Silver Spring, Maryland fintech firm Truebill will be acquired in a billion-dollar deal, the company reported Monday.

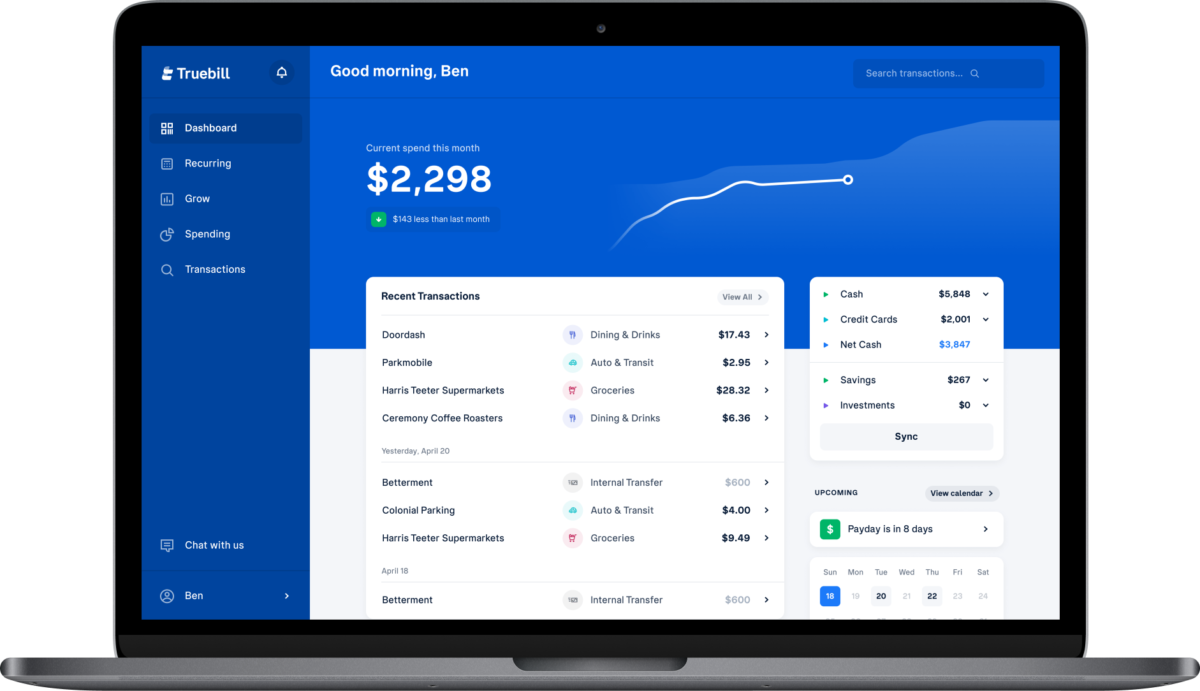

Founded in 2015, Truebill created a personal finance app that uses artificial intelligence to track spending habits. The Maryland company was acquired by Detroit, Michigan-based Rocket Companies, which develops real estate, mortgage and financial services technology, for $1.275 billion in cash. The deal is expected to close before the end of the year.

In a statement on the deal, Rocket Companies and Truebill said the acquisition news is ideal as an organic growth opportunity. Users can begin with personal finance tracking through the Truebill app, then move to Rocket Companies when they’re ready to purchase a car, home or engage in a mortgage deal.

“What my cofounders and I originally created as a subscription cancelation app has become so much more. Now, millions of Americans are trusting us to help them take control of their financial lives,” said Haroon Mokhtarzada, Truebill cofounder and CEO, in a statement. “By joining forces with the Rocket FinTech powerhouse, we will be able to extend our reach and seamlessly connect consumers with even more services. The synergy between Truebill and the Rocket Companies platform could not be stronger, especially when you consider the importance of home ownership as the centerpiece of a healthy financial life.”

According to Rocket Companies, Truebill will be a consistent revenue boost, as it’s on track to generate $100 million in annual recurring revenue. Its 2021 revenue, specifically, is set to more than double that of the previous year.

This news follows a year of strong growth for Truebill, which raised $45 million in a Series D in June and $17 million last November. In June, cofounder and CRO Yahya Mokhtarzada told Technical.ly that the company’s total valuation had reached over $500 million. Since its founding, the company has grown to 2.5 million members, with $50 billion in monthly transaction value. It has raised $85 million in investment capital to date.

In June, Yahya Mokhtarzada noted that Truebill’s growth is largely due to the forced financial focus brought on by the pandemic.

“In the last year, people have really been forced to pay closer attention to their money and try to cut out inefficiencies,” Mokhtarzada said. “And Truebill is just a great tool for that.”