While it didn’t require vaccine mandates and remote employees clad in tie-dye, it turns out the decade of the 2010s was less-than-kind to the country’s startup scene.

The years of 2010-2019 marked one of the least entrepreneurial periods in US history, according to a new analysis from DC’s Economic Innovation Group (EIG), citing U.S. Census Bureau Business Dynamics Statistics, While entrepreneurship rates spiked back up in 2020, the latest report offers further proof that the pandemic boom in starting new firms marked an unexpected turn when compared with the years prior, and the last period that followed an economic shock. It’s important to remember this when considering the next decade, the report’s authors say.

Read the reportAccording to the report, the US had 413,000 new businesses start in 1982, compared to 438,000 in 2019. Plus, these new startups only hired about 2.4 million people in 2019, which EIG says is about the same that they did 40 years earlier in 1982 when the overall workforce was smaller by 57 million people (missing from this dataset is the size of each of these companies. It’s possible that, although there were fewer startups, they could be hiring slightly more people).

Here are the other main findings:

- In 2019, the startup rate — the percent of startups compared to overall firms in the economy — remained largely unchanged for the fourth year in a row at 8.2%.

- That same year, the US saw the highest number of new startups since 2008.

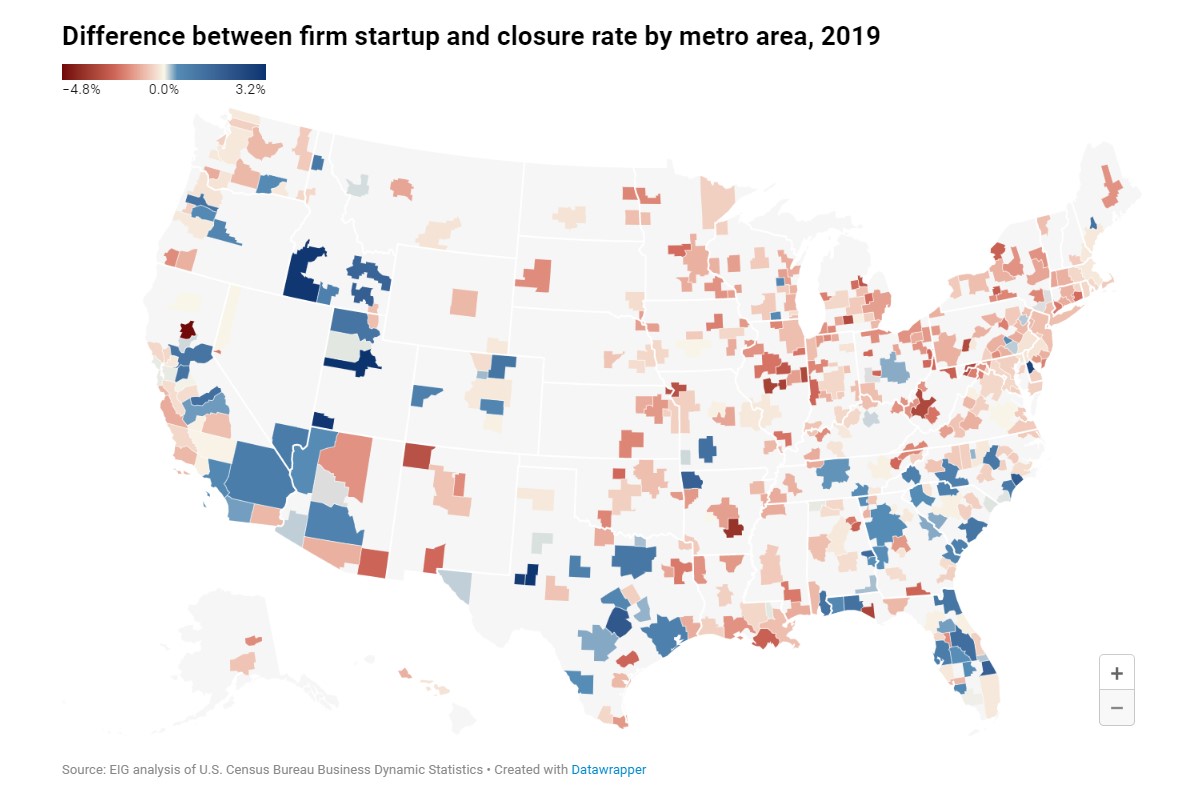

- But, 459,000 startups failed in 2019, and 75% of metro areas saw more startups close than open. The DMV specifically saw a startup-closure rate difference of 0.5%.

Kenan Fikri, director of research for EIG, told Technical.ly that this slow period in the 2010s was the tail-end of an overall decline that started in the early 2000s. The 1990s, by contrast, were a strong period in entrepreneurial history. The decade had a lot of energy for entrepreneurship, embracing the future tech scene as rural metro areas competed with the would-be startup superstar cities like Boston and Silicon Valley.

But the crash of 2008, he noted, changed things. In the period that followed, venture capital was hard to come by. The banking sector went under temporarily, and the new business starts became much more concentrated, as banks were more risk-averse to giving out loans.

What that meant, he said, was that there was a huge change in the 2008 crash, with no real recovery.

“It remained relatively quiescent, relative to what we’d experienced before in prior decades and periods of growth and relative to what we’re seeing now as we’re coming out of the pandemic,” Fikri said. “Which is really interesting, and I think makes this moment especially intriguing, that we can see that something appeared quite wrong with the pre-pandemic economy if you look at startup rates.”

The tech titans

The one sector that did grow in this period, according to the data, was tech. Fikri noted that companies that were able to master tech did well helped to propel their markets. The industry, in turn, began reshaping how people saw the entrepreneurial space, enabling more options for businesses and growing local economies overall.

This tech growth, according to Fikri, created a “safety net” that small businesses and startups are now just testing out for the first time. Going forward, he sees this question: How far can the model of hitching businesses to the tech industry go?

“We can see that technology has reduced the cost of starting a business and allowed millions of Americans to actually try something here in the pandemic,” Fikri said. “To become a freelancer, to pilot a new business model or set up a sidecar income stream using the internet in a way that wasn’t possible in 2008.”

Looking ahead

So far, this has proven to be a strength in the post-Covid economy. According to the report, the US saw nearly 1.5 million new applicants for businesses this year — more than triple all of 2019’s total — and there’s the potential for even more. Keeping this strong growth, Fikri said, relies on learning from the 2010s.

We need to be very intentional about creating an economic environment coming out of the pandemic that is far more intentionally conducive and supportive of entrepreneurs and startups than what we saw in the 2010s.

“It’s not clear whether the pandemic has made markets actually more competitive or less, and it’s not clear how financial markets have changed from here either,” Fikri said. “So I think that it would be a mistake to not take stock of the last decade and draw real lessons from it, and it would be a real missed opportunity to apply them to how we try to craft economic policy going forward.”

For Fikri, continuing this current momentum means creating policy to support entrepreneurship (PPP loans were likely a good start). He said the US can attribute many of the flaws in recovery during the 2010s to the fact that there were so few new businesses starting. This meant, he said, that job recovery was slower, as businesses shed excess employees without intent to rehire, whereas startups create jobs. Plus, he said, recovery was geographically very uneven as small ecosystems had fewer new businesses.

What this means, he hopes, is that policymakers, influential people and companies can learn from the last decade and support startup-friendly initiatives and policies.

“We need to be very intentional about creating an economic environment coming out of the pandemic that is far more intentionally conducive and supportive of entrepreneurs and startups than what we saw in the 2010s,” Fikri said.