Pandemics, quarantines, wildfires in California, flooding in New Orleans, freezing in Houston. Forget about “global warming.” That doesn’t even begin to sum it all up. “Global weirding” is far more inclusive.

It is amazing that the economy is doing this well and recovering so quickly. We had a flash depression in spring of 2020, when unemployment went to the highest level in 80+ years. Stocks dropped by 30% in less than two months, and bounced back by the end of the year.

We are still quite some ways from normal. But in this case, government intervention helped prevent an economic catastrophe.

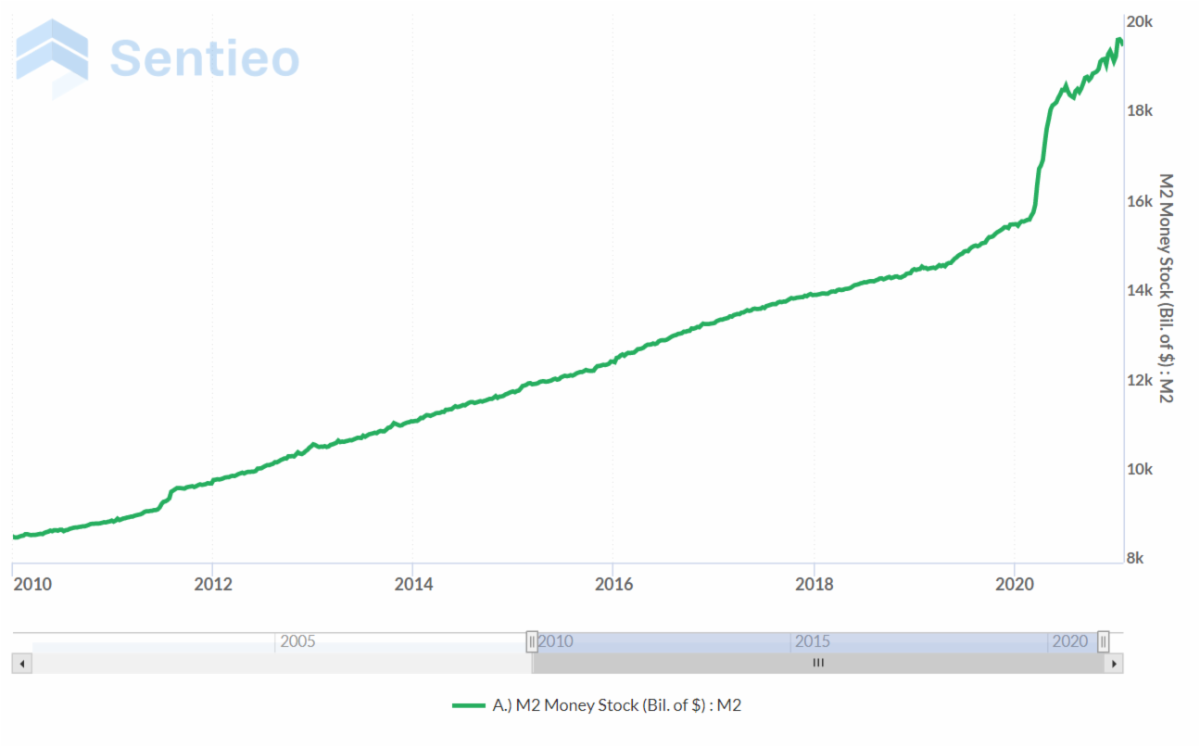

Of note was the Federal Reserve pumping trillions into the U.S. money supply, proving that printing presses still work (even in the digital age).

This was a huge jump in the amount of money swishing around. It’s an increase in liquidity that we’ve simply never seen before. It was a massive experiment in economic policy.

A few days ago, one of my astute clients asked why inflation isn’t a bigger problem. If there is 25% more cash flowing through the economy, why isn’t everything 25% more expensive?

Sure, we’ve all seen stocks and real estate prices go through the roof. Some glitches in the supply chain created shortages in plywood, bicycle parts, and semiconductors. But on the whole, inflation isn’t a serious problem right now. The Consumer Price Index is increasing at a rate of about 5% annualized. This is higher than normal, but nowhere near double-digits.

Speculation in paper, virtual and real estate assets may have reduced inflation in the “real” economy.

