This piece first appeared in Technical.ly CEO Chris Wink’s Builders newsletter. It features tips on growing powerful teams and dynamic workplaces. Sign up to get more pieces like this in your inbox before they appear on our site.

In a few short months, the startup founders raise a seed round that included First Round Capital and Mark Cuban. Over the next few years, they raise more than $650 million, open splashy downtown offices that host meetups and politicians, acquire nearly a dozen other companies and become one of DC tech’s most celebrated tech unicorns. At the tail end of the pandemic frenzy, they went public valued at $1.3 billion. Today, the company has a market cap closer to $150 million, a tenth of its value just a year ago.

The journey of policy-software company FiscalNote can tell you a lot about the cheap-money era of the 2010s and, now, of the state of local tech economies this year.

Plenty is right about FiscalNote. But a decade of reliable growth was capped by the unbridled exuberance of the pandemic. The year 2023 was a reckoning for entrepreneurs and technologists. Valuation collapse, shrinking budgets, layoffs and the emergence of a new hype cycle around artificial intelligence — all playing out in every region that is developing an economy for the future.

That’s a theme from Technical.ly’s first year-end State of Local Tech Economies webinar (don’t yawn!) that spun off the release of our inaugural State of the Local Tech Economy reports for each market on which we report daily.

Earlier this month, as Technical.ly cofounder-CEO I presented our high-level findings and then led a conversation with InnovatePGH Executive Director Sean Luther, Tech Council of Delaware Executive Director Zakiyyah Ali and Tempest Carter of the City of Philadelphia’s Department of Commerce. Watch that, download our reports and get a few quick snippets of my remarks below.

Technical.ly’s inaugural State of the Local Tech Economy reports

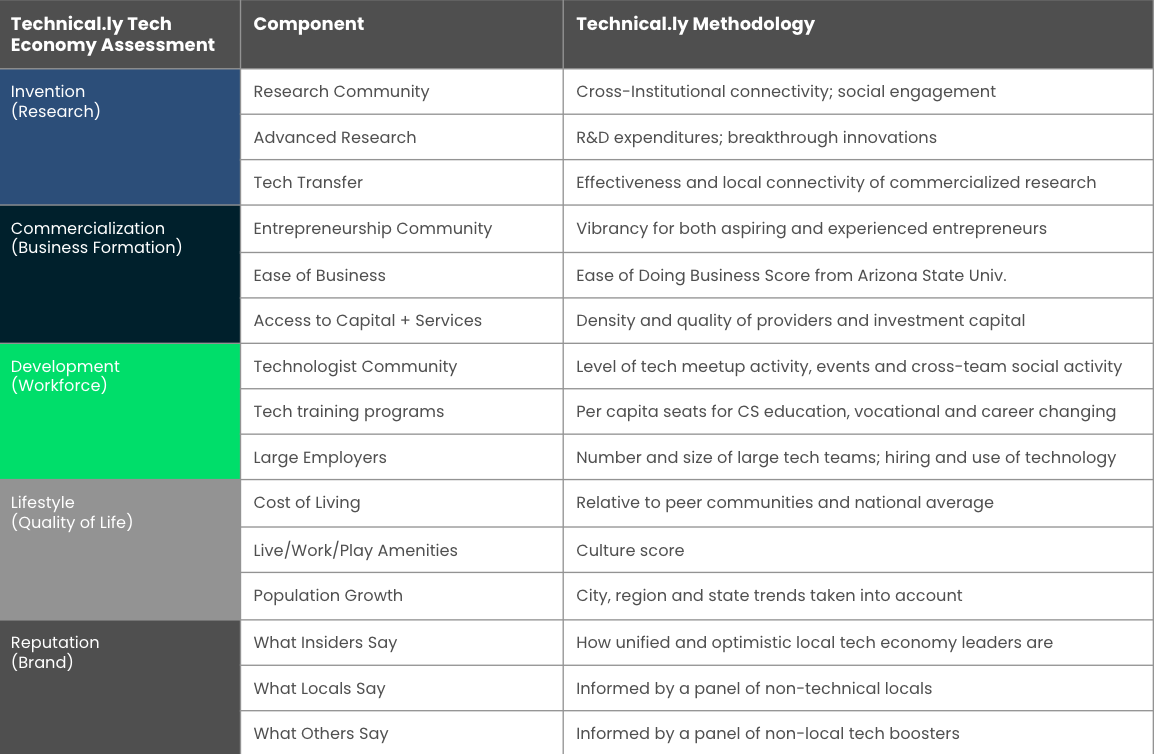

Technical.ly evaluates a tech economy in five categories, as listed in the above chart that appears throughout our reports: Invention (Research & Development), Commercialization (Business Formation), Development (Workforce), Lifestyle (Quality of Life) and Reputation (Regional Brand).

