In 2012, there were 117 venture capital deals made in Washington, D.C., with $484 million going to a variety of tech startups. That’s a benefit reaching into Baltimore’s startup community.

It also makes D.C. the 10th-best location to find venture funding, according to research by the Martin Prosperity Institute and documented at the Atlantic Cities.

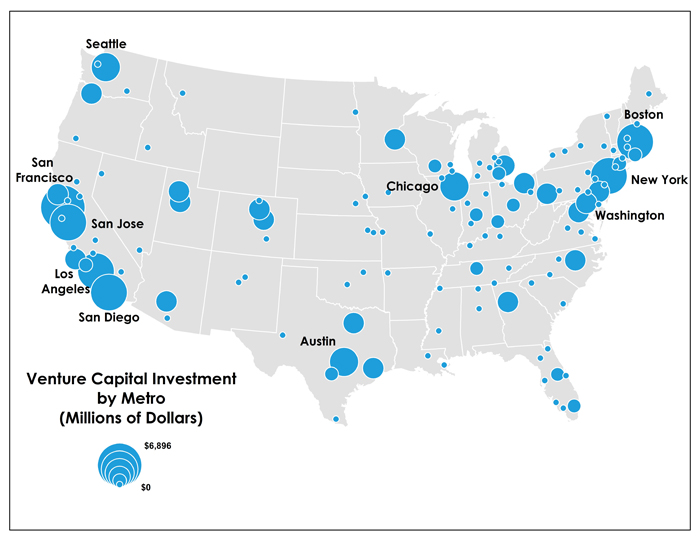

Additionally, the Northeast corridor from Boston to D.C. is beginning to flex its VC muscles, and the metro areas making it up — Boston, New York City, Philadelphia and D.C. — accounted for $6.2 billion in investment in 2012, or 23 percent of total VC funding in the U.S.

As for Baltimore:

Eight additional metros account for more than $100 million in venture capital investment: Salt Lake City, Cleveland, Houston, Detroit, Baltimore, Dallas, Portland, and Santa Rosa.