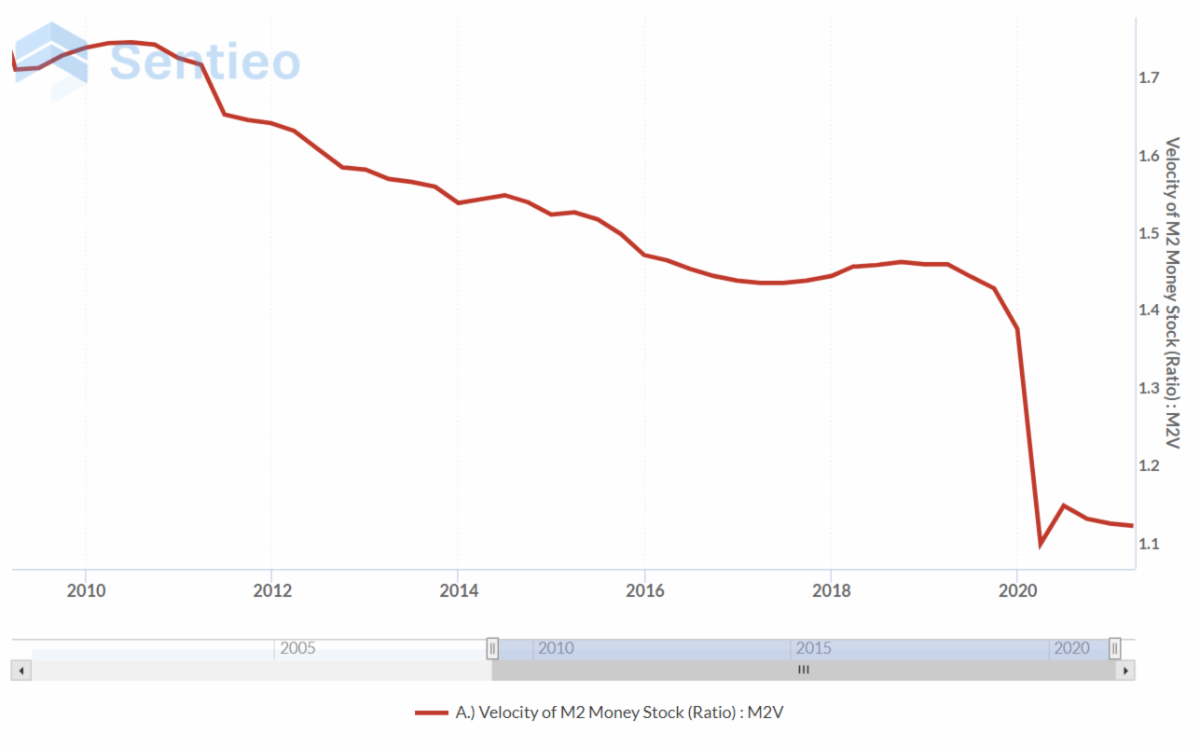

The other part has to do with something that isn’t discussed on the news all that often: the idea of monetary velocity.

COVID-19 quarantine was an off-Broadway production of the apocalypse. It was dull and everyone couldn’t wait until the end. There was nothing to do and very little to buy. So, people stopped spending, and started trading crypto on Robinhood.

Monetary velocity is a measurement of how many times a year a dollar actually gets spent. And this figure fell through the floor last year when people stopped going out to the malls. Velocity contracted from 1.7 down to 1.1.

Monetary theory says that:

- Q*P = M*V

- Q = Quantity of goods and services produced (GDP)

- P = Price of goods and services produced (inflation)

- M = Money supply (M2)

- V = Velocity (the number of times per year a dollar is spent)

With higher M we get higher Q or high P (preferably Q). Because V has dropped so quickly, the response of both Q & P has been muted.

Going forward, here’s what I would worry about:

1. Higher interest rates leading to lower valuation multiples for stocks. This could also wreck havoc on home prices, which were supported by cheap mortgages.

The early stages of inflation are usually quite benign. The later stages are not as much fun.

2. Higher taxes. Specifically, taxes on capital gains and inheritances. Because at some point, we have to pay for all of this.

So far, we haven’t seen either of these things. As they say in New Orleans, laissez les bons temps rouler (let the good times roll)!

I am most intrigued by cryptocurrencies (specifically, Ethereum) as an alternative monetary platform that operates independently of the Fed. Over the centuries, governments have rarely shown restraint with regards to printing money or spending within their means. The big risks to crypto here are technical (is it possible?) and regulatory (will governments thoughtfully embrace and regulate cryptocurrency, or will they crush it?).

P.S. For a terrific history of money, do check out Carmen Reinhart and Kenneth Rogoff’s classic “This Time is Different: Eight Centuries of Financial Folly.”