Leaders from Philly’s Kensington Corridor Trust and the Boston Ujima Project joined a panel hosted by ImpactPHL this month to discuss the work they are doing in their respective cities to support small business, and ensure the people who have lived in their neighborhood for years get to stay there amid changes.

ImpactPHL committee member and Activest cofounder Ryan Bowers led the conversation with Kensington Corridor Trust Executive Director Adriana Abizadeh and Boston Ujima Project Executive Director Nia Evans.

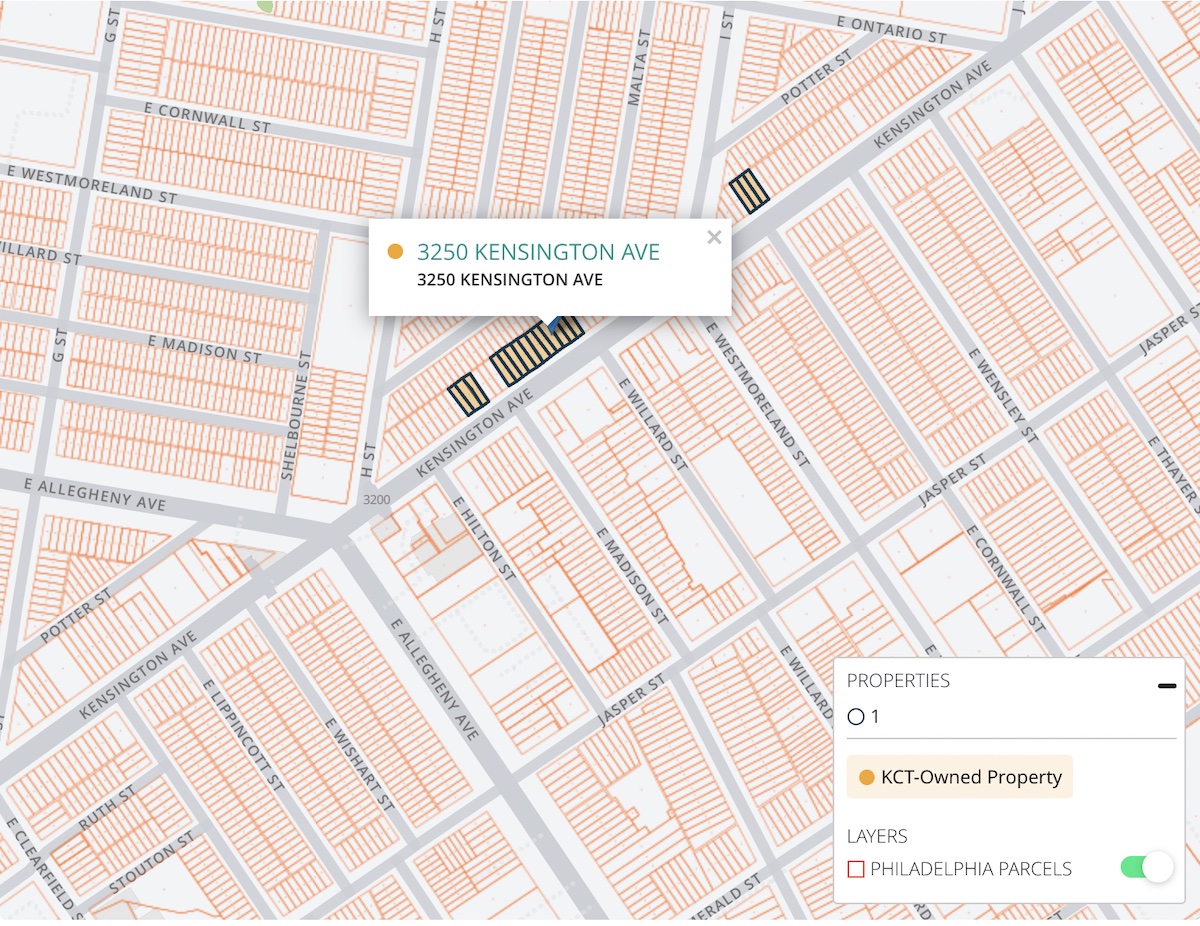

Kensington Corridor Trust was started in 2019 as a response to gentrification in the Kensington neighborhood. The organization purchases (mostly) commercial mixed-use real estate on the Kensington Avenue Corridor which is then put into a trust for the neighborhood to control.

