It’s really freakin’ hard to build a company. In fact, there’s no rational reason to do so.

According to private equity research company CB Insights, 42% of the time your startup will fail due to lack of a market need for the product, about a third of the time you’ll run out of cash, and about 20% of the time you’ll have either not assembled the right team, not stood up to competition, set an unsustainable pricing model, or simply built a user un-friendly product.

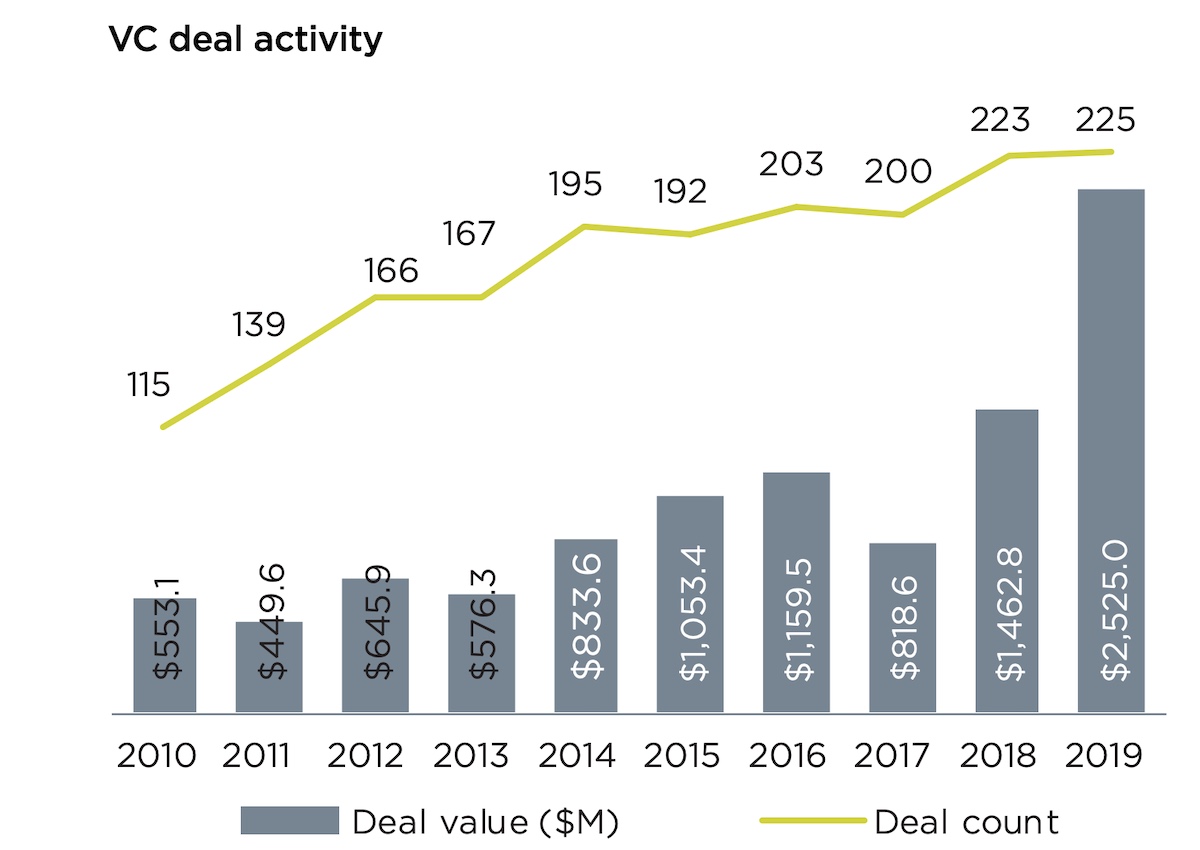

And yet, according to the PACT’s 2019 Philadelphia Venture Report, there were 225 venture capital deals to Philadelphia metro area startups in 2019 and $2.5 billion in venture capital dollars invested into our region. I actually worked at one of these venture capital funds backing local startups, and we invested in some 28 companies in the Greater Philadelphia region in 2019.

I wanted to write this essay because I don’t think we have a collective understanding of just how much is being built in Philly. From later-stage companies like Biomeme building RT-PCR technology to rapidly identify COVID-19, to early-stage startups like Katika, an online marketplace, directory, and experiences platform that provides a central location for customers to discover Black-owned services, there is no shortage of ideas being brought to life in our region.

Venture capital

At a high level, venture capital dollars infused into the Philadelphia metro area has been trending up since 2010, hitting that $2.5 billion in 2019. More importantly, the number of deals done in the region has also been trending up since 2019, hitting 225 in 2019, up over 100% from 2018.

