Building an impactful, mission-aligned portfolio is often described as a “double bottom-line” investment exercise.

This is meant to convey the notion that there are two distinct objectives that an investor is targeting — one rooted in a financial outcome and one rooted in the furthering of specific societal goals. Done properly, this exercise involves decisions that reflect the tradeoff inherent to incorporating multiple considerations, with a goal of achieving peak efficiency.

Modern portfolio theory

In traditional investing, where the only stated goal is an ultimate financial gain, there are also multiple variables considered, with a framework used for evaluating efficiency known as the Efficient Frontier. Formulated by Harry Markowitz in 1952, the exercise plots individual assets, or a portfolio of assets, on a graph that consists of two axes: an x-axis that reflects a level of risk (defined typically by standard deviation, or volatility of returns), and a y-axis that reflects expected level of return.

From left to right, the return profile of an investment gets more volatile, and therefore less certain, to which risk is ascribed. From bottom to top, the expected return profile of an investment gets proportionately higher, thus seen as more attractive given the return-seeking nature of traditional investment decisions. An efficient investment is one deemed to have the best possible level of expected return for a given level of risk, or conversely, the lowest level of expected risk for a given level of return.

An investment with minimal expected return but significant associated safety, like cash or U.S. Treasury bills, is on the efficient frontier at the point furthest left and lowest, while an investment with significant expected return and commensurate associated risk of principal loss, like equities of developing nations, is on the same frontier but at the point furthest right and highest. In between those two extremes is a curved line, which is a representation of various investments with well calibrated risk-return characteristics.

Investing for impact

The decision to apportion all, or some, of a portfolio to investments deemed to be consistent with the mission of an organization or the values of a family, is often the result of a process designed to evaluate a set of investment guidelines. These guidelines are memorialized in a document called an Investment Policy Statement (IPS). A traditional IPS covers variables such as organizational structure, intended purpose for funds, investment objective, time horizon, cash flow considerations, target asset allocation, eligible asset classes, eligible vehicles, evaluation benchmark, and other considerations around how investment decisions are made.

Increasingly, one of those considerations involves a desire to direct allocations towards mission-aligned investments. This will necessitate the creation of an additional set of guidelines, memorialized as mission-aligned investment policy, either in a separate IPS or as a component of a traditional IPS. Relevant sections of a mission-aligned IPS include a description of mission or values and often delineate between public securities (often referred to as SRI or ESG strategies) and private investments.

Within public security guidelines, the document will identify types of screens (exclusion criteria, inclusion criteria, thematic), investment style (active or passive), criteria development (customized, off-the-shelf), and policies for selection and monitoring. With regard to private investments, variables are scoped out that include vehicle-type (fund or direct investments) and business stage (angel, venture, growth, buyout), as well as policies for sourcing, due diligence, selection, monitoring, and measuring impact.

Finally, guidelines are established for how a portfolio is constructed. These will cover a range of factors including risk metrics, growth expectations, income needs, and liquidity. It is this concept of portfolio construction, which is admittedly part art and part science, where a properly developed investment policy around the efficient frontier concept can increase the likelihood that over time the work of an advisor and investment committee will be deemed a success.

