What do you do when you aren’t allowed to take your money out of the bank and your country’s currency (and with it, your savings) might soon be worth only a fraction of what it was before?

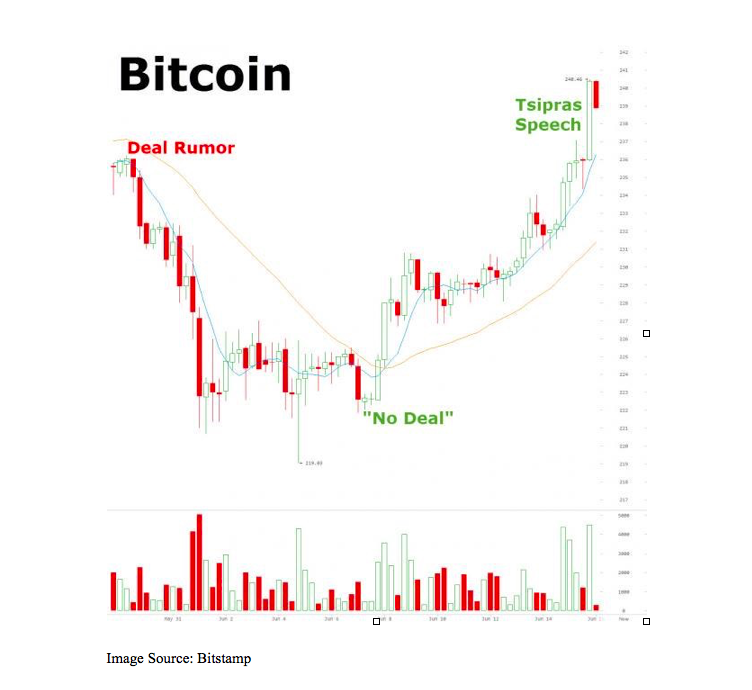

Well, some Greeks are turning to bitcoin, the much-maligned supranational digital currency. The price of bitcoin has been in decline more or less since it shot to prominence in November 2013, but recent fears related to the value of Greek bank deposits have given the governmentless currency its first sustained rally in some time.

According to Williamsburg-based Andrew Keys, Greece is the perfect demonstration of why bitcoin has a purpose.

In order to forestall a run on the banks and be able to pay for services, the Greek government has instituted capital controls wherein the banks are closed indefinitely and people can only take €60 per day out of ATMs.

“In Greece’s example, the money became the country’s money, the politician’s money,” Keys, the director of investor relations and business development at the blockchain technology company ConsenSys, said. “The banks did not permit access to people’s own money. In a decentralized world — and bitcoin is a prime concept of decentralized capital — that could never happen.”

Keys, who previously worked for UBS and the hedge fund Dovetail Capital, also said that a good deal of the rise in the price of bitcoin is likely due to speculative investors seeing a possible market need for the currency. Though many have predicted a similar market need in the U.S., none has ever materialized, and bitcoin exchanges have been plagued with software issues and fraud.

“America doesn’t necessarily have the need for [bitcoin] as currency because there are stable capital markets and a stable central bank,” Keys said. “I do see places like Argentina as an excellent example, as well as Greece, Portugal and Spain. The capital markets could understand that one place they could put their money would be in a decentralized currency like bitcoin. Investors also understanding the implications.”

Greece is expected to resume negotiating with its European partners on Wednesday.