Small businesses across the country have demonstrated their resilience during the COVID-19 crisis. With the vaccination rollout expanding and signs of recovery becoming plentiful, small business optimism is beginning to turn.

Understanding the depth and breadth of the distress the small businesses sector faced across the District of Columbia, Maryland, and Virginia region is essential context for understanding the local sector’s road to recovery. The Small Business Pulse Survey (SBPS) is a recent addition to the U.S. Census Bureau’s collection of data products that provides weekly updates on the health and well-being of the country’s small businesses.

Two clear trends emerge in the SBPS data for the DMV.

First, the small business recovery in the DMV has been moving more or less in lockstep with the nation’s. The region is not inordinately hurting, like New England, nor is it roaring ahead of the rest of the country, like the South or the Mountain West. Instead, the region mostly tracks national trends, and has from the start.

Second, within the region, the very-urban District has experienced a greater degree of economic pain than neighboring Virginia and Maryland, and most other states.

So goes the DMV

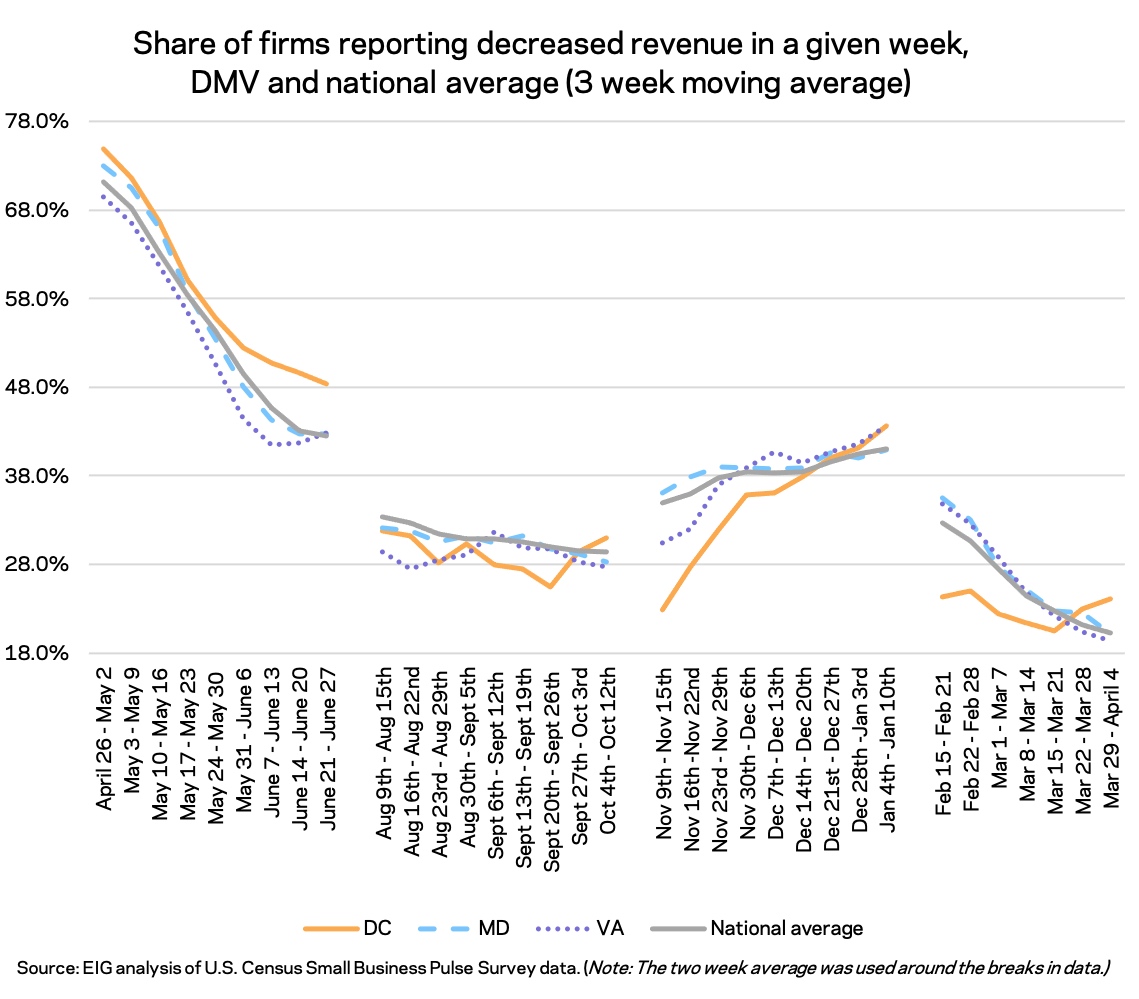

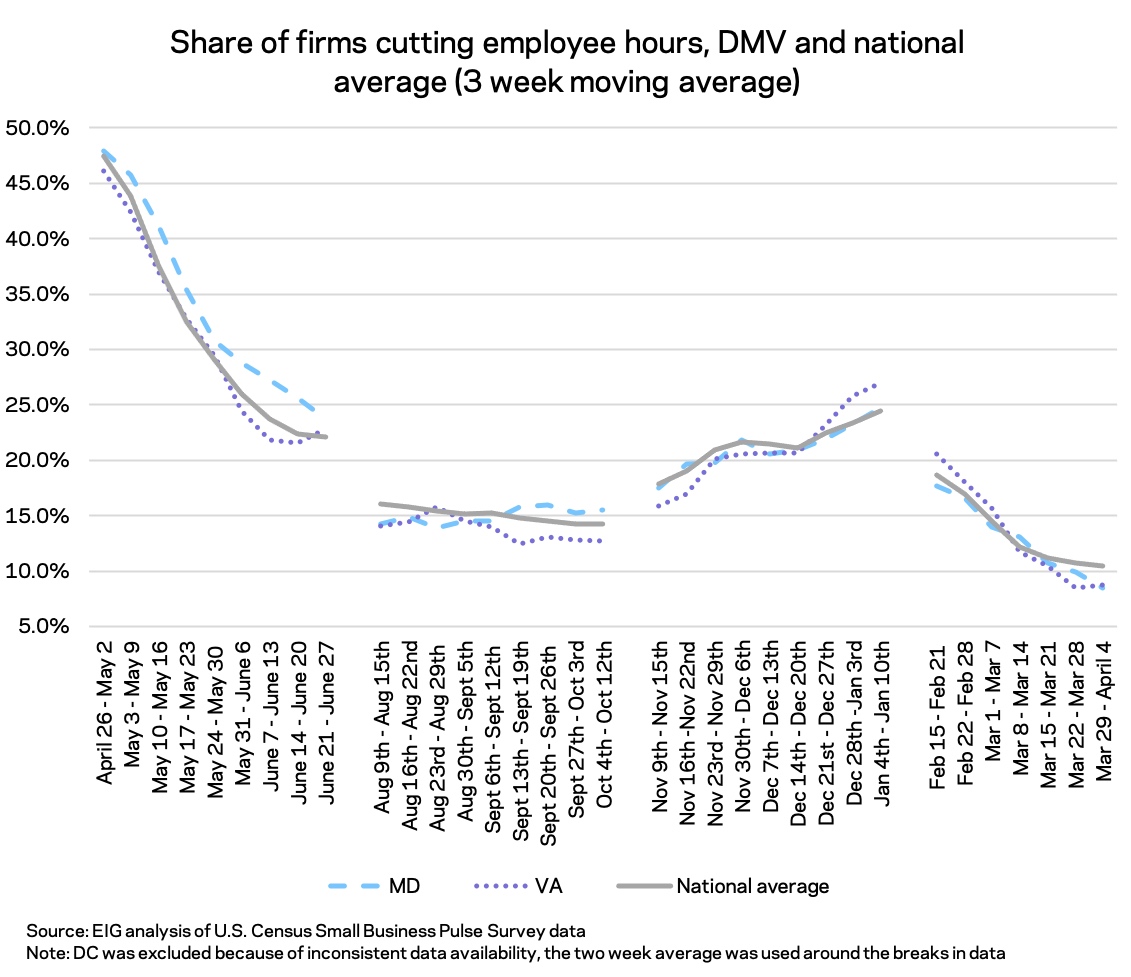

The broad pattern of economic pain and recovery in the DMV has loosely mirrored that of the nation as a whole. In the initial stages of the pandemic, high shares of small businesses saw revenues decline precipitously and cut employee hours to match. In late April and May 2020, roughly 70% of small businesses reported declining revenue and over 45% of small businesses in Maryland, Virginia, and D.C. reported cutting employee hours.

Conditions stabilized somewhat in the late summer and early fall, although around 30% of small businesses continued to report week-on-week revenue declines and around 15% were still cutting hours. Key metrics worsened substantially for the holidays. By early January, nearly 40% of local businesses were again losing revenues.