Building impact efficiency

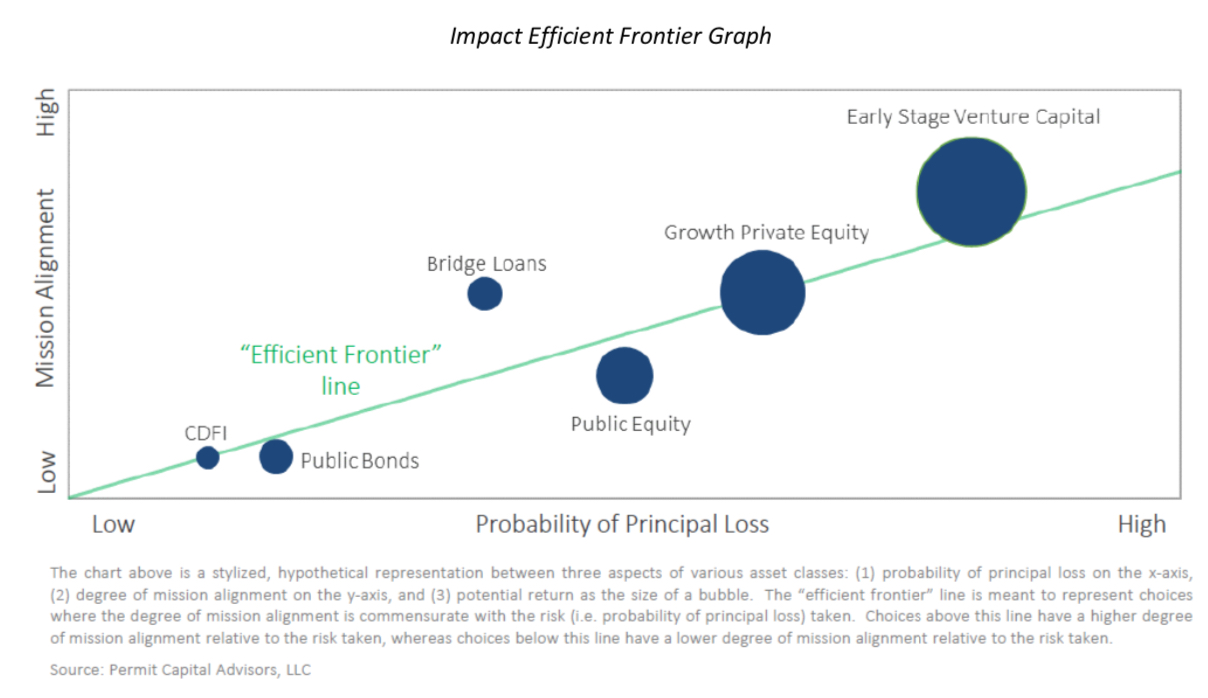

As discussed earlier, traditional efficient frontier plots two variables: risk (volatility) and return. Given the nature of an impact, or mission-aligned, investment framework, this is stepped up to three variables: risk (principal loss), degree of mission alignment, and return. Much like in a traditional efficient frontier, risk is plotted along the x-axis. The degree of mission alignment is plotted along the y-axis. The prospective return is represented by the size of a bubble that sits at the point where an investment’s position on the two axes comes together.

The rationale for using a different measure of risk, the likelihood of principal loss as opposed to volatility, is directly tied to the aspect of goal setting that involves the furthering of specific social intention. Understanding the probability, and scenario analysis, involved in setting loss expectations can help an investor properly structure, monitor, and potentially assist with an investment so as to maximize the likelihood of success of the enterprise they are investing into.

Ultimately, if capital is lost, there may be fleeting opportunity for a business that is looking to do good in the world, but for the capital deployed to catalyze sustainable value an investor would likely at least have the ability to receive a return of capital invested. Further, entering into transactions with a reasonable expectation that there won’t be meaningful permanent principal impairment should allow a family or investment committee to continue to operate in risk-seeking mode. This also highlights the notion that one specific type of risk inherent to an impact investment is that the desired impact will not come to fruition, making comprehensive investment due diligence even more important in this setting.

The degree of anticipated mission alignment that an investment will likely deliver is the result of a process that is largely carried by the beneficial owner of the portfolio, as opposed to an investment advisor. The collaboration required to then integrate a customized evaluation of mission and/or values into principally financial metrics makes the relationship between stakeholders of critical importance. In general, the more aligned investments will fall within the spectrum of private opportunities, as the limitations of a public security screening process are a byproduct of the universe of such securities.

It is a worthy exercise to screen out securities based upon business activities or hiring practices that are inconsistent with an investors’ belief system or to include them based upon the same. However, to put dollars to work in an investment that is as tightly bound to mission as a grant, or charitable contribution, is unusual outside of private investments where fewer limitations exist.

The prospective return of an individual investment, as represented by bubble size, is important to consider because the expected return of an entire portfolio is important to understand. The ability to project how much money an organization or family will have at their disposal can help shape policies around giving, dependent as well upon the duration of their goal, meaning is this something that is designed to be done to perpetuity, or for a period of time tied to the sunset of a foundation or the life of a family generation.

On, above or below the line

The impact “efficient frontier line” shown here plots a range of mission-aligned investments that a portfolio might include. These span across public and private investments as well as equity and fixed income strategies. From least to most risky, in a traditional investment context, these cover a CDFI program, public bonds, bridge loans, public equity, growth-stage private equity, and early-stage venture capital. To further examine positioning on the graph, compare the placement of public bonds to bridge loans.

While public bonds of investment-grade issuers and bridge loans may offer a similar return, thus the matching circle sizes, public bonds could be identified that are less likely to experience principal impairment. However, a customized bridge loan program that a foundation would endeavor to structure could be used to provide funds to its grant recipients that are experiencing a cash shortfall due to delays in public funds that it has been promised. This would represent an investment that would suggest a very tight fit with the organization’s mission.

The nature of the double bottom-line investment objective may mean that a curved line is difficult to plot precisely. The value in attempting to find the “best fit” line on an efficient basis amongst prospective investments, affects not only the process by which investments are made or passed on, but also in the decision of how to size them.

An opportunity that falls above the line, meaning low risk of principal loss relative to the expected degree of mission alignment, and is represented by a relatively large bubble, would likely warrant an allocation of meaningful size. Put differently, if an organization or family could make a reasonable return by deploying capital towards an opportunity that would potentially merit consideration as a grant or donation, it should be willing to put more dollars towards this investment than they would otherwise.

Conclusion

Building a portfolio of investments in any context, if done properly, requires an analytical framework to be created and maintained. In the case of an investor looking to integrate mission or values into their investment decisions, that requirement is magnified, but it is also an exercise that carries multiple benefits. Not only can it yield positive portfolio results, but it can enhance the likelihood that supported businesses and entrepreneurs will achieve their goals as well.

Finally, the process by which stakeholders (boards, investment committees, investment advisors) work together to scope out investments across dimensions ranging from mission to investment due diligence, can help ensure productive relationships driven by collective understandings, synergies, and ultimately, ongoing successes.