The Technical.ly Tech Economy Assessment. (Technical.ly/Chris Wink)?>

In its own way, FiscalNote can tell you something about each. As the company has grown, it has boasted more of its foundational research, celebrating its 13th patent earlier this year. Most American research and development comes from the private sector, which is highly focused on commercializing it, as FiscalNote demonstrates clearly. Though its headquarters were in downtown DC, FiscalNote maintained offices in other parts of the country and hired remotely to meet its hiring demands. Across it all, the company’s relationship to place was tied to where its workforce wanted to live, and how it contributed to DC tech’s reputation.

Here are a few other key points to understand about the state of local tech economies.

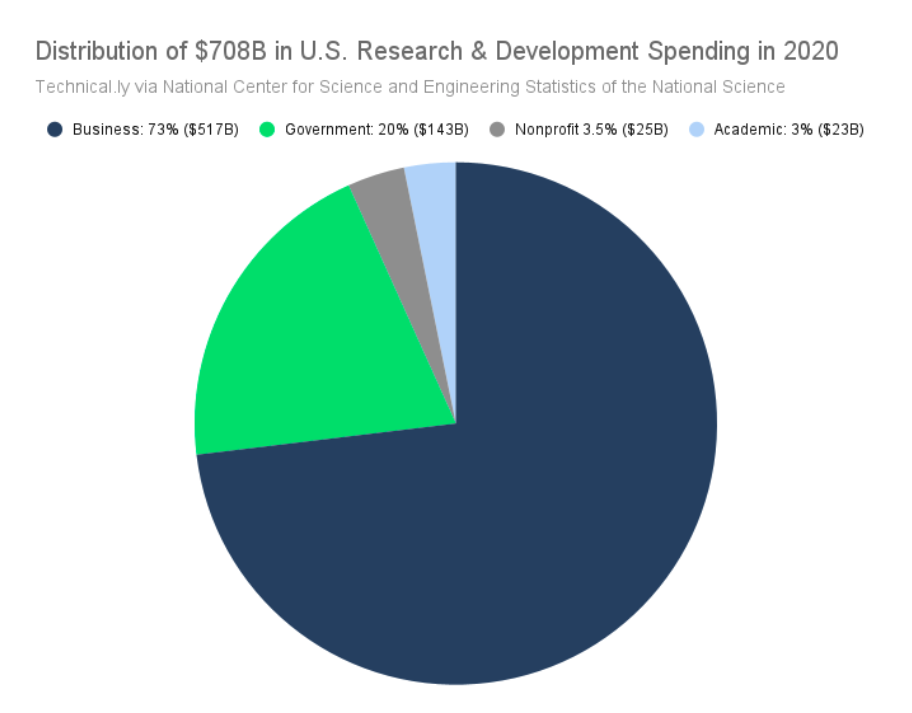

Most R&D comes from the private sector, not academic universities

More than 75% of research and development expenditures were made by the private sector in 2020. That’s representative of a decades-long trend that worries proponents of freely shared research. Academic research is a far tinier player: The combined R&D budgets of the five largest research universities is smaller than most of the top 20 private company budgets. But academic research tends to outperform in breakthroughs and is typically far more transparent about its findings than intellectual property-hungry corporations.

The distribution of R&D spending in the US in 2020. (Technical.ly/Chris Wink)

