Delaware’s reputation as a corporate tax haven draws countless business owners around the world to incorporate here, set up a mailbox address and then go do business somewhere else. We at Technical.ly play the game “Is this ‘Delaware company’ actually in Delaware?” several times a week. It’s the reason Mark Zuckerberg hung out on the Riverfront before a day in Delaware Court of Chancery. Apple, Coca-Cola, Google and Wal-Mart are all incorporated here, too.

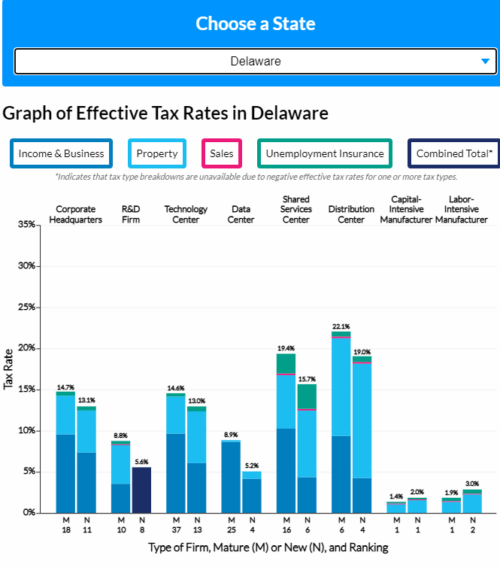

As it turns out, actually having a business located in Delaware has tax advantages, according to the nonprofit Tax Foundation, which ranked the states by costs of doing business within eight business models, including R&D; tech, data and distribution center; and both capital- and labor-intensive manufacturing.

For mature firms, Delaware ranked #3; for new firms, it ranked #2 and in the individual manufacturing categories, Delaware ranked #1.

The Tax Foundation report, called Location Matters, uses a different methodology from its State Business Tax Climate Index released in October, where Delaware ranked #13. That index is primarily intended as a tool for lawmakers. Location Matters, which includes an interactive web tool, was designed for business owners, allowing them to calculate estimated taxes in different states and compare them directly.

Two cities in Delaware were included in the ratings: Wilmington, which is classified as a Tier 1 city (a major city over 50,000 people), and Dover, which is classified Tier 2, or a mid-sized city. The state’s biggest advantages include modest property taxes, no sales tax, and major incentives for some operations.

Organizations like the Delaware Prosperity Partnership and the Delaware Business Roundtable are hopeful that the results will bring more businesses to physically locate in the state, along with more jobs.

“Creating long-term, well-paying jobs is a critical part of establishing a growing economy that contributes to the wellbeing of all Delawareans,” said Dr. Janice Nevin, president and CEO of ChristianaCare and chair of the Delaware Business Roundtable, in a statement. “This study confirms that our state is very competitive when it comes to corporate taxes, which helps to provide a good foundation for economic growth. We must also continue to focus on the other variables that are essential to creating job opportunities, including expanded broadband availability, infrastructure improvements, and education and training.”

Read the full report