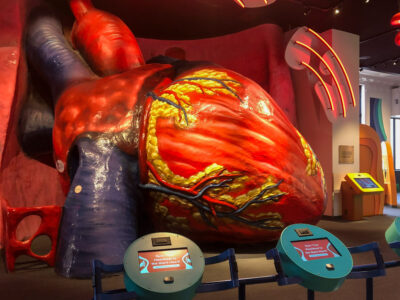

Look inside: Franklin Institute’s Giant Heart reopens with new immersive exhibits

How Berkadia's innovation conference demonstrates its commitment to people and technology

What actually is the 'creator economy'? Here's why we should care