Editor’s note: These figures may vary slightly, as some deals aren’t accounted for until weeks after quarterly VC reports are published.

After rebounding from its paltry venture capital deal volume in 2021 with an impressive first quarter of 2022, Pittsburgh slowed back down in Q2. So, what did the Q3 hold for the region?

According to PitchBook and the National Venture Capital Association, which dropped their Q3 2022 PitchBook-NVCA Venture Monitor on Thursday, Pittsburgh’s startups brought in $171.96 million across 19 deals across July, August and September 2022.

That’s a higher dollar amount than Q2, which brought in $124.11 million. (Of note: The Venture Monitor now lists 36 deals total for Q2, rather than the originally reported 19. See the postscript for more details.) Meanwhile, Q1’s total was $222.47 million across 18 deals — an especially strong first quarter, though Technical.ly noted at the time that one strong quarter does not make a trend.

Still, overall, Pittsburgh companies have already raised a total of $518.54 million in 2022. That’s compared to 2021’s total of $373.98 million across all four quarters — and it’s looking like 2022 is on track to be one of Pittsburgh’s best years for VC, ever. It also appears that Pittsburgh is bucking the national trend of deals being down.

Pittsburgh’s 10 largest reported deals were:

- Novasenta — $40 million Series A

- Anexus Health — $33 million Series B

- iraLogix — $22 million Series C (which Venture Monitor’s Q2 report put at $14 million, the amount reported in a May SEC filing, instead of the company’s July announcement of $22 million)

- ECM Therapeutics — $16 million later-stage raise

- Carbon6 Technology — $14 million Series A2

- Abridge — $13 million Series A1

- Maven Machines — $10 million Series A1

- Bloomfield Robotics — $6 million later-stage raise

- Fullgreen — $6 million later-stage raise

- Aspinity — $5 million later-stage raise

For the nation as a whole, in the past three months, deal activity across all activity levels has seen its third consecutive decline in completed deals. Where there was a “record high” of 5,049 deals in Q1, that number has declined by 20% with a count of 4,074 deals for Q3. This is the lowest number of deals since the final quarter of 2020.

The report attributes the waning number of deals to factors such as the global economic downturn.

“The continued public market volatility has weakened capital deployment in early-stage deals as investors become more apprehensive about the large, outlier-sized deals of the past couple years,” the report said. “Investors are focusing on investing in the fundamentals of a startup instead of relying on another VC firm to invest at an even higher valuation.”

