When it comes time for the next growth phase, conventional wisdom for many startups is to dust off their pitches and reach out to angel investors. But education technology company Digital Dream Labs, which is at an inflection point this year, decided to cast a wider net.

While the company is ready for a formal raise, it co-founder and CEO, Jacob Hanchar, said the strategy of seeking funds from smaller investors paid off.

Hanchar and Digital Dream Labs used the equity investing platform Republic to raise small amounts of money from thousands of private investors all over the world. The campaign, which ends in January, raised nearly $400,000 in its first 12 weeks. On Republic, Digital Dream Labs joined the numerous companies around the country that are taking advantage of the CROWDFUND Act, signed into law in 2012 and adopted by the Securities and Exchange Commission in late 2015.

Since then, crowdfunding sites like Republic have offered companies a platform to sell securities. Anyone with at least $50 can invest in Digital Dream Labs through its campaign page, which contains details about the company’s product offerings, target market, competitors, and more. The page also has a discussion board where users can ask the company questions.

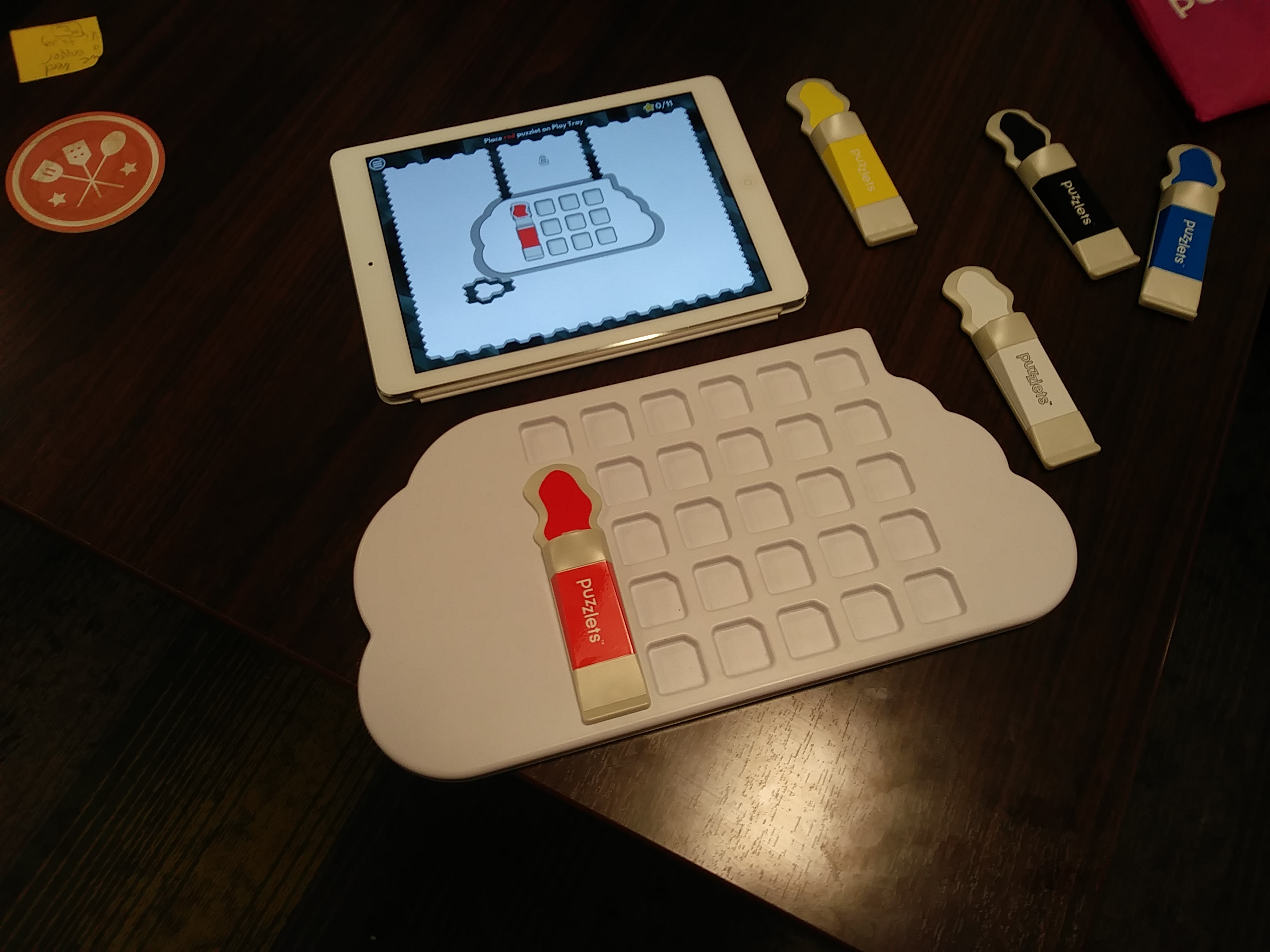

According to Hanchar, money from the campaign will help Digital Dream Labs expand in size and launch new software-only products. The company currently offers products like Puzzlets, a learning tool used predominantly by schools that allows elementary and middle school children to play educational STEAM games virtually or through an interactive Play Tray.