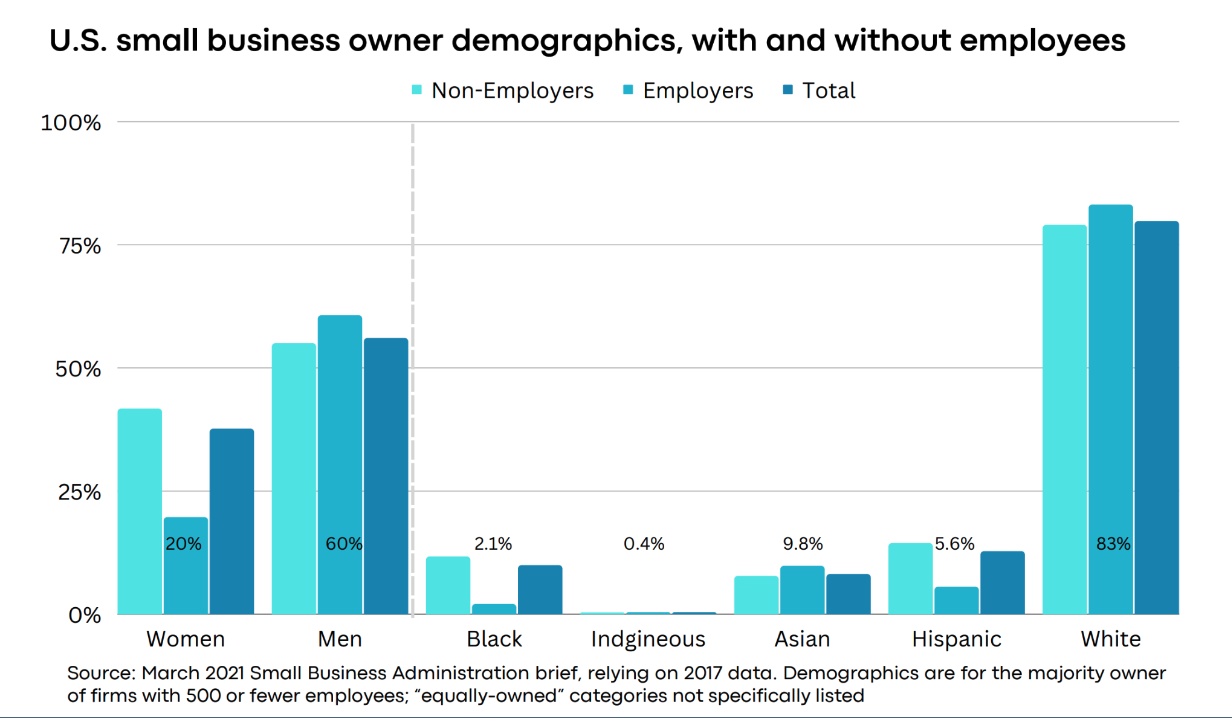

Entrepreneurship has continued its pandemic boom, but most won’t grow

Rates of business incorporation have surged during the pandemic, powered by women generally and Black women specifically, as documented by Technical.ly’s report on inclusive entrepreneurship this year. A split is developing though as many of these new business owners are prioritizing work-life flexibility, not business growth. Increasingly this form of entrepreneurship may be seen as an extension of the workforce, as companies rely more on contractors, consultants and vendors.

The percentage of US small business owners with and without employees. (Technical.ly/Chris Wink)

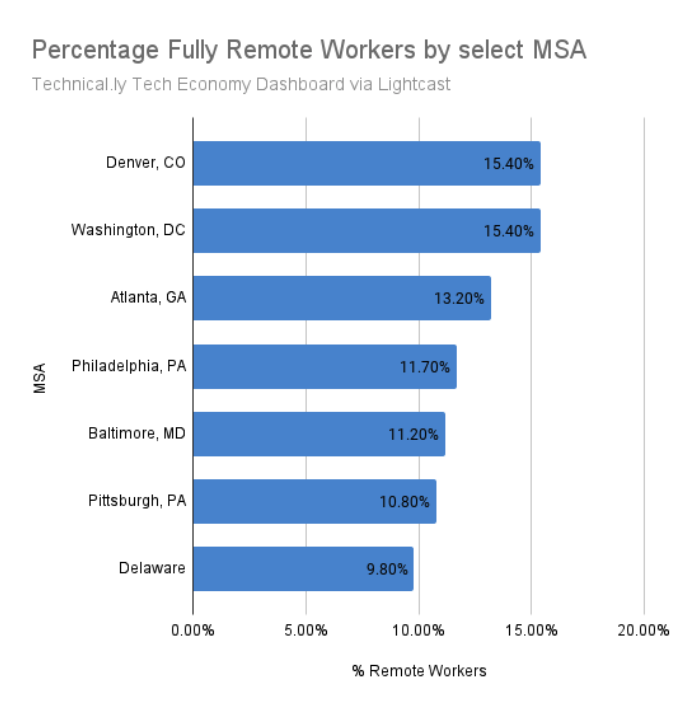

Remote work has stabilized into a new normal

In 2023, future remote work trends likely came into focus. The change is truly dramatic, but most Americans still aren’t remote — if you think otherwise, check your bubble. Most recent figures:

- A quarter of remote-capable jobs are now fully remote, which translates to 10-15% of all workers depending on the metro, according to Lightcast data in Technical.ly’s Tech Economy Dashboard.

