Silver Spring, Maryland-based Truebill raised $45 million in a Series D round led by Accel, the company announced Tuesday. Venture investors including Bessemer Venture Partners, Cota Capital and Eldridge Industries also participated in the funding round.

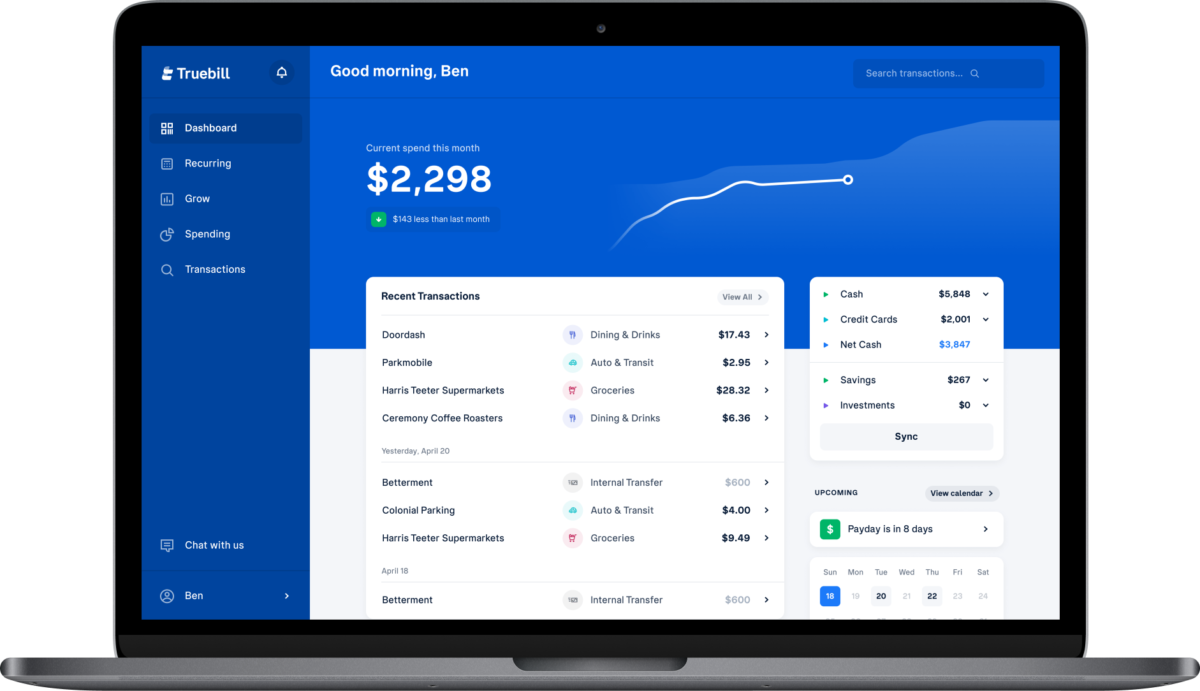

Truebill, a personal finance mobile app, uses artificial intelligence to track and analyze spending habits, in order to help users better manage finances. It also lets users track and cancel subscriptions, and negotiate discounts on phone and cable bills. Cofounder and CRO Yahya Mokhtarzada told Technical.ly that the company’s total valuation has now reached over $500 million.

With the new round, the company has raised $85 million to date. Mokhtarzada said that Truebill wasn’t really looking for a raise, but had such a strong growth period in Q1 that it started gaining some investor interest. The new funding will be used for hiring, primarily on the engineering side, as well as marketing, operations and customer support.

Additionally, Mokhtarzada said, the funding will also be used to invest in data science, allowing the company to expand its machine learning functions. Truebill eventually intends to use machine learning to predict and prevent things like overdrafting before they happen.

“It’s obviously very easy to tell someone that they overdrafted, but what’s much more difficult is anticipating that with accuracy two, three days or even five days in advance,” Mokhtarzada said. “And then the other piece is, if you’re able to anticipate that, are you then able to head that off?”

Most recently, Truebill added tools that let users see spending insights, create a monthly budget, track that budget from the app and view credit reports. It’s currently developing a wealth management dashboard for centralized assets and debt viewing, with a holistic net worth tracking feature launching in the next month.

Truebill CEO Haroon Mokhtarzada said that over 10,000 members sign up for the financial service daily.

“With this new capital, we’re transforming Truebill into an all-in-one, holistic platform that makes it easy for members to not only manage subscriptions and spending but also optimize their savings and make informed decisions to improve their financial health,” Mokhtarzada said in a statement. “Truebill is rapidly becoming the most valuable financial membership for everyday consumers.”

The Series D raise is the latest in Truebill’s rapid growth since its founding in 2015. CrunchBase News reported that the company posted 3.5x year-over-year revenue growth since November, and doubled its team to more than 100 people. It also grew its userbase from 1 million to 2 million, the outlet reported.

Yahya Mokhtarzada said that Truebill expanded marketing efforts to include advertising on apps like Tik Tok, Reddit and Snapchat, in addition to brand advertising that led to growth. However, he added additional growth is primarily due to many people’s financial focus in 2020.

“In the last year, people have really been forced to pay closer attention to their money and try to cut out inefficiencies,” Mokhtarzada said. “And Truebill is just a great tool for that.”

The company also raised a cool $17 million in Series C funding in November, which also included participation from Bessemer, Elridge and Cota Capital, as well as Firebolt Ventures and Day One Ventures. At the time, it planned to use the funding for new product development including debt payoff, net worth tracking, savings app features and shared membership for joint accounts.