For context, VCs generally invest in companies they believe to have a.) identified a significant problem, b.) built a differentiated product, c.) identified a large and growing market and d.) formed an exceptional team with the know-how to execute on their strategy and the grit to continue when things get tough. Consequently, the activity of VCs is important to track as it can be considered a lagging indicator of startup formation and density of talent, which the Philly area has in spades.

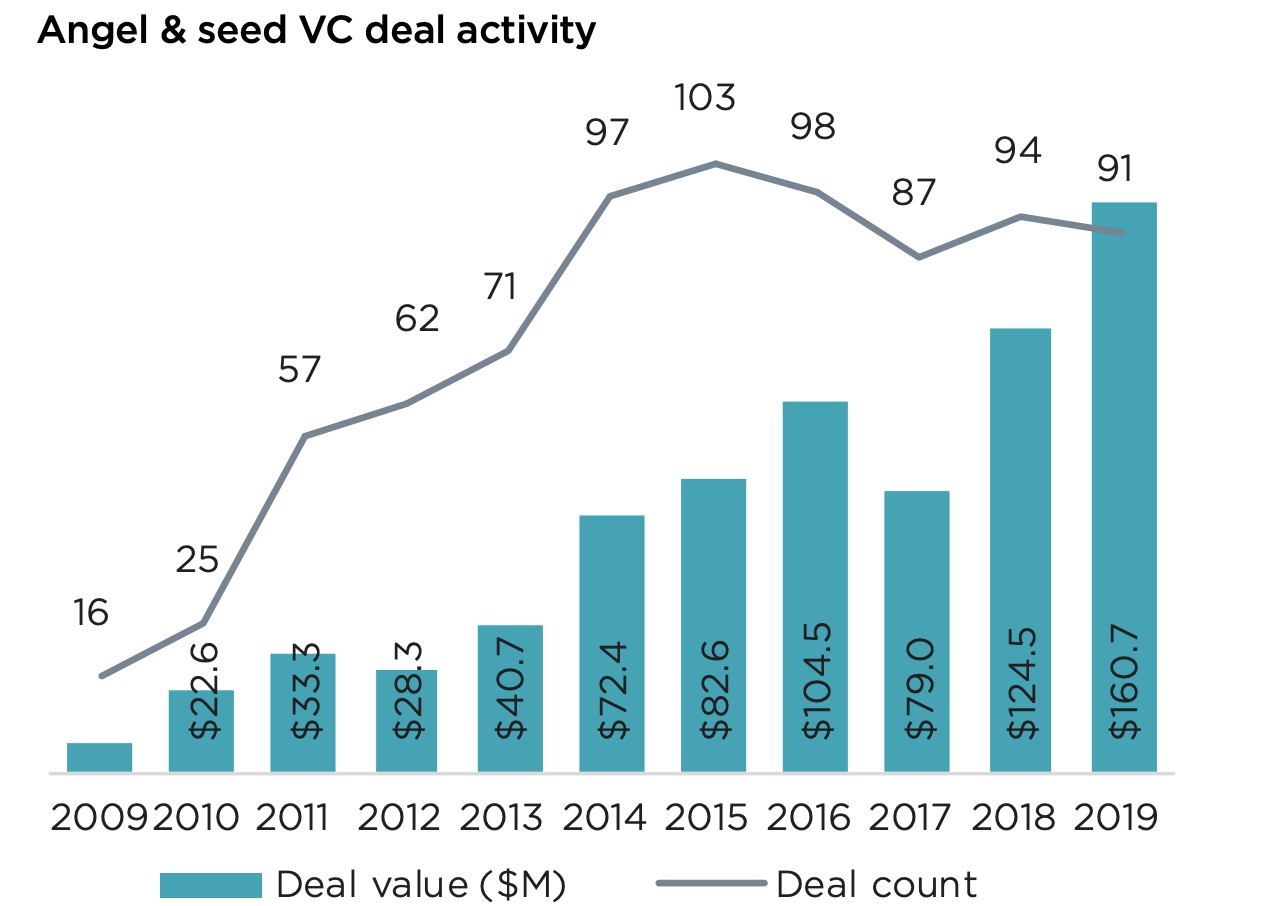

A pre-Series A company can generally be assumed to have a minimum viable product, a strong core team and a clear understanding of what they need to do to be successful in their chosen market. This is the stage of company where the Philadelphia area really shines. Angel and seed deal activity has grown more than 500% since 2009, hitting 91 deals in 2019. Robin Hood Ventures, Broad Street Angels, Keiretsu Forum, Mid-Atlantic Diamond Ventures, Ben Franklin Technology Partners, Delaware Crossing, Dreamit Ventures, Backstage Capital, Village Capital, University City Science Center, Philly Startup Leaders, J&J Innovation Labs, Comcast NBCUniversal LIFT Labs and NextFab are just a sampling of the angel networks, seed investors and accelerators leading much of the early-stage activity in the region.

