Over the last few months, a lot has been said about the upcoming changes to StartUp PHL and more broadly about city and state involvement in fostering an environment that supports local startup growth.

As a non Philly-native who chose Philadelphia as home for my company, VeryApt, and as a StartUp PHL portfolio company, I thought it would be helpful to give my perspective on the program: how it’s driven Philly’s tech ecosystem and how it can be even better the second time around.

Prior to raising a $270,000 angel round led by StartUp PHL, my two cofounders and I had just graduated from our respective grad programs and had placed 3rd in Wharton’s Business Plan Competition. We could have settled our company anywhere, with New York and San Francisco being the obvious choices. For a startup, the initial round of funding is where geography is most critical. Most angels don’t want to invest outside of their backyard, which explains the natural tendency for startups to relocate where there is the most capital.

StartUp PHL shouldn't focus on nebulous goals like job growth or economic development. It should aim to return capital to investors.

If you are a biotech, healthcare, or software-as-a-service (SaaS) company, Philadelphia is a logical choice to start your company, as there have been several substantial startup exits in the last two decades that have resulted in a strong ecosystem of angel investors, institutional investors, government grants and local universities to support new companies in these sectors. But on the consumer tech side, where I work, we haven’t had many large wins so the same infrastructure doesn’t exist.

For us, StartUp PHL solved that critical funding gap by creating an early stage investment vehicle that was both sector-agnostic and also run by Josh Kopelman, a partner at First Round Capital, immediately lending our company national credibility. It gave us immense confidence in former Mayor Nutter’s vision to make Philadelphia a thriving tech ecosystem by not only investing a considerable amount of capital into Philadelphia startups, but by entrusting the fund to someone with a proven track record in early stage investing like Josh.

Here’s what made StartUp PHL stand out among some of the other funding options we considered in Philly.

- Transparency and speed: It took less than three weeks to get from our initial application to a term sheet — that’s lightning fast. Plus, throughout the process, we were given a clear sense of what to expect at each stage. This was a huge distinction from many other local funds that we had spoken with that needed several months to make a decision with limited transparency on the actual process. In our experience, good early stage investors make decisions quickly.

- Credibility: It was important to get funding validation from a proven early stage investor, and who better to do this than Josh, who has started multiple successful Philadelphia companies and subsequently proved himself to be one of the best early stage investors in the country? Knowing that Josh had validated our thesis helped immensely when we raised our most recent $1 million funding round. (Editor’s note: We’ve heard this from other founders around town, that Josh is a kingmaker of sorts in Philadelphia, for better or for worse.)

- Funding terms: Beyond ensuring that the company stay in Philadelphia for 18 months, there weren’t any restrictive clauses or non-standard terms. The terms were fair and put together in a way that would be favorable for future VC financing.

As a company that has been part of StartUp PHL for the last two years, we’ve been really impressed with the success experienced across the portfolio.

When compared against the aggregate performance from renowned accelerators like Y Combinator, TechStars, DreamIt and 500 Startups, StartUp PHL has performed favorably in terms of its startups receiving follow-on funding and mortality rate. Time will tell if StartUp PHL will generate its share of large exits, but in the short run, the fund has directly contributed to a significant number of skilled tech jobs in Philadelphia and has brought in millions of dollars of outside capital into the Philly startup ecosystem. Even in cases where companies have grown and left Philadelphia, like Tesorio or Netsil (formerly Gencore Systems), it’s likely they will provide a positive return to the fund in the long run. VeryApt, for the record, plans to stay in Philadelphia for the long haul.

VeryApt, for the record, plans to stay in Philadelphia for the long haul.

As we move forward to the next stage of StartUp PHL, there are a few things that I hope the next incarnation of the fund takes into account.

First, I hope we are able to find someone to run the fund that has a proven track record within their own fund and will continue to build StartUp PHL as a strong brand with national credibility.

Second, the fund needs to allocate part of its capital to reinvest in startups that secure follow-on funding. Currently, StartUp PHL’s mandate doesn’t seem to allow follow-on investing. Not only is this unfortunate for the startups in the fund, but it’s bad business for the city. Early stage investors make almost all of their investment returns from a small portion of their companies, so its critical that they reinvest in those companies during later funding rounds. In fact, Y Combinator came to a similar conclusion recently and raised a follow-on fund specifically focused on investing in its portfolio companies.

Lastly, the fund should continue to be run with the goal of returning capital to investors — in this case, the Philadelphia Industrial Development Corporation (PIDC) and the venture firm that runs it — rather than more nebulous goals like job growth or economic development. If StartUp PHL focuses primarily on shareholder returns like traditional venture capital firms, the fund will inherently invest in companies that have the highest likelihood to drive significant job growth and economic development in the long run.

Before you go...

Please consider supporting Technical.ly to keep our independent journalism strong. Unlike most business-focused media outlets, we don’t have a paywall. Instead, we count on your personal and organizational support.

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!

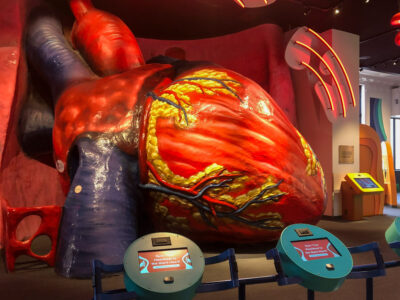

Look inside: Franklin Institute’s Giant Heart reopens with new immersive exhibits

How Berkadia's innovation conference demonstrates its commitment to people and technology

What actually is the 'creator economy'? Here's why we should care