July has already been a pretty big month when it comes to money in the District.

On the very last day in June, Xometry officially made its IPO, raising $302.5 million with shares jumping 98% on day one (shares have since mellowed out to $62.75 from the initial $44 per share offering). Plus, on the investment front, MassLight announced six $100,000 investments up for grabs and just this week we reported that 1863 Ventures still has $5,000 grants available via a partnership with Capital One and the Rockefeller Foundation.

But that’s not all that D.C. has to offer in the midst of this heat wave. Here’s what else is going on this month in the world of raises, investments and acquisitions.

###

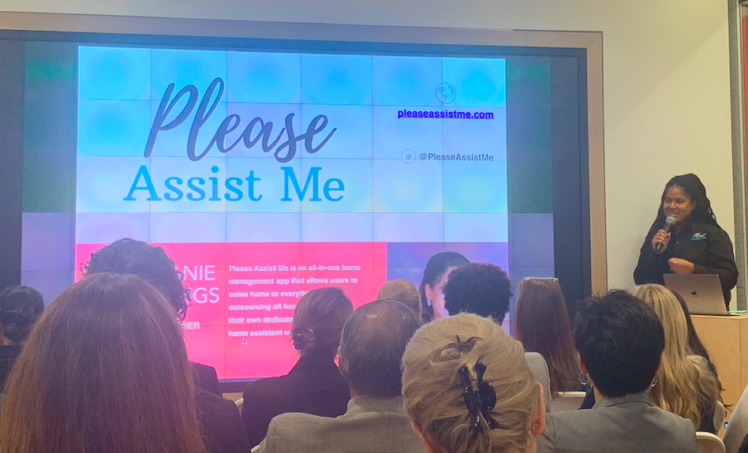

Personal assistant company Please Assist Me, helmed by Stephanie Cummings, nabbed a $500,000 investment from Atlanta’s Collab Capital. It’s more than double of previous total funding for the three-year-old company (which, btw, was also a 2020 ReaLIST startup to watch).

The funds will be used to further build out Please Assist Me’s tech platform, which helps with day-to-day tasks like cleaning, laundry, grocery pickup and more. It will also be put towards growing the team, with openings in operations, software development, marketing and sales, plus the assistants that help get the job done.

Collab Capital itself has had a pretty exciting year, raising $50 million from backers like Google, Apple and Goldman Sachs. It’s the firm’s first fundraise, and all of it will be put towards Black-owned businesses.

###

Downtown D.C. investment management firm RockCreek said it surpassed $900 million invested in Black-owned and managed firms.

Of the funding, $300 million was invested in 2020 alone, and the firm has $17 billion total in assets under management. Among those receiving investment, per a news release, was D.C.-based Zeal Capital Partners, the inclusive investment firm founded by Nasir Qadree. RockCreek looks globally, so many of the recent investments include venture funds based outside of D.C., such as Authentic Ventures, Hollis Park Partners, Base10 Partners’ Advancement Initiative and Ocean Park Investments.

“We have always invested in founders who are innovative in their thinking about solving difficult problems and building long-term value,” said founder and CEO Afsaneh Beschloss in a statement. “We will continue seeking out diverse and inclusive talent that has been overlooked for far too long.”

###

Merkle, headquartered in Columbia, Maryland, announced plans this week to acquire Texas customer experience agency LiveArea from PFSweb for $250 million. The deal is expected to close in Q3 of 2021.

LiveArea’s 590 employees will join the Merkle team, and Merkle said the acquisition will help grow the experience and commerce portions of business. The merger also aligns with the goals of Dentsu Group, Merkle’s parent company, to reach 50% of revenues from customer transformation and technology. LiveArea’s clients include big names like Salesforce, SAP and Adobe.

“LiveArea represents a unique opportunity for Merkle to significantly expand our commerce capabilities – broadening our commerce footprint in the US market while also adding commerce expertise in EMEA,” said Michael Komasinski, president of Merkle Americas in a statement. “The addition of LiveArea to the Merkle family will further enhance our ability to competitively deliver CXM services and integrated solutions, efficiently and at scale.”

###

Some other $$ changing hands around the DMV:

- Newport News, Virginia-based Huntington Ingalls Industries agreed to acquire McLean’s Alion Science and Technology from Veritas Capital for a cool $1.65 billion.

- Chantilly, Virginia-based VTG won a $27 million contract in June from the Naval Sea Systems Command. The funding will be used to support the Naval Sea Systems Command’s Small Business Innovation Research and Small Business Technology Transfer programs, which fund small businesses developing Navy technology.

- Kidney treatment startup Somatus raised $60.12 million in funding to support its ongoing expansion. The announcement comes almost exactly a year after the McLean, Virginia-based company raised $64 million in a Series C.

- Sirnaomics, a Gaithersburg biopharma company, raised $105 million in Series E funding led by the Rotating Boulder Fund, with additional new and existing investors.

- Edinburg, Virginia’s Shenandoah Telecommunications sold its wireless assets to T-Mobile USA for $1.94 billion in cash.