Starting next month, Zoom meetings will come with an extra fee on the monthly bill.

Zoom, the videoconferencing platform that became a go-to for meetings and events in the pandemic, sent a notification to users last week that it will charge a sales tax on telecommunications services. Per the email, the company said it will charge 8% sales tax for businesses and residents who use the service in Baltimore city. It will charge 9% sales tax for users in Prince George’s County.

“Like many other unified communications companies, Zoom is required to collect certain taxes from some of its users depending on where they’re located,” a company spokesperson said in a statement in response to questions from Technical.ly. “Effective November 1, 2020, Zoom will begin collecting and remitting these taxes to the appropriate local governments. The potential tax is dependent on where the user is located in Maryland and the specific services the user purchases from Zoom.”

The taxes are on telecommunications services for Zoom are only in Baltimore city and PG County. Zoom said it conducted a review, and found only these two Maryland jurisdictions charged these taxes. The tax applies to all conferencing services, which include both audio and video, as well as Zoom Phone products except Zoom Phone Pro.

A notice for Baltimore city’s telecommunications tax states that it is applicable to “all telecommunications ‘lines,’ meaning a wired or wireless connection, identifiable through a unique telephone number, to an exchange, wireless, or other telecommunications service.”

Baltimore city did not yet provide answers to our request for comment to explain further; we’ll update this story if we hear back. For its part, Zoom wrote that the “definition of communication services subject to these taxes has been expanded as technologies evolve to include most services sold by Zoom.”

As new technology comes into wider use, it also often falls under the regulatory structures that others face.

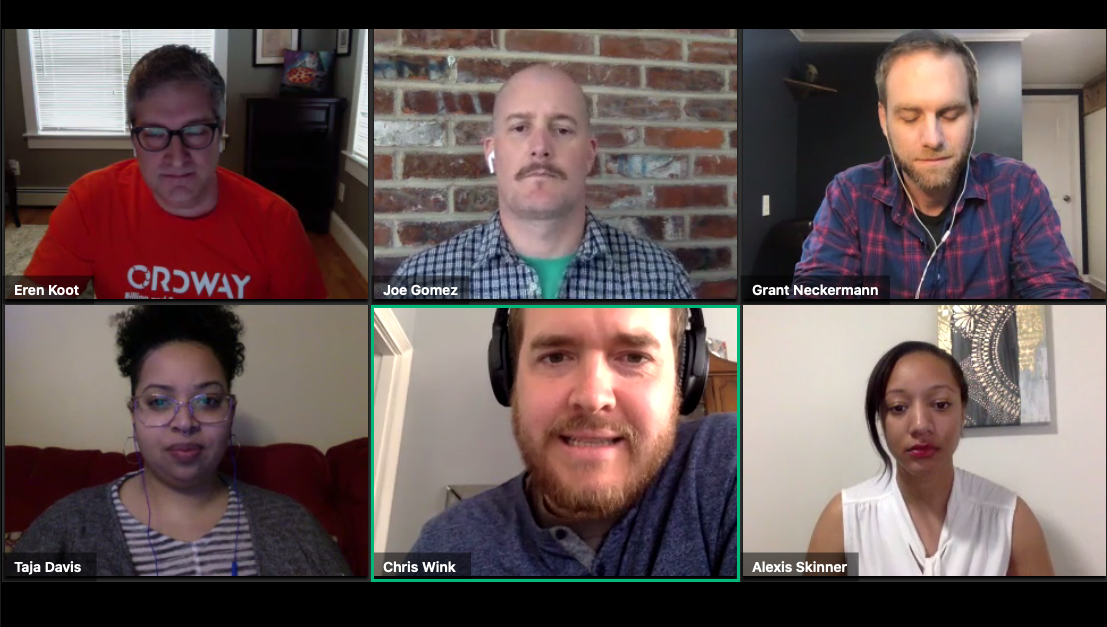

In this case, the move from Zoom comes at a time when usage of videoconferencing skyrocketed. With many companies working remotely, they can’t meet in person. So Zoom has become a primary way that companies conduct business, interface with clients and even host happy hours. And word of this tax arrives when students are meeting remotely and businesses are stretched amid an economic downturn.

Zoom sent notification that it will start charging 8% sales tax to businesses and residents in Baltimore city. Thoughts?

— Stephen Babcock (@stephenbabcock) October 21, 2020

Dave Carberry, CEO of Baltimore-based geotargeted advertising and marketing company Enradius, said such taxes that are placed on companies end up being paid by local businesses. Earlier this year, the state legislature considered a tax on digital advertising, though it was eventually vetoed by Gov. Larry Hogan. Carberry feared it would’ve had the same effect.

“I just don’t think it’s fair for smaller businesses that are in the city trying to make ends meet,” he said.

According to Barron’s, Zoom is making similar moves in Virginia, New York and California.

Join the conversation!

Find news, events, jobs and people who share your interests on Technical.ly's open community Slack

This Black gaming advocate has a mission to transform education through esports

This Week in Jobs: Get out there with 22 new job opportunities available to you!

This national network empowers Black nonprofit leaders through community, capital and capacity