In a global race to secure a more favorable tax climate, the array of tax incentives and programs can leave you missing out. So if you own a company in Pennsylvania, you might sometimes wonder if there are opportunities from which you could benefit.

A diverse group of Pennsylvania tech and biotech companies walked away with nearly $14 million from the state last year as beneficiaries of the Keystone Innovation Zone Program (KIZ), one of the state’s most widespread programs, among others.

“This program was specifically established to help young technology companies grow,” said Mike McCann, President of MVM Associates, a consulting firm that helps businesses secure these and other state benefits.

Tech companies that are less than eight years old, located in specific zones and who meet some other basic criteria can earn up to $100,000 annually in the form of a tax credit which can be sold for cash. In 2012, for example, Apple bought $2.3 million worth of credits from Pennsylvania companies to reduce its longer term taxable footprint.

What’s a tech company? The KIZ tax credit program is designed for firms that are creating a new product or process and not geared toward service-only focused companies like a computer repair company.

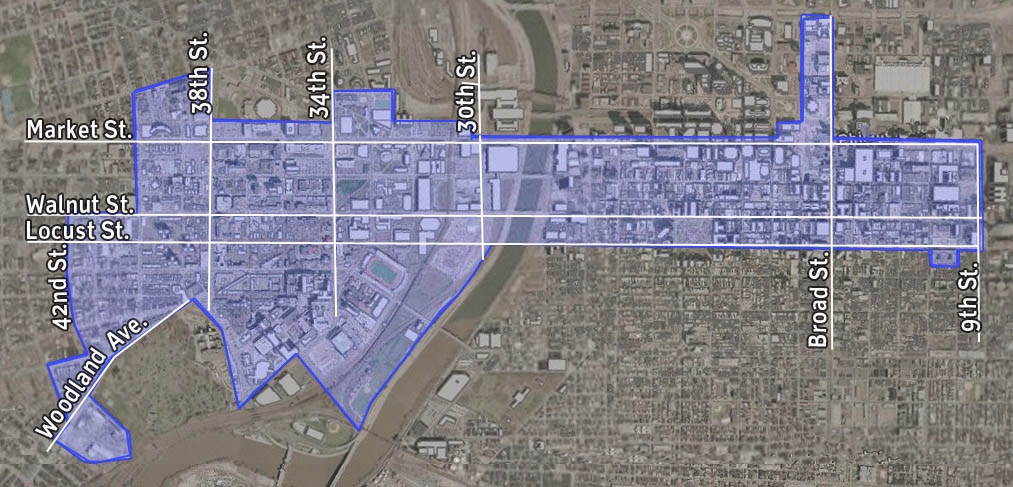

There are numerous local zones throughout the area including in Center City and surrounding counties, including the dense University City corridor. MVM has worked with many local tech firms to help them apply and then convert KIZ tax credits into cash which can be infused back into their business.

Despite its success and growing awareness of the KIZ program, in 2012 $11M of the $25M state budget remained untapped. That same year, MVM helped its clients sell $8 million of tax credits to larger companies. How does MVM get its cut? The company takes a commission on the transaction received, no hourly fees.

“We want to get the word out to tech companies about this program and encourage them to apply,” said McCann. “If the entire budget isn’t utilized, the money will eventually go away.”

With that in mind it makes sense to take a minute to find out if your organization is already benefiting from the KIZ program, or to tell a friend in the tech community about it.

For more information about KIZ, call Anne Fabry at MVM Associates at 215-540-8463 or visit MVMGrants.com.