“Part of this was a marketing effort, and what I love is we have 2,000 strangers who believe in what we’re doing. I’ve never met these people, and they’re saying, ‘Look, I’m going to put 100, 200 hard-earned dollars into this idea,’” Hanchar said.

While the majority of the investors in Digital Dream Labs are located in the United States, investors from other countries have contributed and plan to donate their time as well.

One Canadian familiar with the ed-tech space offered to help the company get its products into schools in his country. Hanchar said he has wanted to expand into Canada for a long time but didn’t have a chance to do so until now.

Gary Ross, an attorney with the New York law firm Ross Law Group, said the SEC’s approval of the CROWDFUND Act opened the door to nonaccredited investors, in particular. The SEC primarily defines an accredited investor as an individual with a yearly income exceeding $200,000 or a net worth of over $1 million.

“You think about the people who are crowdfunding, it’s usually people who are surfing the internet and come across these companies out there,” said Ross, who helped Digital Dream Labs fill out compliance paperwork for its Republic raise.

Before the SEC adopted regulation-crowdfunding procedures, the activities conducted by platforms like Republic were technically illegal, according to Republic’s deputy general counsel and chief compliance officer, Maxwell Rich.

Regulation crowdfunding “opens up a new paradigm for angel investing, where truly anyone, regardless of net worth, income, or social connections, can find and invest in private companies that may become highly successful one day; that being said, there is a high risk of loss, like with all other early-stage investing,” Rich said in an email.

He also said that over the past three years, Republic’s user base has gone from a few thousand to over 300,000, with at least 25 companies raising at a given time.

To use platforms like Republic, companies need to file a Form C disclosure document with the SEC. They can raise no more than $1.07 million per year, and investors who wish to invest more than $2,200 must fill out extra paperwork proving they can cover any loss.

The process also requires an audit and a questionnaire that an attorney must fill out, Hanchar said.

According to Ross, the paperwork can be a burden for true startups due to the uncertain nature of investing and the time commitment involved. While the process can cost as much as $20,000 depending on the price of accounting, larger raises like an IPO carry a far higher upfront cost.

“An IPO costs well into the six figures, and so it’s a whole lot for companies to do,” Ross said.

Hanchar said the $1.07 million limit makes sense given his company’s size and represents an amount of money that he can use in a more methodical way. He also said the percentage of each investment taken by crowdfunding sites ‒ 6 percent in the case of Republic ‒ is trivial given the platform’s benefits.

With the money from the Republic raise, Digital Dream Labs plans to expand its team from nine to 16 employees and start hiring soon after the campaign closes. Software-only products could begin rolling out next month.

A structured rollout will follow the planned release of Cork the Volcano in January. The game teaches coding and uses the Puzzlets’ Play Tray, according to Hanchar.

Following Cork the Volcano, software-only versions of Abacus Finch, Swatch Out, and Monsters Molecules will be released. The games teach math, art, and chemistry, respectively.

The new products, which will use a virtual Play Tray, are geared toward elementary educators and parents who can’t afford hardware.

To fund operations and product launches, Hanchar said that Digital Dream Labs accepted money ‒ totaling about $900,000 ‒ from angel sources before. Major investors in the company include Innovation Works, AlphaLab, and the Urban Redevelopment Authority.

But raising money from angel sources hasn’t always been worthwhile. Hanchar said he spent countless hours traveling around the country and pitching to angel groups that just don’t get it.

“I would rather have 1,000 people investing $100 here and there, than guys who are going to invest a couple hundred thousand dollars, then jerk me around for two or three years. That’s what I love about [Republic] … you can access the people, and the people are real,” Hanchar said.

He recommends other entrepreneurs consider regulation crowdfunding as an alternative.

“My suggestion would be for everyone in Pittsburgh to start with this,” Hanchar said. “It’s saving me money; I don’t have to run around to various places across the country and pitch. The pitch is already done, and people know whether they’re going to like it or not like it.”