The Washington, D.C. metro area usually escapes the worst economic effects of traditional downturns.

The region’s highly educated cadre of government workers and other white collar professionals tend to insulate the capital area from economic shocks, yet those supports proved insufficient in the face of pandemic-induced business closures and job losses sweeping the country since March. However, amid the seemingly endless deluge of bleak economic news, a rare bright spot has emerged: the record high number of new business applications.

A surge in potential new business seemed improbable early in the pandemic, as visits to the District’s recreation and retail establishments — places like restaurants or movie theaters — fell by half based on cell phone mobility data collected by Google. Even as other states began to inch closer to normal in the summer and fall, D.C. recreational and retail activity in the era of social distancing languished around 50% below normal, much lower than in any other state based on a recent analysis from the Economic Innovation Group (EIG). By contrast, retail visits in Maryland and Virginia were reduced by about 20 to 25% relative to pre-pandemic levels, on par with the country as a whole.

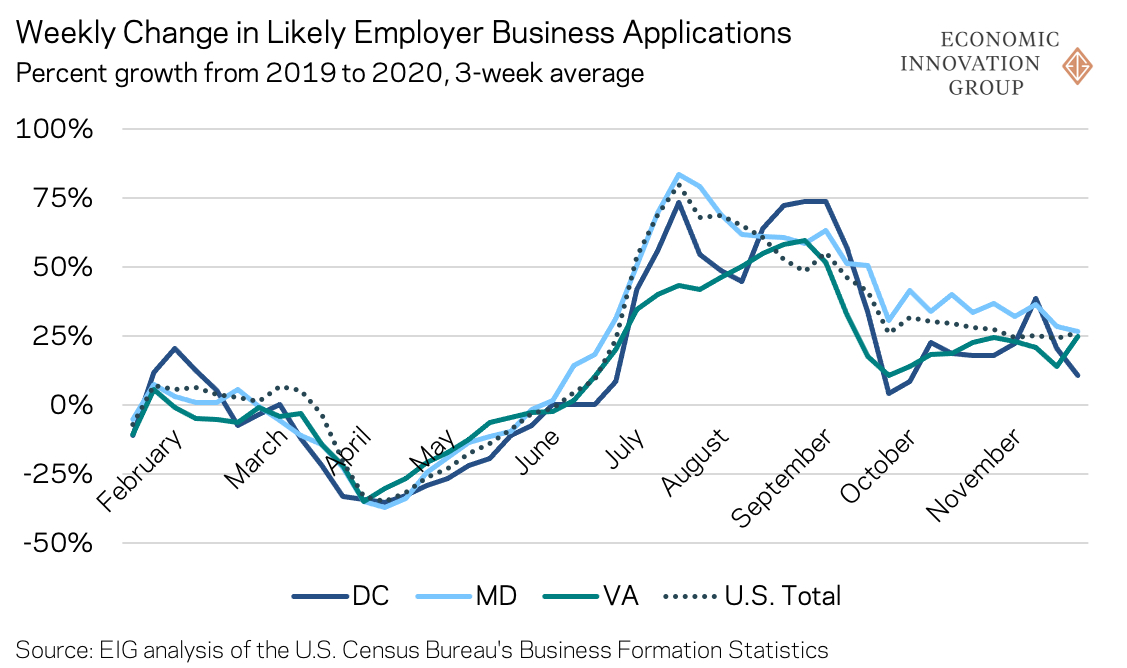

As much of the economy went into hibernation in mid-March with the hope of a relatively short interruption to business as usual, economic activity and vital new business formation cratered. A month into the crisis, the number of people submitting applications to form “likely employer” businesses — entities that have a high chance of becoming active businesses with employees within several months of filing — had dropped nationwide by 35% compared with the year before. That slowdown was equally felt across the capital region, according to weekly data collected by the U.S. Census Bureau.

