Editor’s note: These figures may vary slightly, as some deals aren’t accounted for until weeks after quarterly VC reports are published.

Following quarter after quarter of record-breaking venture capital spending in the Philadelphia region, Q3 2022 proved significantly quieter.

PitchBook and the National Venture Capital Association dropped the Q3 2022 PitchBook-NVCA Venture Monitor on Thursday, with data showing that the Philly region didn’t net more than a billion in investments, or near it, for the first time in seven quarters. The region had consistently seen huge deals over the last two years, with $4 billion invested across 278 deals in the first half of 2022 alone.

But a slowdown in Philly that’s following national trends isn’t necessarily a bad thing, the report and one local expert said. Let’s jump in.

How did Philly fare?

The region pulled in $619.59 million in venture capital dollars across 89 deals this past quarter, compared to nearly $2.7 billion in Q2 across 123 deals, and $1.3 billion in Q1 across 155 deals. The top deals this quarter in Philly went mostly to biotech and life sciences companies, with Orchestra Biomed netting the largest investment in July at $110 million. Vitara Biomedical followed in July with $75 million, and Savana, a fintech software company, took third with $45 million invested in a Series A.

This report also notes a $25 million raise for mental health platform NeuroFlow, and Fort Robotics‘ $25 million raise.

Other deals on the list include $40 million for Wayne software company PurpleLab, $31 million for Philly biotech company Enterin, $30 million for Wayne computer networking company Cornelis Networks, $24 million for Berwyn financial services company Advisor Credit Exchange and $22 million for King of Prussia home healthcare service InHomeTherapy.

The market here in Philly reflected much of the US, where both the amount of dollars spent and the number of deals those dollars were spent on were down. The only region in the US to net more VC dollars and deals this past quarter than the one before it was New England, per the report. There’s still been a significant amount of investment into healthcare, clean technology and transportation companies this year. Overall, the whole country has only seen 59 public listings so far compared to 303 last year.

Dean Miller, president of thePhiladelphia Alliance for Capital and Technology (PACT), told Technical.ly this downward trend doesn’t concern him. Macroeconomic trends always have a big impact on all industries, he said, and venture capital is not immune.

“Big companies started reducing their spending back in the beginning of the year and venture lags the public markets by a quarter or two,” Miller said in an email. “Fundamentally, I am not concerned with Philadelphia’s long term prospects as a growing ecosystem for startups. Our position as a top and growing region for cell and gene therapy, enterprise tech and consumer startups among others has a strong foundation.”

[Editor’s note: Read Technical.ly’s July deep dive on these market changes: “As VC deals and valuations decline, what’s a tech founder to do? Don’t panic, these pros say“]

Where the VC market is going

The Venture Monitor report echoes Miller’s sentiments, calling out that rising interest rates and “complicated” macroeconomic trends are influencing the VC market and companies considering going public. While Q3’s activity was lower than some historic highs in 2021 and early 2022, this quarter’s activity follows generally positive trends in the market, it said. The report also called out the Inflation Reduction Act and the CHIPS and Science Act as huge investments in technology and infrastructure that will likely help companies in the future.

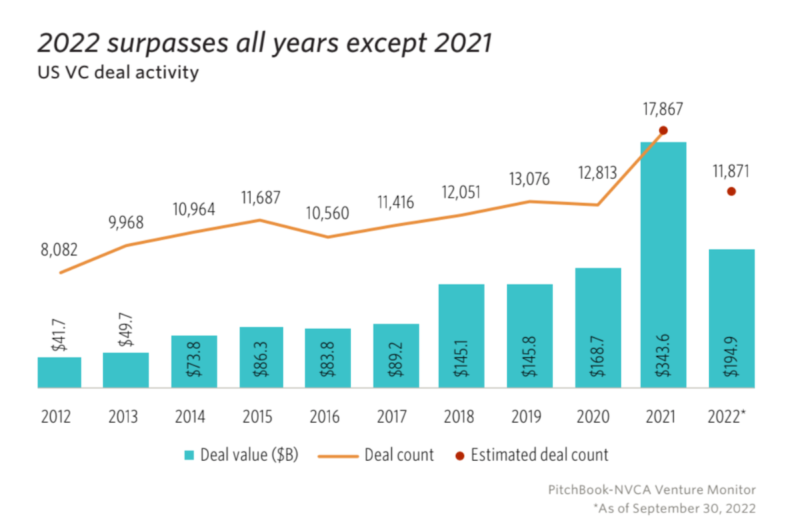

US VC deal activity since 2012. (Image via PitchBook-NVCA Venture Monitor report)

Though 2022 is seeing fewer VC dollars and deals than 2021, it’s on trend with where the market was headed before that record-breaking year. Heading into Q4, the country was on track to see more deals than 2019 and 2020. Angel and seed deals were slightly down compared to years prior, coming back to 2020 levels, the report found. And other early-stage investing followed suit.

“The continued public market volatility has weakened capital deployment in early-stage deals as investors become more apprehensive about the large, outlier-sized deals of the past couple years,” the report said. “Investors are focusing on investing in the fundamentals of a startup instead of relying on another VC firm to invest at an even higher valuation.”

Later-stage funding follows a similar track — lower than 2021 numbers, but on pace to beat 2019 and 2020 numbers. The report summarizes that although the numbers don’t compare to those a year ago, 2021 was truly outstanding year for venture capital, almost an outlier. Compared to the years leading up to 2021, Philly and the rest of the country might be in a readjustment period, but still on track for overall growth over the years.

“The facts of Q3 paint a mixed picture for the VC industry,” Venture Monitor wrote in its report. “Investors report that they are making deals, and there is a consensus between managers and founders on how to prepare for potential challenges ahead.”

Join the conversation!

Find news, events, jobs and people who share your interests on Technical.ly's open community Slack

Philly daily roundup: Minecraft in a Philly school; PTW kicks off; Tech and art happy hour

Philly daily roundup: Philly's top innovation leaders; City buildings go solar; PTW kicks off on Friday

Philly daily roundup: UPenn's AI master's degree; Advice for EDA Tech Hubs; Last day of ACP