Through each of these twists and turns, the sentiment of the region’s small businesses, especially those in Maryland and Virginia, have moved tightly with national averages. This has held true into the spring as key indicators have started to improve rapidly and in lockstep. Fewer businesses are now cutting employee hours than at any time since the start of the pandemic. On this measure, Maryland and Virginia have even pulled ahead of the national average, suggesting their recoveries could be gaining steam.

Lingering impacts in DC

The District has felt the economic fallout of the pandemic most acutely in the region. Its businesses registered higher levels of pain longer in the spring of 2020, and their recovery is not yet accelerating as quickly, one year later, as in neighboring states. D.C. has consistently ranked among the places with the highest average share of businesses reporting a large negative impact of the COVID pandemic, and it remains among the top five worst-impacted nationally and only two rungs behind tourism-dependent Hawaii.

The heightened distress in D.C. tracks the general trend that the places that suffered most acutely in both public health and economic terms early in the pandemic, such as New York and New Jersey, tend to be among those most severely affected even a year later. The District contains none of the rural, small town, or exurban areas that other states do, either — the types of communities in which the economic impact of the pandemic has generally been light. Instead, as a city-state dominated by a central business district and reliant on public transportation (that also runs on a good deal of tourism and business travel), small businesses located downtown have been hit particularly hard. Professional-heavy DC has a higher share of households with at least one person teleworking than any state or metro area.

