After a string of backlash from consumers and constituents, the Internal Revenue Service (IRS) seems to be rethinking its plans for identity verification tech in filings.

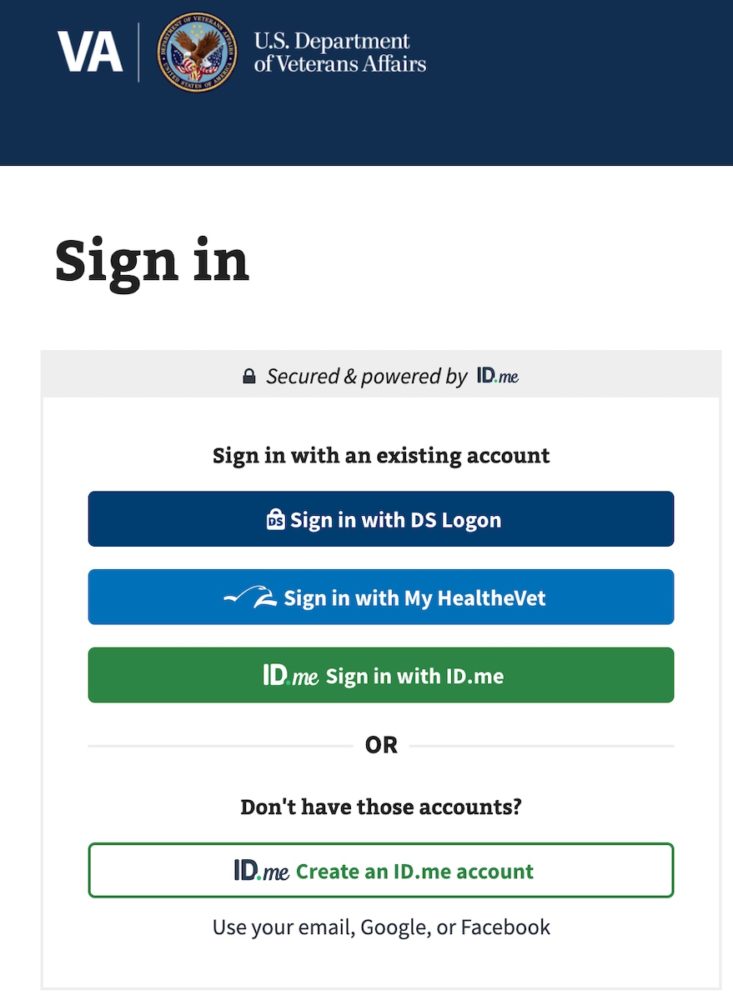

ICYMI, last week, McLean, Virginia-based identity verification company ID.me was fielding privacy concerns following a semi-recent deal with the IRS regarding tax filings. Per the deal, the IRS would be using a photo-based, multi-factor identity verification technology, courtesy of ID.me, for users looking to log in to their account online (though users could still file taxes without this step). But after shouts of privacy violations and racial bias in photo recognition, the deal is not smooth sailing.

This week, a coalition made up of advocacy groups including Fight for the Future, Algorithmic Justice League, Electronic Privacy Information Center and Surveillance Technology Oversight Project launched DumpIDme. The online petition calls for ending the deal with ID.me, citing multiple instances of facial recognition leading to wrongful arrests and protestor tracking.

“The new IRS system, set to go into effect this summer, could expand the scope of these harms and impact the lives of millions more people,” the petition reads. “Whether it’s a collection of selfies, driver’s licenses, or images from social media accounts, building databases of sensitive personal information — including faces, voice recordings, fingerprints, and other forms of biometric data — represents one of the largest threats to our safety in the digital age.”

With privacy concerns building, the IRS is allegedly reconsidering using the facial recognition software from ID.me at all, Bloomberg reported. A department official told the outlet that the IRS would be looking for alternatives to ID.me, saying that it was always on the hunt for ways to make the process more secure. The IRS did not immediately respond to Technical.ly’s request for comment on the department’s plans going forward.

Still, the IRS seems to have verification top of mind. As of this week, another DMV company, Accenture Federal Services (a subsidiary of Accenture), announced that it inked a $73 million contract with the IRS to develop an automated fraud detection and identity theft prevention system. Accenture will be supporting the department through the five-year contract to work on its IRS Return Review Program, which detects potentially fraudulent tax returns to avoid incorrect or invalid tax refunds.

The company declined to answer questions about when the deal had been struck, details of the technology and how it would avoid similar privacy pitfalls.

Accenture Federal Services has been working with the IRS for over 40 years, the company said, including through its Affordable Care Act, Foreign Account Tax Compliance Act, Tax Cuts and Jobs Act and Taxpayer First Act programs.

“Accenture Federal Services is excited to deliver an evolved fraud detection process with fully-integrated advanced analytics to help the IRS expand anomaly detection for individual and business tax returns,” said Elaine Beeman, senior managing director and civilian portfolio lead, in a statement. “Our work includes a host of enterprise modernization initiatives, including cloud architecture, automation, testing, and agile methodologies to help the IRS create more value.”