As investors, growers, software developers, hardware engineers and even a state senator gathered to talk about the future of the cannabis industry, there was one word on everyone’s mind: legitimacy.

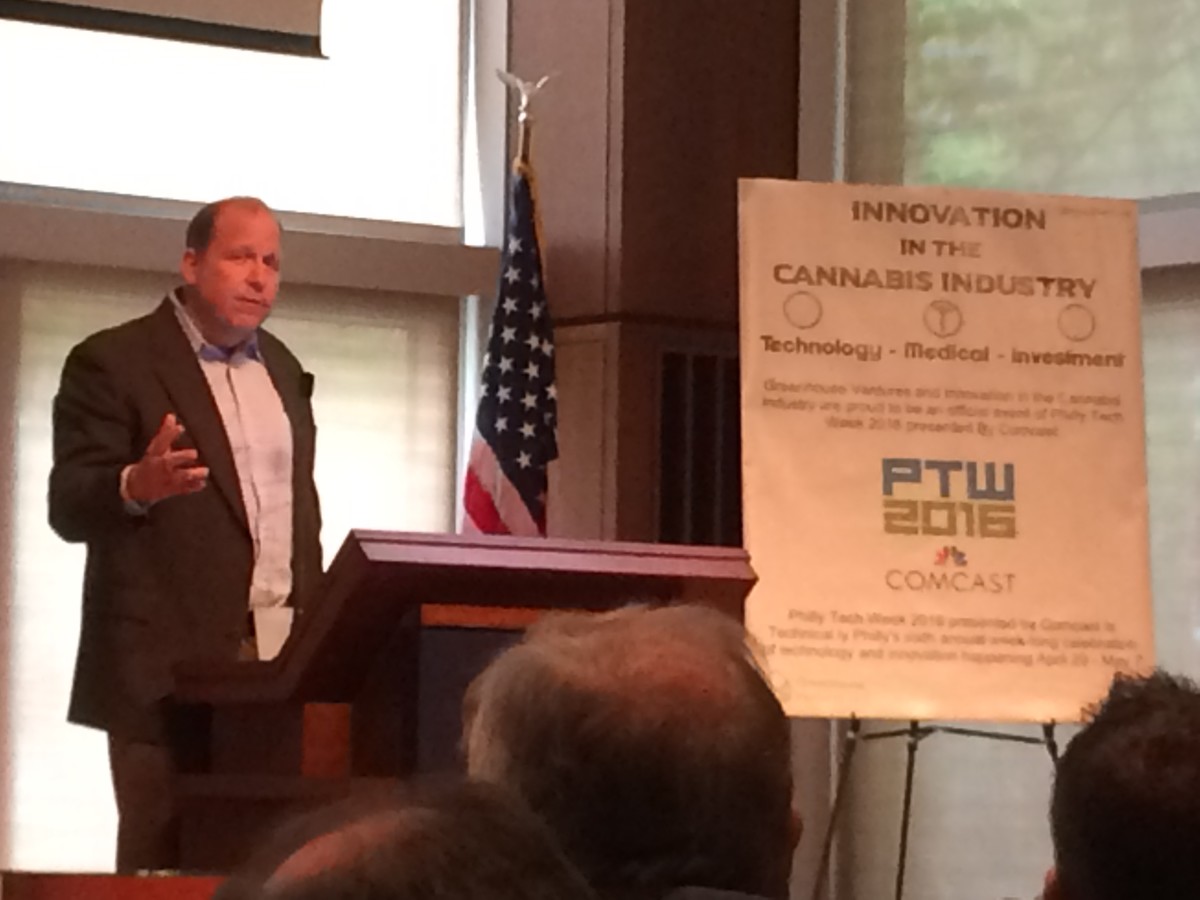

Last Saturday, Greenhouse Ventures, which pitches itself as an accelerator for cannabis startups, hosted a daylong conference at the Chemical Heritage Foundation during Philly Tech Week 2016 presented by Comcast. Two weeks ago, Pennsylvania Gov. Tom Wolf signed the Medical Marijuana Act, allowing for 150 dispensaries throughout the state, state Sen. Daylin Leach (D-Montgomery) pointed out. Translation: bookoo bud bucks if you’ve got the pockets for it and you’ll never have to worry about getting locked up.

https://twitter.com/CannabisEditor/status/726481330020691968

The conference offered a look into an industry that’s moving into legitimacy. Case in point: the event was a business conference like any other and attendees looked the part — all suits and grave looks, barring giggles at the occasional reefer reference. When you have to pay a $10,000 nonrefundable application fee for a dispensary license, you come heart-attack serious or you don’t come at all. (Not to mention that analysts eyeball the cost of building a growing operation at $3 million, Philly.com reported.) These guys weren’t your father’s dealer — these guys were your father.

On a panel about the future of the cannabis industry and tech sat cannabis entrepreneurs from Boulder, Colo., and Los Angeles, Calif., who worked in all parts of the industry. Some, like Surna and Urban-Gro, sold equipment for growers, while another company, KIND Financial, built business software for cannabis companies. Another company called Green Lion Partners says it helps cannabis business grow and scale.

Greenhouse Ventures was cofounded by Tyler Dautrich and Kevin Provost, the team behind accelerator coPhilly. The accelerator lists Lindy Snider, daughter of Flyers owner Ed Snider, as an advisor. Lindy Snider is a cannabis investor. Most recently, she led a $2 million round for KIND Financial, the Inquirer reported in February 2015. KIND is run by former Philadelphia real estate broker and developer David Dinenberg.

The panelists spoke of the hardships of working in an emerging market and their predictions for the industry.

Stephen Keen, CEO of Boulder-based Surna, argued that one of the biggest current roadblocks is funding, as growers will not upgrade their operations if they can’t afford it. (This will sound familiar to any early-stage tech entrepreneur.) He also mentioned that most cannabis companies are failing to turn a profit even if their year-on-year revenues are multiplying, due to the need for constant reinvestment. Deep pockets and patience seem to be the key to longterm success, while breaking even should be the goal for the immediate future.

Data will also play a key role in the future of commercial cannabis. A recurring complaint among the panelists was that they wanted to be treated as any other industry would — they wanted to open bank accounts, they even wanted to pay taxes. Rigorous data collection and product tracking will facilitate this, the speakers said, as the need for transparency is doubly important for a black market shifting to a white market. In other words, an industry that’s accustomed to keeping books longhand needs to move to Quicken or banks won’t (or can’t) take them seriously.

Product tracking also takes care of the government’s concern regarding “product diversion” (i.e. purchasing cannabis in a legal market to resell in a black market), since the entire process, from “seed to sale,” will be accounted for through data collection.

Data collection would also improve cannabis products, from agricultural hardware to financial software to the plants themselves. Mike Bologna, CEO of Boston-based Green Lion Partners, predicts a massive influx of data scientists into the cannabis sector in the near future, as there is a dearth of data due to the industry’s past as a black market.

In 20 years, it seems like marijuana will be as American as apple pies and hedge funds.

Here’s a look at the future of the cannabis industry