“It is intentionally built as an anti-displacement strategy and really hoping to ensure affordability long term, both on the residential and commercial fronts for the corridor,” Abizadeh said, with an aim of supporting “the folks who have lived there historically.” The org is a traditional 501(c)(3) nonprofit as well as a perpetual purpose trust.

Similarly, the Boston Ujima Project started in 2014 in response to gentrification in Boston.

“A group of organizers, grassroots organizations, community members, impact investors, foundations, small business owners came together to look at two primary issues,” Evans said. “One was looking at small businesses in our communities, and the inability to access traditional capital. And then the other was also looking at grassroots organizations in our communities.”

The “Ujima Ecosystem” is made up of a membership body and the Ujima Fund, which was launched in 2018 to invest in these local small businesses and grassroots orgs.

Engaging with community and sharing lessons

Boston Ujima Project hosts neighborhood meetings called “assemblies” to ask community members for their opinions on local businesses.

“Because we are leaning on the expertise of our community members, we’re learning about opportunities,” Evans said.

The organization has invested in a composting cooperative and a cooperative grocery store, supporting a “solidarity economy framework,” which means making decisions that support social gains, not just financial gains.

Abizadeh said this framework “is so critical to these democratically governed models, whether they be funds or more like a city and neighborhood trust, or so many others — really tapping into the worker ownership and to localized ownership and collective ownership is deeply deeply ingrained in our work.”

Boston Ujima Project gets inquiries from people around the country who want to learn and implement something similar in their community, per Evans. Kensington Corridor Trust is now one of those “translocal” members.

“We created a translocal membership to connect with communities that we believe are acting out of a real urgency and a real sense of need, where they are,” Evans said. “We are not an organization that is intended to be singularly focused. We understand ourselves as part of not just a broader ecosystem in Boston, but I would say a broader ecosystem in the US.”

Abizadeh said Kensington Corridor Trust wants to be “model making” itself, meaning “we are really thinking about what it would look like to have the neighborhood trust model replicated both within Philadelphia and beyond — perhaps not in its exact form, but acknowledging that it can be replicated and scaled to meet many purposes.”

Receiving and offering support

Evans said the benefit of having a community-based capital pool is that many different types of investors can contribute what makes sense to them to the fund.

While Kensington Corridor Trust needs capital investments to continue operating, lower interest, longer terms and subsidy investments help it be more sustainable, Abizadeh said. But the organization also needs support from experts in different fields; more people working together makes the work more effective. The Trust is relatively new, but it’s already seen success by generating revenue, breaking ground and obtaining vacant lots.

Both leaders said that while they’re not directly involved in building the workforce in their cities, they support workforce development in their communities, and thus more ways for people to build wealth.

For Ujima, “we don’t attempt to take on workforce development directly ourselves, but what we do do is uplift the businesses that we do think are providing great jobs, make sure we’re investing in them so that they can continue to provide great jobs so that they can survive,” Evans said. “They can grow if they want to. And we can we can see those benefits proliferate throughout our communities.”

Sarah Huffman is a 2022-2024 corps member for Report for America, an initiative of The Groundtruth Project that pairs young journalists with local newsrooms. This position is supported by the Lenfest Institute for Journalism.Before you go...

Please consider supporting Technical.ly to keep our independent journalism strong. Unlike most business-focused media outlets, we don’t have a paywall. Instead, we count on your personal and organizational support.

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!

The person charged in the UnitedHealthcare CEO shooting had a ton of tech connections

From rejection to innovation: How I built a tool to beat AI hiring algorithms at their own game

How a laid-off AI enthusiast pivoted to become a founder — while holding down a day job