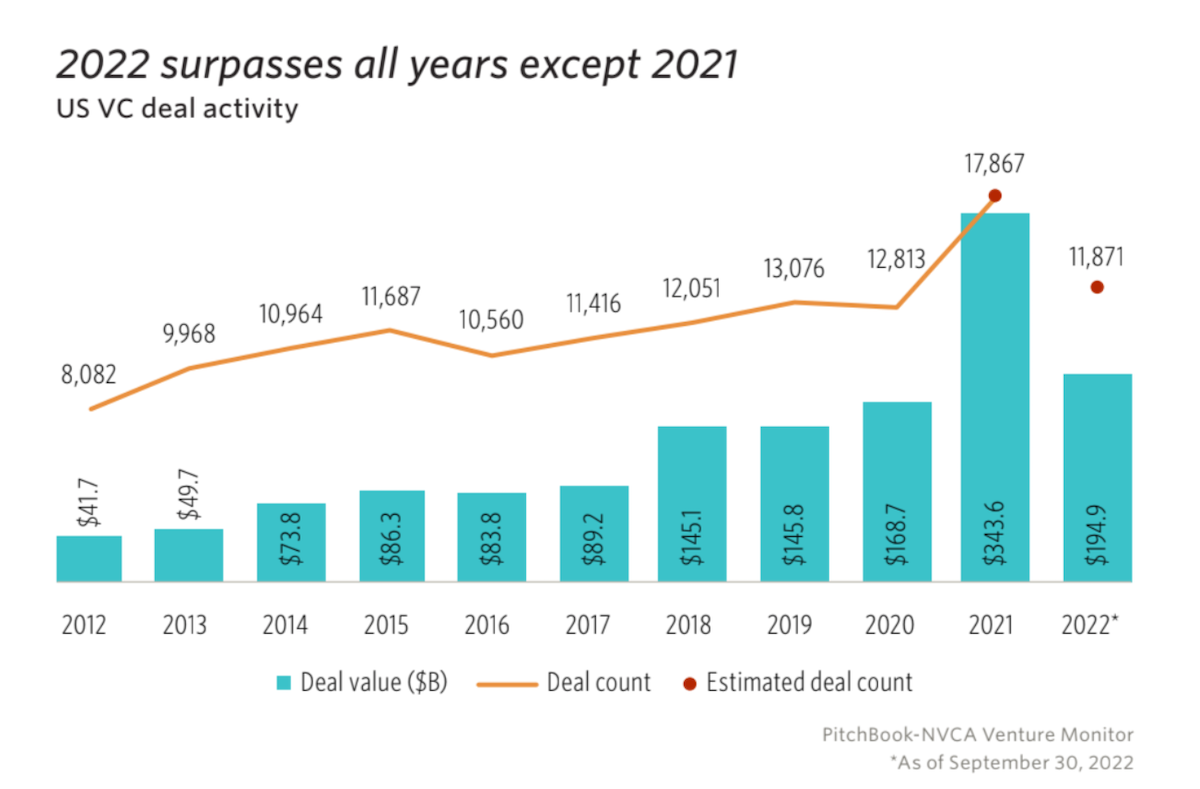

Though 2022 is seeing fewer VC dollars and deals than 2021, it’s on trend with where the market was headed before that record-breaking year. Heading into Q4, the country was on track to see more deals than 2019 and 2020. Angel and seed deals were slightly down compared to years prior, coming back to 2020 levels, the report found. And other early-stage investing followed suit.

What do local VCs make of these figures? Sean Sebastian, a partner at Black Tech Nation Ventures and Birchmere Ventures, told Technical.ly via email that although he usually hesitates to make assumptions about venture investment trends from just a few quarters, he finds the numbers encouraging.

“Overall we’re seeing pretty steady deal flow locally — not notably up nor down in quality or quantity,” Sebastian said. “Despite some recent big successes like Duolingo and Aurora [which both went public in 2021], Pittsburgh is still a fairly early-stage venture market overall, and those deals tend to be relatively immune to fluctuations in the later-stage ‘unicorn’ end of the market. It’s encouraging to see investment activity in robotics and life sciences, two areas that require substantial investing expertise.”

412 Venture Fund Managing Partner Ilana Diamond also noted Pittsburgh’s prowess in healthcare, biotech, autonomy and robotics as a reason that the region could maintain strong numbers in a downturn. Local founders took the long view in planning their fundraising this year, she said.

“In 2021, when valuations on the coasts were sky high, founders in our region often took a longer-term view and balanced the goal of getting strong valuations for their fundraising rounds with maintaining a path to continued valuation growth for future rounds,” Diamond said. “That long-term view is paying off now when companies that maximized short-term valuations during the bubble are facing the prospect of down rounds in the current environment.”

And Catherine Mott, the founder of BlueTree Capital Group, said she wasn’t surprised about Pittsburgh’s trends in funding and attributes the positive trends to grassroots efforts to attract VCs from other parts of the country to the city. Mott added that she has high hopes for the future due to the trends and grants such as the Pennsylvania State Small Business Credit Initiative and the Build Back Better Regional Challenge’s $62.7 million that’ve been poured into the region.

“I expect the momentum will fall as it has in the rest of the country,” Mott said. “The investment bubble is tamed by reality and VCs have to double down on their existing portfolio companies.”

_

P.S. Technical.ly has reached out to a Venture Monitor rep for clarification about this disparity and a spokesperson said: “PitchBook’s research process sometimes captures transactions that fall within a specific quarter after the quarterly report publication date or uncover new information on existing deals, which is why numbers tend to shift.”