In response to decreased demand, some businesses are decreasing their physical footprints. At least 13% of small businesses in the District report decreasing the amount of space they rent or lease compared to at least 4% in Maryland and 5% in Virginia. The good news for D.C. is that despite steep job losses during the crisis, new businesses have been opening at pre-pandemic rates throughout the pandemic and the District has devoted targeted resources to supporting small businesses. If supported businesses can hold on until offices reopen and new businesses rise to replace those that closed, D.C.’s prospects for a recovery may be stronger than the data would suggest.

Despite the acute pain small businesses experienced, recovery expectations are on an upward trajectory nationally. Locally, recovery expectations have been improving but with some volatility, leaving the amount of time before the majority of businesses are back operating at their normal levels an open question. For now, between those that never felt much of an impact from the pandemic recession and those that have recovered, roughly three in 10 businesses in Maryland and Virginia are operating at their normal levels. That leaves 70% of the region’s small businesses — more including D.C. — eagerly awaiting a return to normal.

The Small Business Pulse Survey is not a perfect gauge of the health of small businesses in a given area—timely data nearly always makes conscious sacrifices in some precision in the name of rapid return—but it provides a unique look into the general trends playing out in real time across the country and in the region. As the DMV moves towards recovery, policymakers must keep in mind the longevity and severity of the crisis for the region’s small businesses. For many, the crisis may persist for several more months and even the businesses that survive may be weakened. However, local businesses have proven their resilience time and again throughout the pandemic, and with the right support from landlords, local governments, and consumers, the region’s small business sector could flourish as economic life returns this spring. Policymakers must ensure that these businesses at the heart of our local economies and our local communities are also at the heart of the recovery.