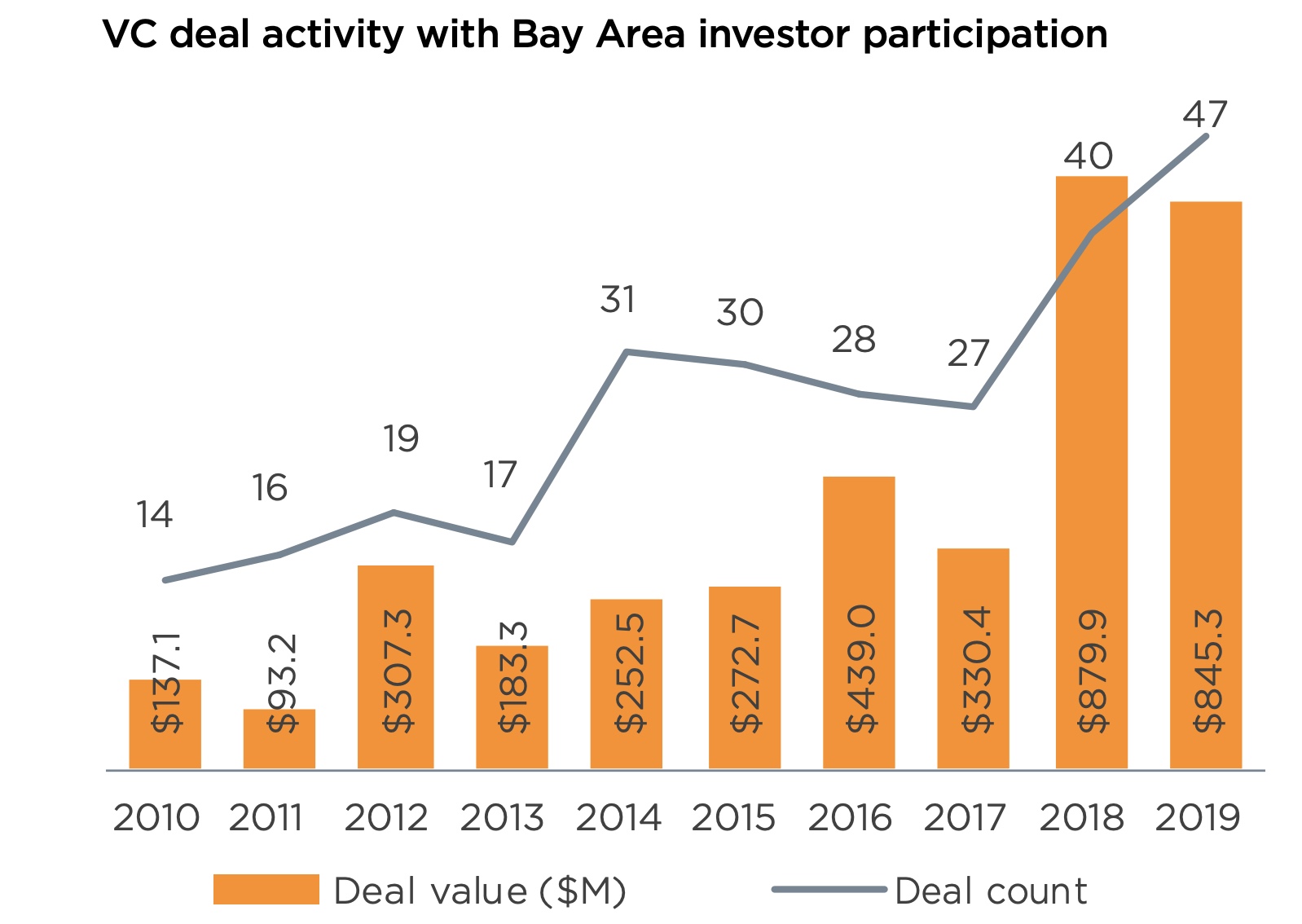

By sheer consequence of geographic proximity, it is much easier for a VC to invest in companies in their city, state, or coast. Consequently, another indicator that is important to examine is how often investors from outside a region are investing in local companies. If we look at venture deals with participation from Bay Area investors, for example, total funding and deal counts have been trending up since 2010 and the city really made strides in the last two years. Despite hovering around $200 million to $400 million invested per year from Bay Area investors from 2010 to 2017, we hit $879 million and $845 million in 2018 and 2019, respectively. And not only that, our annual deal count from Bay Area VCs went from the 20 to 30 range up to a sustained 40+ for 2018 and 2019.