- Two-thirds of professional jobs are hybrid, per Gallup, meaning that a local workforce is still matched to employers.

Americans have very different experiences though. Most Americans work for big companies, many of which have had stricter return to office policies. By industry and company size, this gets murkier.

The percentage of fully remote workers by select MSA. (Technical.ly/Chris Wink)

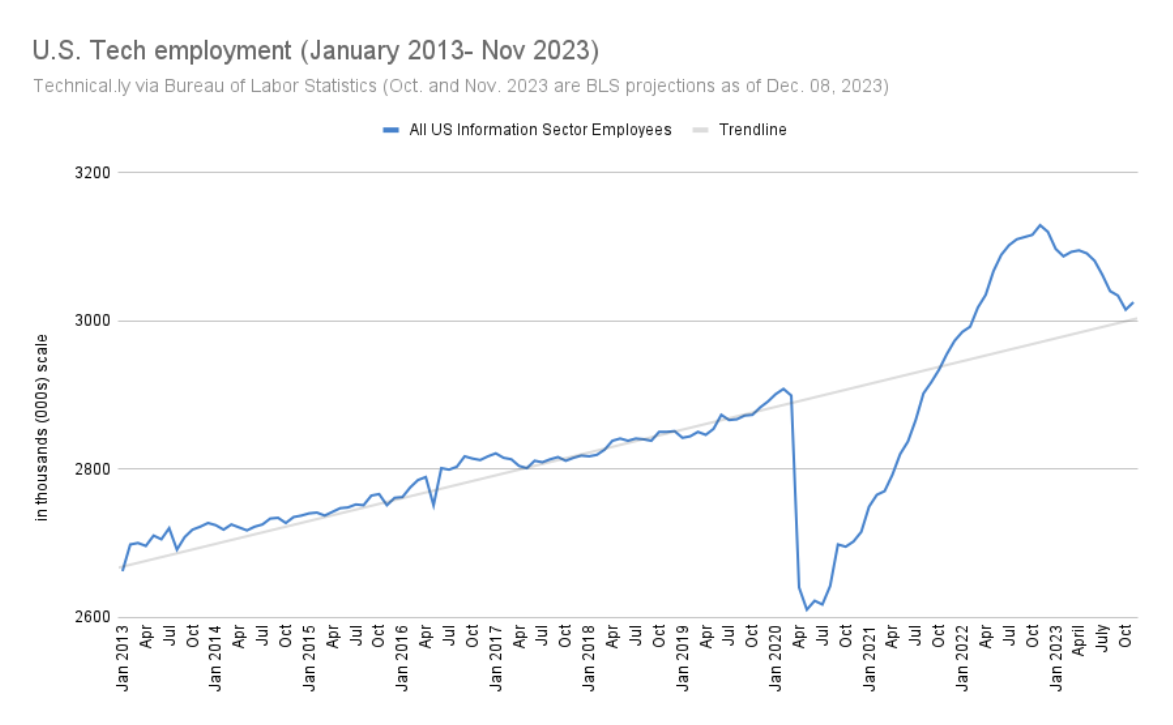

Tech hiring suffered a downturn but appears to be rebounding above a pre-pandemic trend line

Tech layoffs dominated our headlines this year, but a Technical.ly analysis demonstrates that the American tech workforce remains above the pre-pandemic trend line. Heightened efforts on diversifying the tech workforce ought to get more nuanced. Progress has come; Black and Hispanic residents are better represented in overall tech employment, but lag in the most coveted role: software developers.

US tech employment rate from 2013 to 2023. (Technical.ly/Chris Wink)

In conclusion

FiscalNote still has an office in DC. Going remote will not solve structural workforce challenges. I believe those that invest locally should be celebrated. It’s a workforce that will keep local tech economies vibrant, it’s community.

The local tech economy story of the 2010s was about entrepreneurs — a trio of friends coding in a motel room. They still matter mightily. Most new jobs come from new business. Still, the 2020s may well be the decade of the tech worker — where they live, how they use technology and what they learn and create.

Before you go...

Please consider supporting Technical.ly to keep our independent journalism strong. Unlike most business-focused media outlets, we don’t have a paywall. Instead, we count on your personal and organizational support.

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!

This Week in Jobs: Fall from the coconut tree and check out these 22 career opportunities

Gen Z pivots to gig jobs instead of full-time work: Who is that good for?

Baltimore Money Moves: Under Armour to pay out $434M in class-action settlement