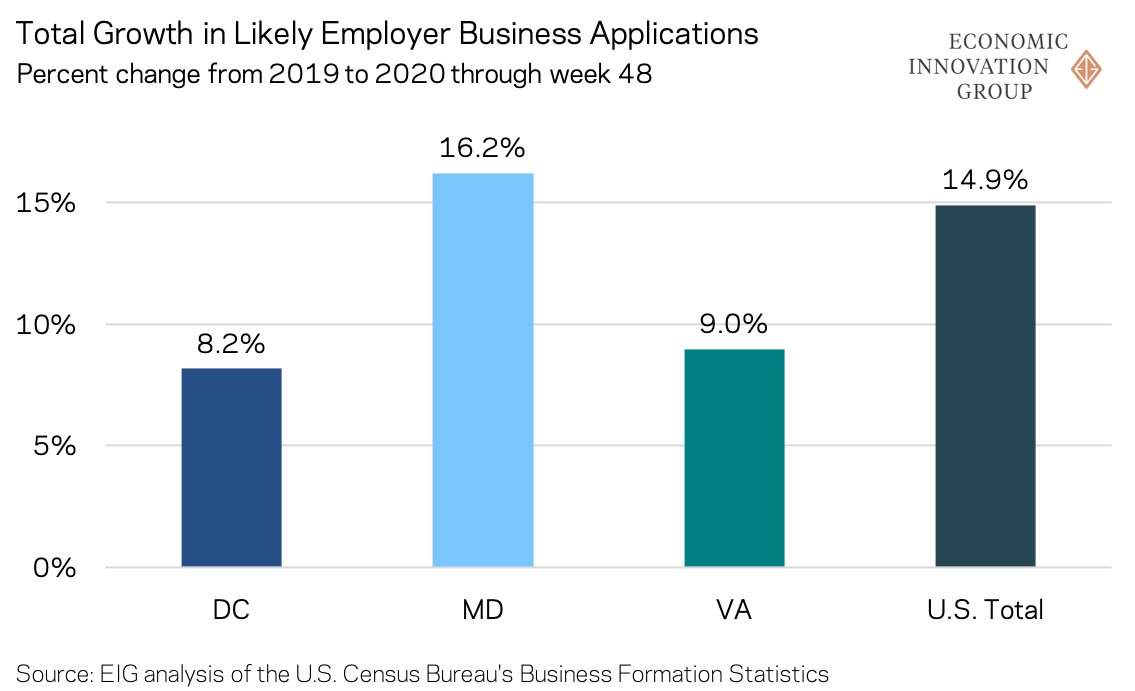

But as summer began, new business applications began to boom in the DMV along with most of the country. Local D.C. entrepreneurs were looking to form new enterprises in late summer at weekly rates that were frequently double the pace of creation in 2019. At their peaks, new business applications in Maryland and Virginia were coming in respectively at 86% and 63% above their pace from the prior year. The velocity helped to quickly plug the gap in new business formation that had opened up over the springtime. Activity through late November remained elevated following the summertime boom, which has propelled the total number of applications at this point above last year by a combined 6,600 in D.C., Maryland, and Virginia. (For more on the 2020 trends in business formation, see EIG’s weekly blog).

To be sure, the data presented here represent applications to start businesses, so there is no guarantee they will all turn into active business and survive, but past outcomes suggest that a very high percentage of applications do in fact begin operating within several months of applying. Nationally, we know that the spike has been broad-based across industry sectors and led by some obvious contenders on the front lines of pandemic-driven changes like non-store retailers that sell goods online or directly to consumers. This frenzy in entrepreneurial activity should help accelerate an eventual recovery and resumption of economic life in the DMV — an economic reinforcement that will be sorely needed based on the damage the pandemic continues to inflict on the region’s critical small business sector.

However, the net effect of the year’s surge in entrepreneurship on the local economy will be tempered by the (still to be determined) magnitude of closures this year. Nationwide, the number of small businesses open as of late November stood nearly 29% below January levels, leading to painful consequences for both employers and workers. Some of these businesses may eventually reopen, but others will shutter permanently — inflicting major losses on our stock of investment capital, know-how and jobs. In D.C., the share of small businesses open was down a shockingly high 45% from January, while the figure stood at 23% in Maryland and 27% in Virginia.

Minority business owners in particular were forced to shut down their businesses at some of the highest rates early on in the crisis, in part because they tend to be clustered in industries and regions that were most-affected by the COVID-19 pandemic. This racial dimension is potentially devastating to the D.C. area’s rich ecosystem of minority entrepreneurs. D.C. is home to a higher share of Black-owned businesses than the national average and several other major East Coast cities (e.g., Atlanta, Boston, New York City and Philadelphia). Black-owned businesses often take in less revenue than non-minority businesses and have less capital to rely upon in a crisis, placing them at higher risk for failure.

Even as so much seems out of local control right now — the course of the pandemic, the sustainability of federal relief, the number of local businesses that will survive — one thing local leaders should prioritize is smoothing the way for entrepreneurs to create the businesses and jobs that will repair the region’s economic health and revitalize our neighborhood centers. That hope may yet come from the record number of people who are surprisingly still determined to start new ventures in the face of a potentially devastating winter with their financial survival on the line. The boost from a wave of new employer businesses could be essential to helping the region emerge next spring ready for economic renewal.