I do not use these numbers as a means to say Bay Area investors are the standard-bearers for determining what regions are important. They are not. The takeaway is that while the Philadelphia area is indeed seeing more and more activity every year, we are also taking up an increasingly large mindshare of investors literally across the country. We have been telling our story for years, and the world is beginning to listen.

Healthcare

Philadelphia is one of the best places in the country to build a healthcare startup.

For one, our region is home to renowned institutions such as the Children’s Hospital of Philadelphia (CHOP), Penn Medicine, Independence Blue Cross, Thomas Jefferson University Hospital, Temple Health, Einstein Medical Center, Fox Chase Cancer Center, WuXi AppTec and numerous medical schools. Many of these entities fund employee-founded startups, serve as pilot sites to prove out an initial product idea, are pipelines for recruiting cofounders, are manufacturing and clinical trial partners, and are resources to help build out advisory boards.

Secondly, these institutions are home to a world-class talent pool which has proven fruitful in terms of both company formation and attracting outside capital. Penn was the initial home for companies like Carisma Therapeutics, Cabaletta Bio (IPO, 2019), and Spark Therapeutics (acquired by Roche), the latter of which was a dual collaboration between Penn and CHOP. Temple has seen the launch of companies like Excision Biotherapeutics, based on the pioneering gene-editing work of Dr. Kamel Khalili. Immunome (IPO, 2020) uses technology developed by Scott Dessain, a professor at the Lankenau Institute for Medical Research. Further, entrepreneurs have access to facilities such as the Pennovation Center, the Cambridge Innovation Center and NextFab, to name a few, which offer a combination of laboratory, office and manufacturing space for early companies.

As for digital health, our region is home to companies of every size. We have large companies like Accolade (IPO, 2020) and InstaMed (acquired, 2019), quickly growing companies like HealthVerity, Proscia, Roundtrip, NeuroFlow and countless more startups being formed every week to remedy inefficiencies in our healthcare system.

So why build a digital health company here? For one, the graduate and undergraduate talent pipeline cannot be overstated. For example, Penn has 20,000+ full-time graduate and undergraduate students and Temple has 38,000+ full-time graduate and undergraduate students. Many of the local schools have pitch competitions and healthcare clubs which, when I was working as an investor, allowed for no shortage of meetings with enterprising students.

However, non-students are also able to take advantage of the expertise in our city. It takes work, but I promise you there are individuals at every single one of the institutions mentioned above who would be willing to talk about your idea with you. Our proximity to hot spots like Baltimore, D.C. and NYC also provides founders with the ability to recruit new hires, partner with larger corporations, and seek out investors in these regions while maintaining a local presence. Lastly, the already decreasing costs of building a software startup are amplified in our city by the relatively lower costs of living and financial incentives like Keystone Opportunity Zone Tax Credits offered to local companies.

Going forward

The Philadelphia area is a great place to be when it comes to early-stage investment. We have a wealth of angel investors, accelerators, students and professionals that make themselves accessible to startups. But, there are two distinct areas I think we need to improve: 1.) diversity of our startup ecosystem and 2.) Series A+ financing opportunities.

Regarding point one: Some 43.6% of individuals in Philadelphia county identify as Black or African American, 15% as Hispanic or Latinx, and 7.8% as Asian. But, according to the Census Bureau’s 2017 American Community Survey of 33,000 computer, engineering and science workers in Philadelphia, 25% identify as Black, 7% as Hispanic or Latinx, and 17% as Asian.

Further, according to the Open Access Philly’s Diversity, Equity and Inclusion Benchmark Survey, 50% of respondents replied that their company’s board of directors has only between 0 and 25% diverse community representation. In general, while data is hard to come by, the Philadelphia founder and investor community does not appear representative of the wonderful diversity our city has to offer. It is clear we need a long-term coordinated effort to increase awareness of, and access to, funding opportunities and STEM education for folks of all gender, ethnic, and racial backgrounds. Thank you to the many terrific groups working on these issues, including but not limited to Philly Startup Leaders, Open Access Philly, Mogulette and Coded By Kids.

Regarding point two: We need prior founders and investors with an entrepreneurial bend to launch or back new VC funds in the region. We need to continue to spread the word about why non-regional investors should be actively looking at startups in our area. We need companies to maintain a local presence when they start to take off, and for the post-exit founders to then help local startups with intros to investors when they hit a similar juncture. When Philly companies make their list of 50 investors to approach to lead their Series A, all 50 shouldn’t be outside our region.

There are so many more reasons to build in Philadelphia that could fill pages. And there are an equal number of areas we need to improve. These past eight months have been difficult beyond belief, but one thing is crystal clear: Philadelphia entrepreneurs don’t give up when times get tough. They work harder. And thank goodness they do.

Resources for getting connecting to the ecosystem: